Biologics Market Overview

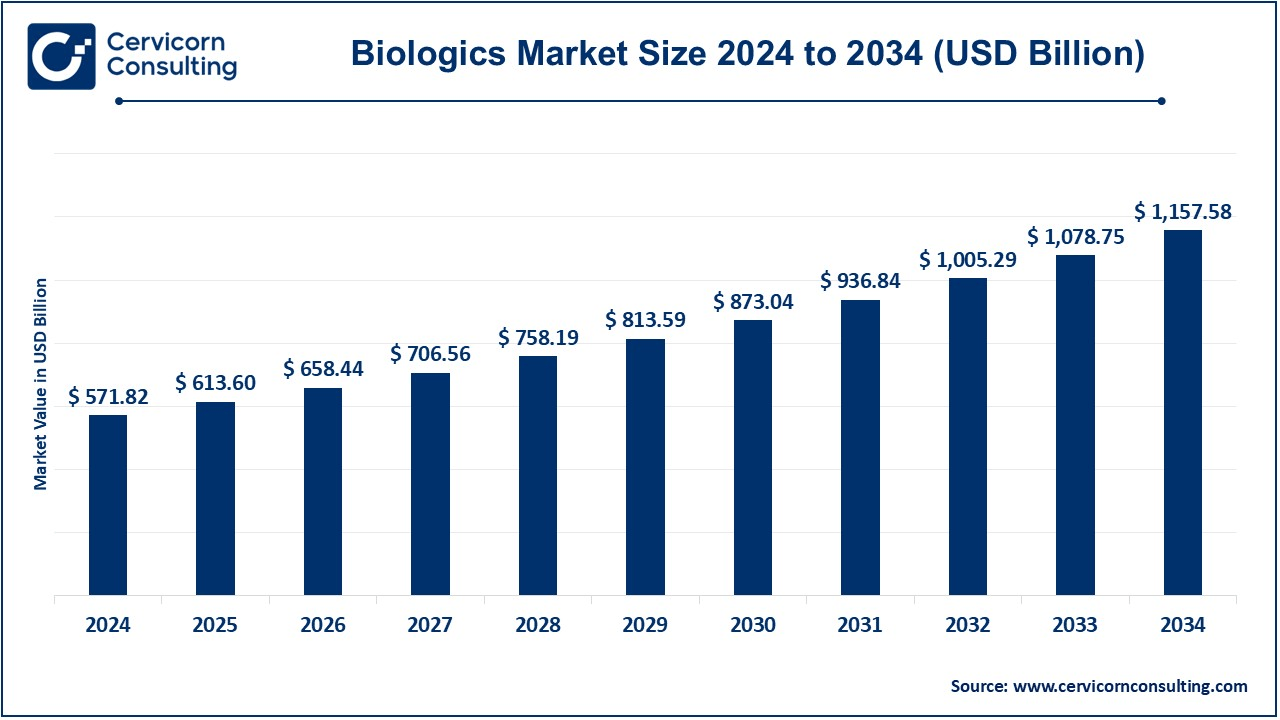

The global biologics market comprises therapeutic products derived from living organisms, including monoclonal antibodies, vaccines, gene therapies, recombinant proteins, and cell therapies, designed to treat chronic, immunological, oncological, and infectious diseases. In 2024, the market was valued at approximately USD 571.82 billion, and it is projected to grow to around USD 1,157.58 billion by 2034, reflecting a compound annual growth rate (CAGR) of 7.30% from 2025 to 2034 (Cervicorn Consulting).

This growth highlights the increasing significance of biologics in modern medicine, driven by unmet therapeutic needs, biotechnological advancements, and evolving regulatory and commercial frameworks.

👉 Get a Free Sample: https://www.cervicornconsulting.com/sample/2576

Key Market Trends

-

Expansion of Gene, Cell, and Advanced Therapy Modalities

-

Gene editing (e.g., CRISPR-based therapies) and cell-based treatments are increasingly mainstream, providing solutions for previously untreatable genetic and degenerative disorders.

-

Regulatory adaptations are allowing more therapies to progress through clinical trials.

-

Example: The rising number of gene therapy approvals in 2024 demonstrates growing acceptance of these advanced treatments.

-

-

Rise of Biosimilars & Biobetters

-

With major biologic patents expiring, biosimilars are emerging as cost-effective alternatives, improving patient access and increasing competitive pressures.

