Market Overview

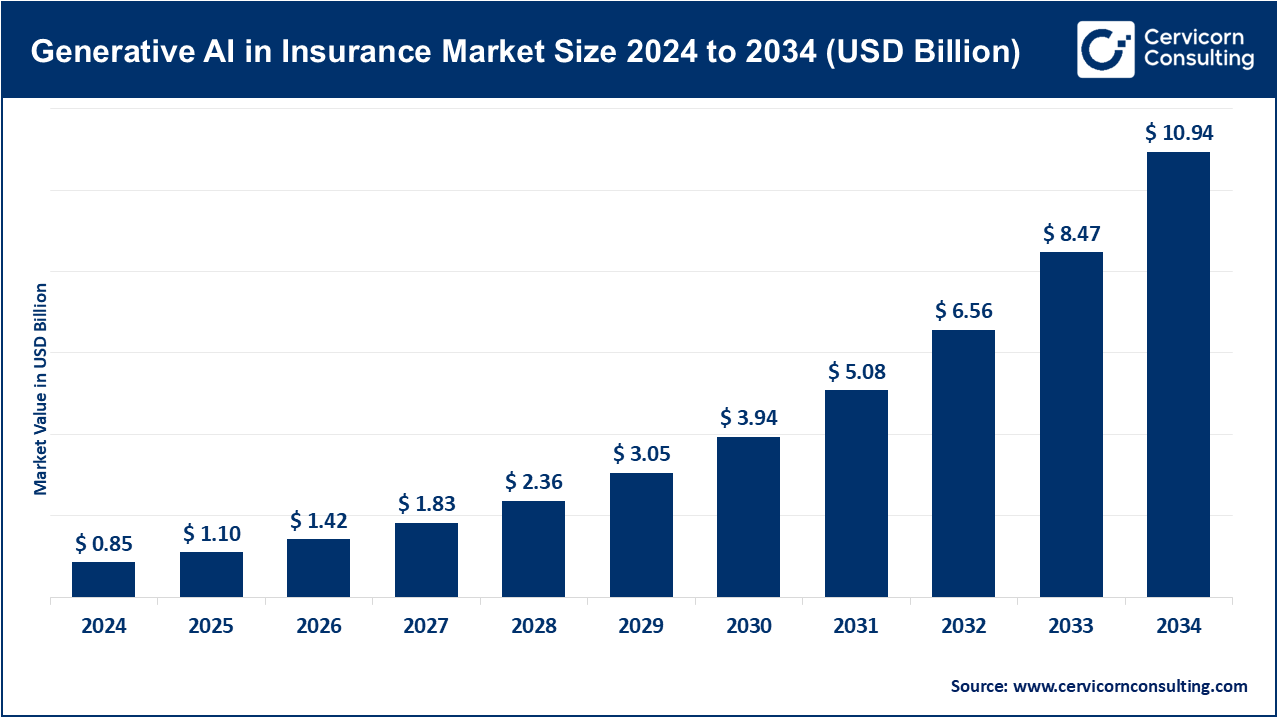

The global generative AI in insurance market was valued at USD 1.10 billion in 2025 and is forecasted to surge to nearly USD 10.94 billion by 2034, expanding at an impressive CAGR of 29.11% during the forecast period. This growth is fueled by insurers’ need to modernize operations, improve customer experiences, and manage evolving risks more effectively.

Generative AI is transforming the insurance value chain by automating claims processing, creating synthetic datasets for simulations, boosting fraud detection, and optimizing underwriting workflows. Beyond operational efficiency, it empowers insurers to build dynamic pricing models, deliver personalized coverage, and enhance customer-centric services. Additionally, generative AI supports predictive and preventive insurance strategies, helping companies model catastrophic risks, strengthen climate-resilient offerings, and design sustainable insurance portfolios.

👉 Get a Free Sample: https://www.cervicornconsulting.com/sample/2757

Key Market Trends

1. AI in Claims Processing

Generative AI is increasingly applied to automated claims evaluation, minimizing manual intervention, especially during large-scale disasters. For instance, in May 2025, Suncorp deployed AI-driven satellite imagery to assess flood and hail damage swiftly, reducing settlement timelines and enhancing customer satisfaction.

2. AI-Powered Customer Communication

Insurers are leveraging AI to create clear, empathetic, and jargon-free communication with policyholders. A notable example is Allstate’s June 2025 GPT-based deployment, which generated over 50,000 daily customer messages, improving transparency, engagement, and trust.

3. Cloud-Based AI Deployment

The majority of insurers prefer cloud-based AI solutions due to scalability, agility, and seamless integration across claims, underwriting, and customer service. Cloud platforms also enable quicker model updates and streamlined orchestration across functions.

4. Personalized & Predictive Insurance

AI models are enabling insurers to customize policies based on behavioral and historical claims data while also facilitating predictive risk modeling. This equips insurers to anticipate potential losses and design preventive measures.

5. Regulatory Compliance & Governance

As AI adoption accelerates, regulatory oversight is becoming more stringent. Insurers are embedding AI governance frameworks to ensure explainability, compliance with data privacy norms, and adherence to both local and international regulations—especially in North America and Europe, where transparency and fairness are highly emphasized.

Market Drivers

-

Rising Data Volumes: The exponential growth of structured and unstructured insurance data, such as claims notes, IoT feeds, and images, is driving the need for AI-powered analytics.

-

Operational Efficiency: Generative AI reduces manual errors, improves accuracy, and accelerates workflows in claims and underwriting, leading to lower operational costs.

-

Demand for Personalization: Customers expect real-time, tailored services, which AI-powered tools like virtual assistants and chatbots are enabling at scale.

-

Technological Progress: Advances in large language models, multimodal AI, APIs, and cloud infrastructure are accelerating enterprise-grade adoption.

-

Partnerships & Collaborations: Insurers are teaming up with hyperscalers and AI startups to develop specialized tools for fraud detection, geospatial integration, and climate risk modeling.

Impact of Trends & Drivers

-

By Application: Claims processing holds the largest share, driven by efficiency and fraud detection benefits, while underwriting, customer support, and policy personalization also see rapid adoption.

-

By Region: North America dominates with a 44% share, thanks to advanced digital infrastructure, while Asia-Pacific is the fastest-growing region due to favorable regulatory sandboxes and rapid digital adoption.

-

By Enterprise Size: Large enterprises are leading in adoption due to strong IT budgets and infrastructure, while SMEs are increasingly entering the market through cloud-based, managed AI solutions.

Challenges & Opportunities

Challenges:

-

Ensuring AI accuracy and minimizing “hallucinations.”

-

Meeting stringent data privacy regulations like GDPR and HIPAA.

-

High integration costs with legacy systems.

Opportunities:

-

Predictive models for climate-related and microinsurance products.

-

Enhanced multilingual and accessible AI-driven customer interactions.

-

AI-powered innovation in personalized policy design and risk modeling.

Future Outlook

The generative AI in insurance market is set for exponential growth, projected to reach USD 10.94 billion by 2034, at a CAGR of 29.11%.

The convergence of AI-driven automation, cloud adoption, predictive insurance, and personalized customer services will redefine claims, underwriting, fraud prevention, and customer engagement. As insurers embrace climate risk modeling, AI-driven policy generation, and preventive insurance solutions, generative AI will emerge as a cornerstone of innovation and competitiveness in the global insurance landscape.