Display Market Overview

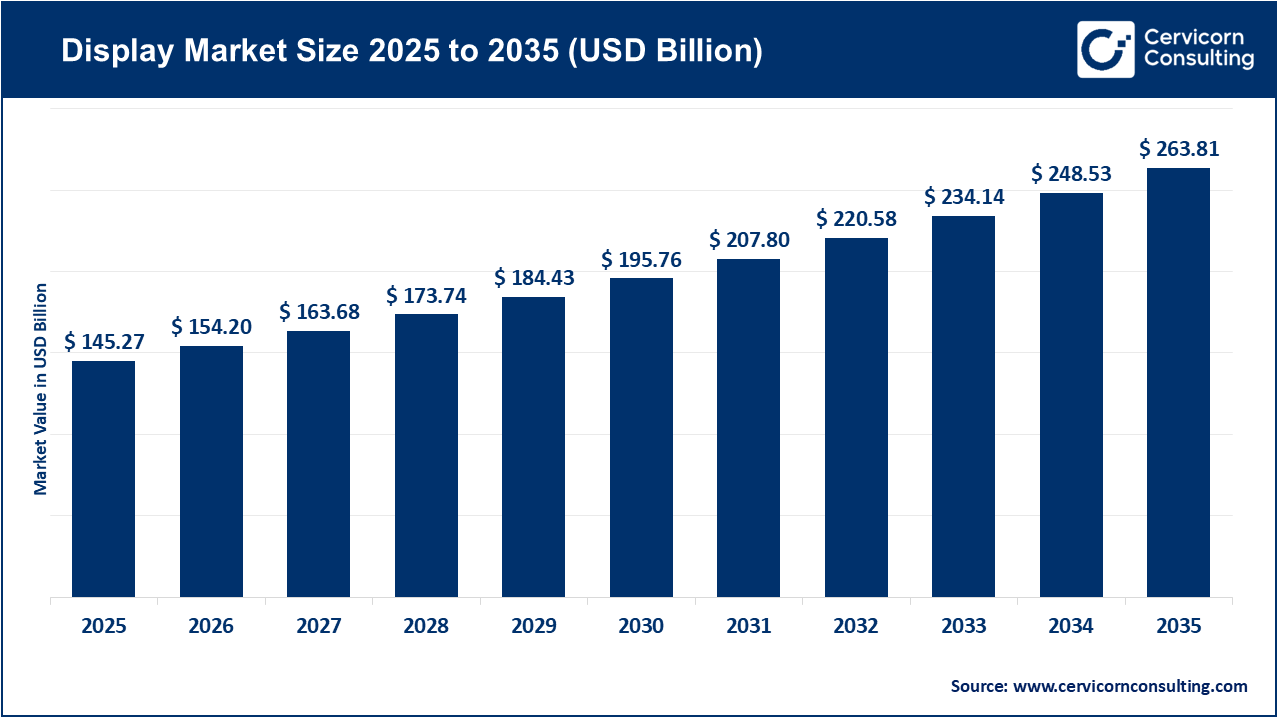

The global display market was valued at USD 145.27 billion in 2025 and is anticipated to climb to nearly USD 263.81 billion by 2035, progressing at a CAGR of 6.49% between 2026 and 2035. This industry covers a broad spectrum of display technologies, including LCD, OLED, micro-LED, direct-view LED, and emerging near-eye systems. These technologies support applications across smartphones, TVs, laptops, monitors, wearables, and AR/VR devices, catering to diverse sectors such as consumer electronics, automotive, healthcare, retail, and BFSI. Rapid adoption of immersive, energy-efficient, and flexible display solutions—especially in Asia-Pacific, Europe, and North America—is significantly fuelling market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2836

Key Market Trends

Growing Preference for OLED and Micro-LED Displays

Both consumers and device manufacturers are shifting toward OLED and Micro-LED systems due to their advantages in color vibrancy, slimness, power efficiency, and superior contrast. OLED smartphone shipments reached around 784 million units in 2024, marking a 26% rise year-over-year, underscoring the shift from traditional LCD technology.

