Market Overview

The global pharmaceutical filtration market was estimated at around USD 14.69 billion in 2025 and is forecast to expand to approximately USD 33.07 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% throughout the forecast period. Market expansion is primarily driven by the increasing scale and complexity of pharmaceutical and biopharmaceutical manufacturing processes.

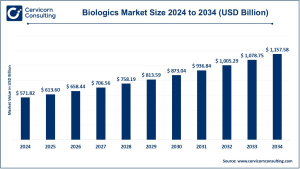

Rising production of biologics, vaccines, monoclonal antibodies, recombinant proteins, and personalized therapies has intensified the need for high-performance filtration systems to maintain sterility, ensure product purity, and comply with stringent regulatory standards. In addition, the rapid growth of contract manufacturing organizations (CMOs) and the continued shift toward outsourcing are prompting pharmaceutical companies to invest in scalable, efficient, and flexible filtration technologies across global production hubs.

Key Market Trends

Growing Adoption of Single-Use Filtration Systems

Single-use filtration solutions are steadily replacing conventional stainless-steel systems due to their operational advantages. These technologies reduce cleaning and sterilization requirements, lower the risk of cross-contamination, and support flexible batch sizes. Leading pharmaceutical manufacturers such as GSK and Roche have incorporated single-use filtration assemblies into final fill operations to enhance sterility assurance and manufacturing efficiency. Adoption of single-use systems is expected to increase significantly, rising from approximately 22% in 2020 to more than 53% by 2028.

Emphasis on Advanced Membrane Technologies

Membrane filtration represents the dominant product segment, accounting for 34.8% of the market, and plays a vital role in sterile filtration and biologics purification. Ongoing advancements in microfiltration, ultrafiltration, and nanofiltration enable higher throughput, improved recovery rates for concentrated biologics, and seamless integration with automated and closed bioprocessing systems.

Regulatory-Driven Focus on Sterility Assurance

Sterile filtration holds a substantial 71.8% market share, underscoring the importance of contamination control in pharmaceutical manufacturing. Increasing regulatory scrutiny related to validation, aseptic processing, and real-time monitoring continues to accelerate adoption of sophisticated filtration solutions designed to meet evolving compliance requirements.

Integration with Continuous and Modular Manufacturing Models

Filtration technologies are increasingly being engineered to support continuous manufacturing and modular production environments. These systems allow faster changeovers, scalable capacity, and adaptable production configurations, which are particularly valuable for cell and gene therapies, vaccines, and small-batch biologics manufacturing.

Geographic Expansion and CMO Partnerships

North America leads the pharmaceutical filtration market with a 38.1% share, driven by strong biologics production capabilities, rigorous regulatory frameworks, and significant investments in advanced manufacturing infrastructure. At the same time, filtration suppliers are expanding their presence in Asia-Pacific and Europe, often collaborating with CMOs to address regional production growth and localized demand.

-

Get a Free Sample: https://www.cervicornconsulting.com/sample/2877

Market Drivers

-

Rising Production of Biologics and Advanced Therapies: Increased manufacturing of monoclonal antibodies, vaccines, and gene therapies is driving demand for reliable and high-efficiency filtration systems.

-

Technological Innovation: Advances in single-use technologies, modular filtration assemblies, and high-capacity membranes improve operational efficiency and reduce contamination risks.

-

Stringent Regulatory Requirements: Global regulatory bodies continue to enforce strict sterility, validation, and quality control standards, accelerating adoption of advanced filtration solutions.

-

Growth of Contract Manufacturing and Outsourcing: Expansion of CMOs and outsourced pharmaceutical production encourages investment in scalable and flexible filtration infrastructure.

-

Demand for Manufacturing Efficiency: Single-use and modular filtration systems help minimize downtime, reduce validation costs, and enhance overall production flexibility.

Impact of Trends and Drivers

The increasing use of single-use systems and advanced membrane technologies strongly impacts final product processing, which accounts for 39.5% of the total market, ensuring sterility prior to product release. Microfiltration leads the technique segment with a 36.7% share, widely used for raw material filtration, water purification, and pre-filtration applications.

Manufacturing-scale operations dominate the market with a 62.9% share, reflecting the high filtration demand associated with commercial pharmaceutical production. While North America remains the leading regional market, Asia-Pacific is emerging as a high-growth region due to the rapid expansion of biopharmaceutical manufacturing facilities.

Challenges & Opportunities

Challenges

High capital costs associated with advanced filtration systems, increased operational complexity, and the need for skilled technical personnel may hinder adoption, particularly among smaller manufacturing facilities.

Opportunities

The growing emphasis on biologics, vaccines, and personalized medicine presents strong opportunities for disposable and modular filtration technologies. Additionally, expanding outsourcing activities and strategic collaborations with CMOs offer significant growth potential for filtration solution providers.

Future Outlook

The pharmaceutical filtration market is expected to sustain a robust CAGR of 8.5%, reaching USD 33.07 billion by 2035. Future growth will be shaped by broader adoption of single-use and modular systems, increased automation in bioprocessing workflows, and deeper integration of continuous manufacturing technologies. These developments are anticipated to strengthen contamination control, improve operational efficiency, and expand market penetration across North America, Europe, and Asia-Pacific.

For a detailed market overview, contact: https://www.cervicornconsulting.com/contact-us