Market Overview

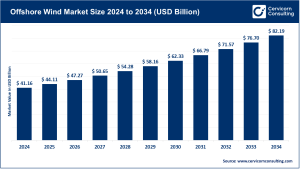

The global data center lithium-ion battery market was valued at USD 5.32 billion in 2024 and is forecast to reach approximately USD 18.19 billion by 2034, expanding at a CAGR of 13.8% (2025–2034). Lithium-ion systems are rapidly replacing traditional lead-acid solutions in modern UPS and energy-storage infrastructures because they offer higher energy density, faster recharge cycles, reduced maintenance needs, and superior lifecycle economics. These benefits align with the operational and sustainability demands of hyperscale, colocation, enterprise, and edge data centers, which are expanding globally to support cloud computing, AI workloads, and digital transformation.

Key Market Trends

1. Intelligent, AI-driven Battery Management Systems (BMS)

Data centers are increasingly deploying intelligent, AI-enabled BMS solutions that leverage IoT and predictive analytics to monitor system health, optimize energy use, and minimize downtime. These smart systems enhance operational reliability and improve energy efficiency by predicting potential faults before they occur, a crucial feature for hyperscale data centers managing massive workloads.

2. Shift to Sustainable, High-Performance Chemistries (LFP & NMC)

The market is witnessing a transition toward Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC) chemistries. LFP batteries, which hold approximately 41.2% market share in 2024, are preferred for their thermal stability, long lifespan, and enhanced safety profile, while NMC batteries are favored in space-constrained facilities for their high energy density. This shift supports data center operators’ sustainability initiatives and long-term cost efficiency.

3. Hyperscaler-led Deployment & Short-Run UPS Architectures

Hyperscale data centers dominate the market, accounting for around 44.5% of total installations. These facilities increasingly prefer short-run UPS architectures (3–15 minutes) that capitalize on Li-ion’s superior recharge speed, compact design, and long service life. Major cloud providers continue to expand investments in modular and scalable Li-ion systems to ensure uninterrupted service during grid fluctuations.

4. Integration with Renewables and Microgrids

An emerging trend is the integration of lithium-ion batteries with renewable energy sources and microgrids. These hybrid systems enable data centers to reduce grid dependence, lower operational costs, and enhance sustainability. Li-ion batteries play a vital role in balancing renewable intermittency and supporting continuous power delivery, especially in regions with unstable grid networks.

5. Regional Manufacturing & Localized Supply Chains

Asia-Pacific holds the largest regional share—around 46.5% in 2024—driven by strong data center construction and the presence of leading battery manufacturers in China, Japan, and South Korea. Localized supply chains are helping reduce costs and improve delivery timelines while supporting the region’s growing demand for hyperscale facilities.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2762

Market Drivers

• Hyperscale & Cloud Expansion

The exponential growth of hyperscale, colocation, and edge data centers has significantly boosted demand for reliable, high-power backup systems. The market’s projected increase from USD 5.32 billion (2024) to USD 18.19 billion (2034) reflects the accelerating investment in cloud infrastructure and AI-driven workloads that demand uninterrupted power supply.

• Lifecycle and Cost Benefits

Li-ion batteries offer longer operational lifespans, higher energy efficiency, and lower maintenance compared to lead-acid alternatives, resulting in a reduced total cost of ownership (TCO). These lifecycle advantages are encouraging enterprises to replace aging legacy systems with advanced lithium-ion solutions.

• Regulatory and Sustainability Mandates

Government policies and sustainability initiatives are accelerating the shift toward environmentally friendly power systems. Stringent regulations promoting the use of recyclable and low-carbon technologies are pushing data centers to adopt lithium-ion batteries as part of broader carbon reduction strategies.

• Advancements in Battery Management and Cooling

Technological improvements in battery management systems (BMS), thermal control, and digital infrastructure management (DCIM) integration are enhancing safety and operational reliability. These advancements make lithium-ion solutions suitable even for legacy data centers undergoing modernization.

• Regional Production and Investment

Asia-Pacific continues to lead due to large-scale manufacturing capabilities, supportive government initiatives, and growing digital infrastructure investments. Localized battery production in China, India, and Japan is helping lower import dependency and ensure stable supply chains.

Impact of Trends and Drivers

-

By Data Center Type: Hyperscale facilities dominate the market with roughly 44.5% share, adopting Li-ion technology for its reliability and space efficiency. Enterprise and colocation centers are gradually transitioning, while edge facilities benefit from compact designs and fast recharge rates.

-

By Application: UPS systems remain the largest application segment (around 42.8% share) due to their critical role in ensuring uninterrupted operations. Energy storage systems (ESS) are also gaining traction as data centers pursue renewable energy integration.

-

By Component: Battery racks and modules account for nearly 39.5% of total market share, while demand for BMS, inverters, and cooling systems grows alongside safety and performance requirements.

-

Regional Impact: Asia-Pacific remains the growth engine, followed by North America, which focuses on grid-support applications and circular battery initiatives. Europe emphasizes compliance with green energy mandates, while the Middle East and Africa show emerging adoption in newly built hyperscale hubs.

Challenges & Opportunities

Challenges

-

High Initial Costs: Despite long-term cost savings, the upfront capital investment for Li-ion systems remains high compared to lead-acid alternatives.

-

Thermal & Safety Concerns: The potential for overheating or fire hazards requires advanced thermal management and regulatory compliance, adding complexity to system design.

-

Limited Recycling Infrastructure: The absence of a well-developed end-of-life and recycling ecosystem for Li-ion batteries poses sustainability and logistical challenges.

Opportunities

-

AI & Cloud Expansion: Continued data-intensive workloads driven by AI and cloud computing present sustained demand for high-performance, scalable energy solutions.

-

Circular Economy & Second-Life Batteries: Initiatives to reuse EV batteries for data center applications can enhance cost efficiency and sustainability.

-

Integrated Energy Services: Vendors offering combined Li-ion, BMS, DCIM, and renewable integration services can differentiate themselves and capture higher market value.

Future Outlook

The data center lithium-ion battery market is poised for robust expansion, growing at a CAGR of 13.8% from 2025 to 2034. Market value is expected to increase from USD 5.32 billion in 2024 to USD 18.19 billion by 2034. Key growth momentum will stem from hyperscale deployments, Asia-Pacific’s production capabilities, advancements in LFP chemistry, and increasing integration of renewable energy systems. Future developments will focus on:

-

Widespread adoption of AI-powered BMS and real-time monitoring.

-

Increased use of LFP batteries for large-scale facilities due to safety and cost advantages.

-

Renewable-linked microgrids to enhance sustainability.

-

Growth in recycling and second-life battery programs to support circular energy models.

Conclusion

The global data center lithium-ion battery market is transitioning from a niche backup solution to a central pillar of modern digital infrastructure. As data centers prioritize efficiency, sustainability, and reliability, lithium-ion systems will play a crucial role in ensuring operational continuity and meeting environmental targets. Companies that invest in intelligent energy management, localized production, and sustainable supply chains will be best positioned to capitalize on this accelerating market shift.