Introduction & Market Overview

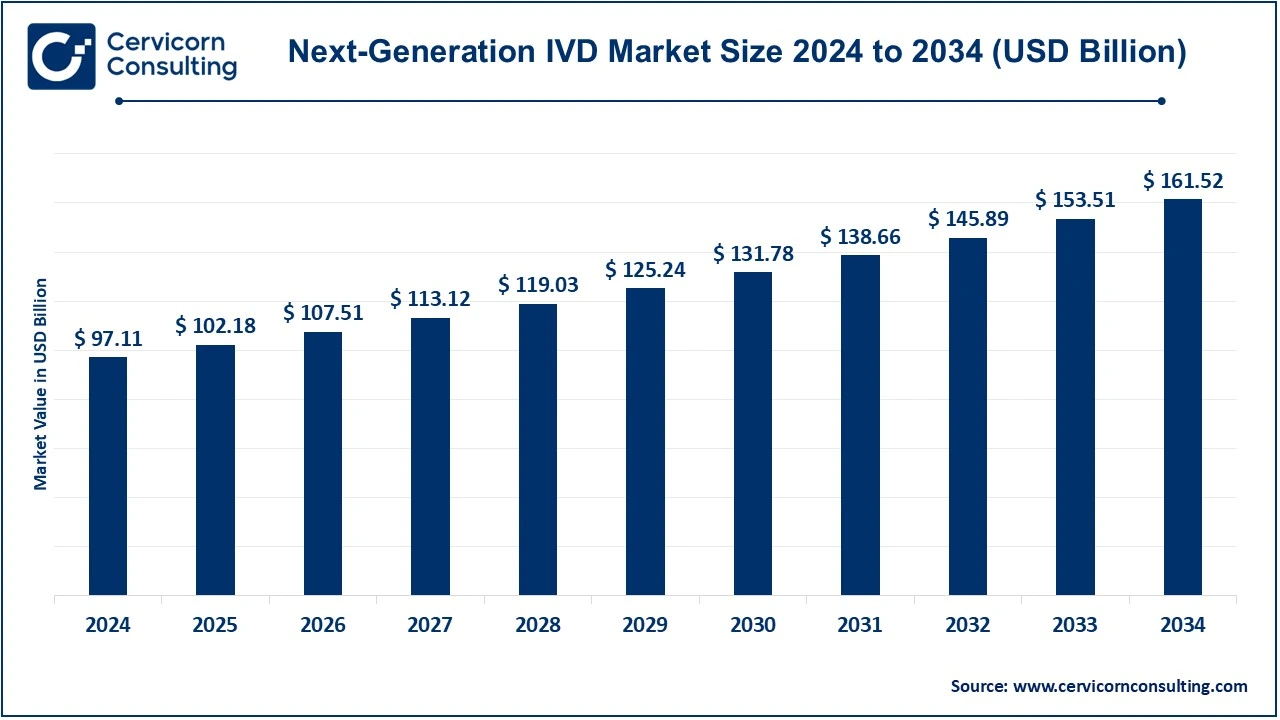

The global next-generation IVD market was valued at approximately USD 97.11 billion in 2024 and is anticipated to reach around USD 161.52 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.21% from 2025 to 2034.

While traditional IVD has been a cornerstone of clinical practice, next-generation IVD represents a new wave of diagnostic solutions distinguished by molecular precision, digital integration, automation, and rapid point-of-care testing capabilities.

This growth marks a significant shift in diagnostics—from conventional lab-based immunoassays and clinical chemistry toward advanced molecular, digital, and AI-augmented platforms, supporting precision medicine, disease monitoring, and decentralized testing.

Key Market Trends

1. AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are being increasingly integrated into diagnostic workflows for pattern recognition, anomaly detection, predictive modeling, and automated result interpretation. For example, AI-driven analysis of pathology slides or cytology samples helps reduce manual errors while boosting throughput. Adoption of AI-based IVD tools has grown by nearly 50% in recent years.

2. Expansion of Point-of-Care Testing (POCT)

Decentralized diagnostics, particularly POCT, is gaining traction by moving testing closer to patients in clinics, pharmacies, and homes. This shift offers faster results, convenience, and reduced logistical burdens, especially for chronic disease management and infectious disease screening. Demand for POCT is rising at approximately 20% annually.

3. Advances in Molecular Diagnostics

Technologies such as next-generation sequencing (NGS), digital PCR, multiplex assays, and liquid biopsies are increasingly applied in oncology, infectious disease detection, and genetic disorder screening. Significant reductions in testing costs (over 70% for genetic tests) are accelerating adoption. These tools enable high sensitivity, multiplexing, and non-invasive sampling, such as circulating tumor DNA analysis.