Expansion of Flexible, Wearable, and Next-Generation Form Factors

Advances in display materials and engineering techniques are enabling foldable, rollable, bendable, and stretchable screens. Wearable devices, AR/VR headsets, and future immersive consumer electronics are increasingly incorporating these flexible display formats.

Generative AI Enhancing Display Performance

AI-driven enhancements are becoming a defining feature of modern display systems. For instance, LG’s 2025 QNED evo TV series integrates Mini-LED panels with AI-based image refinement, improving visual precision and optimizing performance for AR/VR applications by reducing processing burdens on devices.

Localization and Realignment of Supply Chains

Ongoing geopolitical shifts and supply-chain disruptions are pushing major manufacturers to establish localized production hubs for OLED substrates, driver ICs, and related components. This helps reduce reliance on single-source regions and strengthens global production resilience.

Surge in Smart TV and Monitor Adoption

The display landscape continues to expand with rising adoption of smart TVs and computer monitors. Smart TV shipments increased by 38% in 2024, while monitor shipments reached 128 million units, reflecting growing demand from gaming, remote work, and professional segments.

Market Drivers

Increasing Demand for High-End Displays

Rising usage of smartphones, tablets, and wearables continues to propel market demand. In parallel, an increasing number of consumers prefer large-screen TVs and advanced monitors for entertainment, content creation, and remote-work setups.

Technological Evolution Across Display Types

Cutting-edge innovations in OLED, Micro-LED, Mini-LED, and foldable panels are improving brightness, durability, efficiency, and form factor versatility—helping manufacturers deliver premium visual experiences across device categories.

Supportive Government and Industry Investments

Countries including China, Taiwan, India, and the U.S. are investing heavily in display panel manufacturing and R&D, especially for next-generation OLED and Micro-LED technologies. Such initiatives strengthen domestic production capabilities and accelerate technological development.

Integration of AI and Immersive Technologies

AI-driven processing and the growth of AR/VR ecosystems are transforming display requirements in consumer electronics, healthcare, and enterprise environments. These advancements help improve clarity, reduce latency, and enhance interactivity.

Rising Adoption in Automotive and Industrial Applications

Modern vehicles—especially EVs—are now equipped with digital dashboards, head-up displays (HUDs), and infotainment systems using curved and high-brightness panels. Industrial signage and control systems are similarly adopting high-resolution displays for operational efficiency.

Impact of Trends and Drivers

These market trends and growth drivers are influencing multiple sectors:

-

Consumer Electronics: The shift toward OLED and Micro-LED is accelerating premium smartphone and smart TV demand.

-

Wearables & AR/VR: Flexible, lightweight, and AI-supported displays are enabling highly immersive experiences.

-

Automotive: Digital cockpit systems, EV dashboards, and HUD technologies depend heavily on innovative display solutions.

-

Geographical Impact:

-

Asia-Pacific dominates manufacturing and panel production.

-

North America and Europe lead in high-end innovations, AI-integrated systems, and next-gen display development.

-

Challenges & Opportunities

Challenges

-

High development and manufacturing costs associated with advanced display integration.

-

Complex supply-chain structures and fluctuating component availability.

-

R&D intensity and software compatibility issues for premium panels.

Opportunities

-

Rising demand for premium display products, including foldable and stretchable screens.

-

Rapid growth of AR/VR markets across gaming, professional training, and healthcare.

-

Greater adoption of AI-enhanced displays and sustainable display materials.

-

Increasing localization presents new investment and partnership opportunities.

Future Outlook

The global display industry is expected to maintain steady momentum, reaching USD 263.81 billion by 2035 with a sustained CAGR of 6.49%. The next decade will see strong growth in micro-LED production, deeper integration of AI-based display optimization, and widespread adoption of flexible and novel form-factor panels. Expanded regional manufacturing, sustainability initiatives, and advancements in display materials will continue to strengthen the market and fuel innovation across applications.