Market Overview

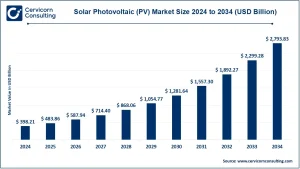

The global renewable energy market was valued at approximately USD 1.51 trillion in 2024 and is expected to expand sharply, reaching nearly USD 7.34 trillion by 2034. This growth represents a strong compound annual growth rate (CAGR) of about 17.13% from 2025 to 2034, underscoring the accelerating global shift toward clean energy solutions.

Renewable energy has become a foundational element of the modern energy landscape, driven by the urgent global push to decarbonize electricity generation and reduce reliance on fossil fuels. As highlighted by Cervicorn Consulting, the market constitutes a vast, multi-trillion-dollar ecosystem encompassing solar, wind, hydropower, bioenergy, and emerging clean energy technologies.

Rapid additions in installed capacity, favorable government policies, and increasing corporate commitments to sustainability have elevated renewable energy from an alternative option to a mainstream power source. The sector continues to demonstrate steady expansion, supported by long-term investment visibility and strong regulatory backing across both developed and emerging economies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2546

Key Market Trends

1. Accelerated Adoption of Solar and Wind Technologies

Solar photovoltaic and wind power remain the primary drivers of renewable energy growth. Ongoing advancements in module efficiency, turbine scaling, and system optimization have significantly lowered the levelized cost of energy (LCOE), making renewables increasingly competitive with conventional generation. Large utility-scale solar installations and expansive onshore and offshore wind projects are being deployed to address rising electricity demand worldwide.

2. Growing Integration of Energy Storage and Hybrid Systems

The incorporation of battery energy storage systems (BESS) into renewable projects is reshaping market dynamics. Hybrid configurations such as solar-plus-storage and wind-plus-storage are gaining traction as they help manage intermittency and improve grid reliability. This trend is particularly evident in regions with high renewable penetration and evolving grid infrastructure.

3. Continued Regulatory and Policy Support

Governments across the globe are strengthening renewable energy adoption through renewable purchase obligations (RPOs), net-zero targets, feed-in tariffs, and competitive auction mechanisms. These measures are accelerating project development while ensuring long-term revenue stability for developers. Clear regulatory frameworks have also attracted growing interest from institutional investors and infrastructure funds.

4. Rising Corporate Renewable Procurement and ESG Alignment

An increasing number of large enterprises are procuring renewable power through power purchase agreements (PPAs) to meet environmental, social, and governance (ESG) objectives. This trend has created an additional demand channel beyond traditional utilities, reinforcing market fundamentals and encouraging broader private-sector participation.

5. Grid Modernization and Digital Transformation

As renewable capacity expands, investments in smart grids, digital substations, and advanced forecasting and monitoring tools are becoming essential. Grid modernization initiatives are enabling more efficient integration of variable renewable energy and supporting the growth of decentralized and distributed generation models.

Market Drivers

Multiple structural and economic factors continue to drive sustained growth in the renewable energy market:

-

Increasing Global Energy Demand: Population growth, urbanization, and the electrification of transportation and industrial processes are driving long-term electricity demand, creating sustained opportunities for renewable power generation.

-

Government Climate Targets and Commitments: National decarbonization plans and net-zero pledges are compelling utilities and industries to transition toward clean energy at scale.

-

Falling Technology Costs: Significant cost reductions in solar panels, wind turbines, and energy storage systems have improved project economics and accelerated deployment.

-

Energy Security Considerations: Volatile fossil fuel markets have heightened the importance of locally generated renewable energy to enhance long-term energy security.

-

Growing Access to Green Financing: The expansion of green bonds, sustainability-linked loans, and climate-focused investment funds is lowering financing costs and supporting large-scale renewable projects.

Collectively, these drivers are enabling the renewable energy market to expand at a healthy long-term CAGR, as emphasized by Cervicorn Consulting.

Impact of Trends and Drivers

The interaction of these trends and growth drivers is reshaping the renewable energy value chain in several ways:

-

By Technology: Solar and wind continue to dominate new capacity additions, while storage-integrated and hybrid systems are becoming increasingly important for grid stability and flexibility.

-

By Region: Emerging economies are experiencing rapid renewable capacity growth due to rising power demand and policy support, whereas developed markets are focusing on offshore wind, asset repowering, and digital grid solutions.

-

By Application: Utility-scale installations remain the largest segment, but distributed generation and corporate PPAs are gaining momentum, broadening the demand base.

Challenges and Opportunities

Despite strong growth potential, the renewable energy market faces challenges such as grid congestion, land constraints, permitting delays, and supply chain disruptions. At the same time, these issues present opportunities for innovation in energy storage, grid infrastructure, power electronics, and digital energy management solutions. Companies offering integrated and flexible renewable solutions are well positioned to capitalize on these opportunities.

Future Outlook

Looking forward, the renewable energy market is expected to sustain robust growth over the next decade, supported by favorable policies, continued cost declines, and rising clean energy demand. According to Cervicorn Consulting, the market is forecast to grow at a steady CAGR, reaching significantly higher valuation levels in the long term. Emerging developments such as hybrid renewable systems, long-duration energy storage, and green hydrogen integration are expected to further enhance the market’s evolution and long-term investment attractiveness.

To Get a Detailed Overview, Contact Us:

https://www.cervicornconsulting.com/contact-us