-

Companies are also developing biobetters—enhanced versions of existing biologics—to maintain market differentiation.

-

-

Integration of Digital Technologies / AI in R&D and Manufacturing

-

AI, machine learning, and digital twin technologies are accelerating biologic discovery, predicting stability, optimizing processes, and shortening development timelines.

-

In manufacturing, automation and advanced analytics enhance yield consistency, process control, and scale-up efficiency.

-

-

Personalized Medicine & Companion Diagnostics

-

Patient-stratified biologics are growing, with therapies increasingly paired with diagnostic tests to ensure the right treatment for the right patient.

-

Companion diagnostics and biomarker research are central to improving clinical trial success and therapeutic outcomes.

-

-

Regulatory & Reimbursement Evolution

-

Regulators in key markets are implementing fast-track, adaptive, and accelerated approval pathways for biologics and advanced therapies.

-

Emphasis on real-world evidence and outcomes-based reimbursement models is influencing adoption and pricing strategies.

-

Market Drivers

-

Rising Prevalence of Chronic and Complex Diseases: Increasing incidence of cancer, autoimmune disorders, diabetes, and rare diseases fuels demand for targeted biologics.

-

Scientific & Technological Advances: Innovations in bioprocessing, gene/protein engineering, vector technologies, and high-throughput screening accelerate biologic development and scale-up.

-

Regulatory Support & Incentives: Governments and regulators provide accelerated reviews, orphan drug designations, and priority pathways to encourage novel biologic development.

-

Increasing Healthcare Spending & Access in Emerging Markets: Growing budgets and healthcare access in countries like China, India, and Brazil support adoption of advanced therapies.

-

Strategic Collaborations and M&A: Partnerships between pharma and biotech firms reduce risk, accelerate commercialization, and expand expertise.

-

Shifting Patient & Payer Preferences: Healthcare systems and patients increasingly favor highly effective therapies with reduced side effects, driving biologics adoption.

Quantitative Insight: With a projected CAGR of 7.30%, the global biologics market is expected to nearly double by 2034, illustrating the strong impact of these growth drivers.

Impact of Trends & Drivers

By Segment / Application:

-

Oncology and immunology dominate due to the shift toward precision-targeted therapies.

-

Rare disease and gene therapy segments are expected to grow rapidly.

-

Biosimilars primarily target high-volume therapeutic areas, such as anti-TNFs and growth factors.

By Region:

-

North America and Western Europe lead in biologics R&D and commercialization.

-

Asia-Pacific (China, India, South Korea) is rapidly expanding due to regulatory reforms, local manufacturing, and domestic demand.

-

Latin America, Middle East & Africa are emerging markets with growth potential through increased access and local production initiatives.

By Manufacturing / CDMO & Supply Chain:

-

Demand for contract manufacturing and fill-finish services has surged.

-

Continuous manufacturing and modular bioprocessing are gaining traction to reduce costs and increase efficiency.

By Payers & Reimbursement:

-

Adoption is influenced by value-based pricing, managed entry agreements, and outcome-linked payment models, especially in cost-sensitive regions.

Challenges & Opportunities

Challenges:

-

High R&D and manufacturing costs.

-

Regulatory complexity across regions.

-

Scale-up and supply chain constraints (e.g., cell viability).

-

Pricing pressures and reimbursement limitations.

-

Immunogenicity and safety risks.

Opportunities:

-

Expanding patient access in emerging markets.

-

Development of biobetters and next-generation biologics.

-

Platform technologies (mRNA, bispecific antibodies, antibody-drug conjugates).

-

Adoption of AI, digital twins, modular and continuous manufacturing.

-

Increasing demand for precision medicine and rare-disease therapies.

Future Outlook

-

Wider adoption of gene and cell therapies and multi-modal biologics.

-

Increased use of AI, automation, and continuous manufacturing to lower costs and accelerate production.

-

Expansion of biosimilars to improve affordability and patient access.

-

Asia-Pacific’s growing share in R&D, manufacturing, and consumption.

-

Transition toward dynamic, outcomes-based reimbursement models.

In conclusion, the biologics market is entering a maturation phase, where innovation, strategic partnerships, and manufacturing efficiency will determine market leadership. Companies that invest strategically in platform capabilities, regulatory alignment, and scalable production will be best positioned for long-term success.

Contact for Detailed Overview: Cervicorn Consulting

Read Report:

Specialty Battery Market Trends, Drivers, and Future Outlook by 2034