4. Automation, Robotics, and Digital Lab Integration

Laboratories are adopting automation and robotic systems to handle higher throughput, reduce human error, and standardize operations. Integration with laboratory information management systems (LIMS), cloud platforms, and digital pathology is creating a more efficient, connected, and data-driven diagnostic ecosystem.

5. Regulatory and Standardization Initiatives

New regulations, including the EU’s In Vitro Diagnostic Regulation (IVDR), enforce stricter compliance, clinical evidence requirements, and post-market surveillance. These frameworks favor companies with strong regulatory expertise and encourage partnerships to meet compliance demands. Concurrently, data security, interoperability, and standards such as HL7 and FHIR are becoming increasingly critical.

Market Drivers

1. Rising Chronic and Infectious Disease Prevalence

The growing incidence of noncommunicable diseases—including cancer, cardiovascular disorders, diabetes, and respiratory illnesses—combined with infectious disease outbreaks, has increased demand for high-precision diagnostics. Early detection and continuous monitoring are primary adoption drivers.

2. Growth of Precision and Personalized Medicine

Next-generation IVD is central to precision medicine, enabling clinicians to stratify patients, select therapies, and monitor responses using detailed molecular and biomarker data. Over 60% of new diagnostic tests in development focus on molecular or digital solutions.

3. Technological Advancements and Cost Reduction

Advances in sequencing, reagents, and miniaturized instrumentation have reduced costs and improved performance. For instance, genetic testing costs have dropped by more than 70%, expanding access. Modular, scalable systems also allow incremental lab upgrades.

4. Government Support and Strategic Healthcare Policies

Government initiatives, grants, and national health policies promote early disease detection, screening, and precision medicine, underwriting the capital investments required for next-gen diagnostic infrastructure.

5. Rising Demand for At-Home and Consumer Diagnostics

Consumers increasingly prefer home-based health monitoring and telehealth integration, pushing IVD providers to develop connected, user-friendly diagnostic devices.

Impact of Trends & Drivers

By Product Segment

-

Consumables (reagents, test kits) dominate revenue (~65% in 2024).

-

Instruments and software benefit from automation, digital integration, and AI-enabled modules.

By Diagnostic Type / Application

-

Molecular diagnostics and NGS gain from precision medicine and cost reductions.

-

POCT expands in emerging markets or outpatient and home health settings.

-

Core lab diagnostics remain foundational but integrate next-gen modules such as AI-driven analyzers.

By Region

-

North America: ~46.1% market share, supported by mature infrastructure and high healthcare spending.

-

Europe: Regulatory frameworks and public funding drive adoption.

-

Asia-Pacific: High-growth market due to improving healthcare infrastructure in China, India, Japan, and Korea.

-

LAMEA: Offers opportunities via mobile diagnostics, public health programs, and government initiatives.

By End Users

-

Hospitals and large labs: Use capital-intensive, high-throughput platforms.

-

Clinics and outpatient centers: Adopt POCT and decentralized diagnostics.

-

Home diagnostics: Emerging growth area driven by patient demand for convenience.

Challenges & Opportunities

Challenges

-

Regulatory compliance and evidentiary burdens (IVDR).

-

High platform costs and reimbursement limitations.

-

Integration and interoperability with legacy systems.

-

Market fragmentation and competition.

-

Supply chain dependencies for specialty reagents and materials.

Opportunities

-

Expansion into emerging markets with underdeveloped diagnostics infrastructure.

-

Companion diagnostics and personalized therapy co-development.

-

Integration with telehealth and remote monitoring.

-

Modular and scalable diagnostic platforms enabling incremental adoption.

-

Monetization through analytics, AI, and software services.

Future Outlook

The next-generation IVD market is projected to grow from USD 97.11 billion in 2024 to approximately USD 161.52 billion by 2034, at a CAGR of 5.21%. Key emerging themes include:

-

Expanded AI-driven diagnostics, encompassing predictive and preventive analytics.

-

Integration with therapeutic decision support, particularly in oncology and personalized medicine.

-

Decentralized and home-based testing, particularly for chronic disease management.

-

Industry consolidation and strategic partnerships to overcome regulatory and scale challenges.

-

Global harmonization of regulatory and data standards to facilitate cross-border adoption.

The next-generation IVD sector is well-positioned at the intersection of healthcare innovation, technological evolution, and rising consumer demand, promising a dynamic growth trajectory in the coming decade.

Contact for Detailed Overview: Cervicorn Consulting

Read Report:

Remote Monitoring and Control Market Trends, Innovations and Opportunities by 2034