Solar Photovoltaic (PV) Market Overview

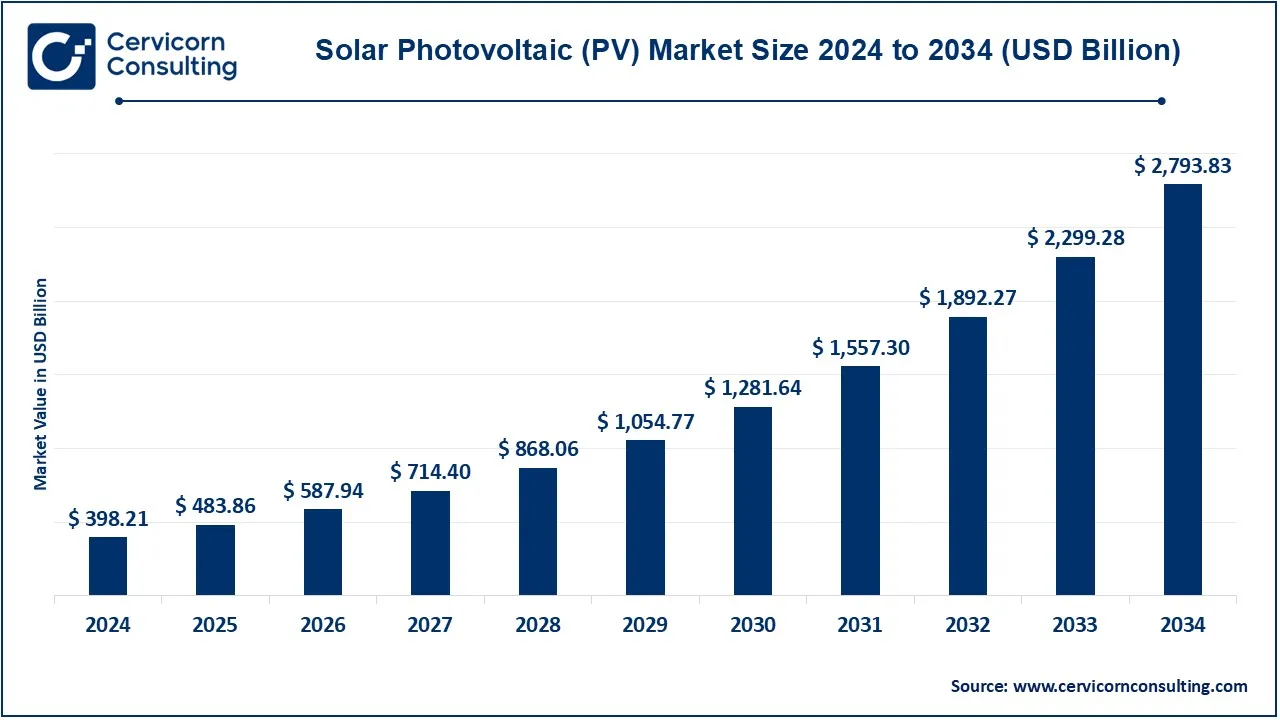

The global solar photovoltaic (PV) market was valued at USD 398.21 billion in 2024 and is projected to soar to USD 2,793.83 billion by 2034, growing at a robust CAGR of 21.50% between 2025 and 2034. This growth is supported by falling technology costs, strong policy backing, and accelerated deployment. In 2023 alone, global PV capacity increased by around 22%, surpassing 1,200 GW, with solar accounting for nearly 60% of all renewable energy additions. On the regional front, Asia-Pacific emerged as the market leader in 2024.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2493

Key Market Trends

-

Decentralization of Energy Generation

The industry is shifting from centralized grids toward distributed and behind-the-meter systems such as residential rooftops, commercial installations, and microgrids.

Example: Growth in building-integrated PV (BIPV) and household adoption. -

Hybrid Energy Systems (PV + Storage + Renewables)

PV is increasingly paired with battery storage systems (BESS), wind, or bio-based energy to reduce intermittency and enhance stability.

Example: Hybrid plants and co-located storage improving grid reliability. -

Green Financing and Sustainable Investments

The expansion of green bonds, sustainability-linked loans, and renewable-focused funds is providing easier access to capital.

Example: Financing innovations accelerating both large-scale projects and R&D for high-efficiency modules. -

Corporate Power Purchase Agreements (PPAs)

Companies are securing long-term PPAs to meet sustainability goals and ensure stable energy supply.

Example: Rising number of utility-scale projects supported by corporate buyers. -

Emerging Market Expansion

Developing regions, especially in Asia-Pacific and Africa, are witnessing strong PV adoption where traditional grid expansion is limited.

Example: Mini-grids and off-grid systems driving rural electrification.

Market Drivers

-

Steep Cost Reductions — PV module and system costs have dropped by over 80% in the past decade, making adoption more attractive.

-

Policy Support & Incentives — Mechanisms like tax credits, feed-in tariffs, and net-metering in over 100 countries are spurring installations.

-

Rising Power Demand & Energy Security — Growing electrification, urbanization, and volatile fossil fuel prices are pushing solar adoption.

-

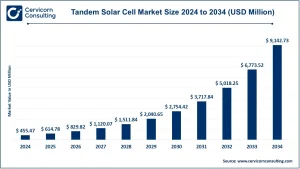

Technological Advancements — High-efficiency cell designs (bifacial, PERC, heterojunction), advanced inverters, and cheaper BOS components are boosting output.

-

Smart Grids & Storage Integration — Enhanced grid capabilities support higher solar penetration, with the on-grid segment capturing ~64% revenue share in 2024.

Impact of Trends & Drivers

-

Utility-Scale Projects: Ground-mounted PV, contributing ~71% of installation revenue in 2024, benefits from scale, financing, and corporate PPAs.

-

Residential & Commercial: Declining costs, net-metering, and storage integration encourage rooftop adoption and greater energy independence.

-

Regional Outlook: Asia-Pacific dominates with 38% market share, while North America and Europe expand through distributed PV and corporate PPAs. Emerging markets like Africa, Latin America, and Southeast Asia are leveraging PV for off-grid and mini-grid solutions.

-

Applications: PV paired with storage is expanding into industrial loads, EV charging networks, and microgrids for healthcare and critical infrastructure.

Challenges & Opportunities

Challenges

-

High upfront costs for households and SMEs.

-

Intermittency and grid integration hurdles.

-

Regulatory complexity and permitting delays.

Opportunities

-

Storage-linked PV solutions offering new revenue streams (e.g., grid services, peak shaving).

-

Financing innovations such as green bonds and on-bill financing for broader access.

-

Leapfrogging in emerging economies through low-cost PV and storage for electrification.

Future Outlook

The solar PV market is on track for sustained double-digit growth, underpinned by continued price declines, storage integration, corporate procurement, and geographic diversification. While utility-scale installations will remain dominant in the near term, the next decade will also see accelerating growth in distributed PV, hybrid systems, and smart-grid connected projects as storage costs fall and digital grid management matures.

Contact Us for a Detailed Overview: Cervicorn Consulting