Market Overview

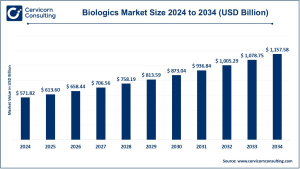

The global healthcare ERP market was estimated at USD 8 billion in 2024 and is expected to reach approximately USD 13.74 billion by 2034, growing at a CAGR of 5.56% between 2025 and 2034.

This growth highlights the accelerating adoption of enterprise resource planning (ERP) systems across hospitals, diagnostic labs, clinics, and long-term care facilities to optimize administrative efficiency, improve visibility across operations, and bridge business and clinical systems. The market includes ERP modules such as finance and billing, procurement, inventory and asset management, human resources, and analytics designed for healthcare workflows.

📊 Get a Free Sample: https://www.cervicornconsulting.com/sample/2435

Key Market Trends

1. Shift Toward Cloud-Based and SaaS ERP Solutions

Healthcare organizations are rapidly migrating from traditional on-premises systems to cloud or hybrid ERP platforms. This move is driven by demands for scalability, remote accessibility, reduced infrastructure costs, and seamless integration with cloud-based analytics and interoperability tools. The Cervicorn report notes accelerated ERP adoption as digital transformation initiatives expand across regions. Notably, smaller clinics and healthcare networks can now access advanced ERP functionalities once reserved for large enterprises.

2. Integration of Clinical and Operational Systems

ERP solutions are increasingly merging with electronic health records (EHRs) and patient-care systems, offering unified data visibility across financial, clinical, and operational functions. Such integration supports automated billing, improved supply traceability, and efficient workforce scheduling. As highlighted in the report, the increasing complexity of healthcare operations and EHR expansion makes ERP a strategic necessity for healthcare institutions.

3. Adoption of Analytics, Automation, and AI

The infusion of AI, machine learning (ML), robotic process automation (RPA), and predictive analytics into ERP systems enables real-time decision-making, demand forecasting, and anomaly detection in financial and supply chain operations. Though Cervicorn’s analysis doesn’t provide explicit AI metrics, it acknowledges the growing digital and data-driven orientation of healthcare providers, framing ERP as a key enabler of “smart healthcare operations.”

4. Compliance, Security, and Interoperability Requirements

Heightened regulatory scrutiny and data protection mandates are compelling healthcare organizations to adopt ERP systems with robust compliance and governance frameworks. The report emphasizes how government-led digital health initiatives are encouraging hospitals to modernize IT infrastructure, adopt interoperable solutions, and maintain secure patient databases—all key factors boosting ERP adoption.

5. Supply Chain Optimization and Cost Efficiency

Rising operational costs and supply chain vulnerabilities—particularly post-pandemic—have made ERP systems essential for procurement management, vendor coordination, and asset tracking. According to the Cervicorn report, these cost-efficiency imperatives remain a central growth driver in the healthcare ERP landscape, especially as providers manage complex supply chains involving pharmaceuticals, implants, and consumables.

Market Drivers

1. Escalating Need for Operational Efficiency

The rising prevalence of chronic illnesses, aging populations, and increasing patient loads have intensified the need for integrated management systems. ERP platforms streamline financial, HR, and operational functions—helping hospitals meet performance and compliance goals. Cervicorn notes that the growing reliance on EHRs and complex administrative workflows makes ERP investment indispensable.

2. Digital Transformation and Government Support

Global healthcare systems are undergoing significant digitization, bolstered by government programs promoting interoperability, health data modernization, and IT funding. For instance, in North America, policy-driven digital initiatives aimed at reducing manual documentation and strengthening health data infrastructure are key ERP market growth catalysts.

3. Technological Innovations in ERP Platforms

Advancements in cloud infrastructure, mobile integration, data analytics, and AI-driven automation are transforming ERP systems into accessible, affordable, and intelligent platforms. These innovations have democratized ERP adoption, particularly among mid-sized hospitals and emerging-market healthcare facilities.

4. Emphasis on Value-Based Care Models

As healthcare systems transition toward value-based reimbursement, ERP solutions provide vital financial and operational insights to support performance-based contracts. Real-time analytics and process transparency—highlighted by Cervicorn—are essential for measuring cost and care outcomes, thus reinforcing ERP’s strategic role.

5. Emerging Market Expansion

Regions such as Asia-Pacific are experiencing rapid growth in healthcare ERP deployment, driven by digital health policies, expanding healthcare infrastructure, and rising patient populations. Cervicorn projects the Asia-Pacific market to grow from USD 1.94 billion in 2024 to USD 3.33 billion by 2034.

Impact of Trends and Drivers

By Provider Size:

-

Large hospitals are deploying enterprise-scale ERP platforms integrating finance, HR, supply chain, and clinical analytics.

-

Mid-sized hospitals and clinics increasingly favor cloud-based ERP for cost-effective scalability.

-

Specialty care providers (e.g., long-term and behavioral health) are adopting ERP modules customized to their regulatory and operational needs.

By Region:

-

North America: Dominant market with strong digital health regulations and advanced IT adoption — USD 2.92B (2024) → USD 5.02B (2034).

-

Europe: Steady growth supported by cloud uptake and regulatory pressure — USD 2.29B → USD 3.93B.

-

Asia-Pacific: Fastest-growing market — USD 1.94B → USD 3.33B.

-

LAMEA: Smaller but growing segment — USD 0.86B → USD 1.47B.

By Application:

-

Finance and billing modules remain key revenue drivers.

-

Supply chain and asset management modules are expanding rapidly amid cost pressures.

-

AI-driven analytics modules are rising in demand for forecasting and operational insights.

Challenges and Opportunities

Challenges:

-

High implementation and integration costs for large systems.

-

Data privacy and security concerns, particularly with cloud deployments.

-

Resistance to digital adoption among healthcare staff.

-

Interoperability gaps between ERP and EHR platforms.

-

Limited infrastructure readiness in developing regions.

Opportunities:

-

Expansion of cloud-based ERP for smaller healthcare providers.

-

Integration of AI and predictive analytics for smarter operations.

-

New growth potential through value-based care, population health management, and interoperability services.

-

Rising demand for implementation, integration, and managed service providers, particularly in emerging economies.

Future Outlook

The healthcare ERP market is poised for steady expansion over the next decade, reaching USD 13.74 billion by 2034 at a CAGR of 5.56%.

Future growth will be characterized by:

-

Broader adoption of cloud and SaaS ERP across all healthcare tiers.

-

Deeper integration of AI, RPA, and advanced analytics into core ERP modules.

-

Strengthened interoperability between ERP, EHR, and national health systems.

-

Strong momentum in Asia-Pacific driven by healthcare digitalization and policy support.

-

Strategic alliances and vendor consolidation enhancing ecosystem collaboration.

Ultimately, healthcare ERP systems are evolving from traditional administrative tools into intelligent, interoperable platforms that align operational, clinical, and financial objectives in the digital health era.

For a detailed market analysis and forecast, visit: Cervicorn Consulting