Market Overview

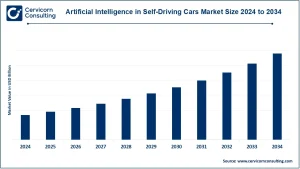

The global automotive software and electronics market was valued at approximately USD 325.43 billion in 2025 and is projected to expand at a robust CAGR of nearly 5% throughout the forecast period, reaching more than USD 528.87 billion by 2035.

As vehicles rapidly transition into intelligent, connected, and software-driven systems, automotive software and electronics have become fundamental to modern vehicle design and functionality. The growing integration of electronic control units (ECUs), embedded software, sensors, and advanced digital architectures is fundamentally transforming how vehicles are engineered, produced, and operated.

The market continues to exhibit strong growth momentum, supported by rising demand for advanced safety technologies, vehicle electrification, connectivity, and autonomous driving capabilities. Today, software and electronics account for an increasingly large portion of total vehicle value, highlighting the industry’s shift away from mechanical components toward digitally controlled mobility solutions.

Key Market Trends

1. Shift Toward Software-Defined Vehicle Architectures

One of the most influential trends in the automotive software and electronics market is the move toward software-defined vehicle (SDV) platforms. Automakers are replacing traditional distributed electronic systems with centralized and zonal computing architectures, which reduce system complexity, enhance scalability, and support over-the-air (OTA) updates. This transition allows vehicles to be continuously upgraded throughout their operational life.

2. Growth of Electrification and Power Electronics

The accelerating global adoption of electric vehicles (EVs) is significantly boosting demand for automotive electronics and embedded software. EVs rely on advanced power electronics, battery management systems, and energy optimization software to ensure safety, efficiency, and performance. As a result, investment in high-voltage electronics and intelligent control systems is increasing across both passenger and commercial vehicle segments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2884

3. Rising Deployment of Advanced Driver Assistance Systems

Advanced driver assistance systems (ADAS) are gaining widespread adoption as safety expectations increase and regulatory requirements tighten. Technologies such as adaptive cruise control, lane-keeping assistance, and automated emergency braking are becoming standard features across multiple vehicle classes. ADAS remains one of the largest and fastest-growing application areas within the automotive electronics market.

4. Increasing Software Content and Digital Revenue Models

Software has emerged as a critical differentiator for automotive manufacturers. Modern vehicles incorporate millions of lines of code to enable infotainment, connectivity, diagnostics, and autonomous functions. Automakers are increasingly exploring software-based monetization strategies, including subscription services, feature-on-demand upgrades, and data-enabled offerings, effectively turning vehicles into long-term digital revenue platforms.

5. Regulatory Impact on Safety and Emissions Compliance

Government regulations targeting vehicle safety, emissions reduction, and environmental sustainability continue to shape market dynamics. Meeting stricter safety standards and emissions targets requires the adoption of advanced electronic systems and embedded software, further reinforcing market growth across all major automotive regions.

Market Drivers

Rising Demand for Vehicle Safety and Connectivity

Consumer expectations for improved safety, convenience, and connectivity are key growth drivers. Features such as connected infotainment systems, real-time vehicle diagnostics, vehicle-to-everything (V2X) communication, and advanced safety electronics are increasingly considered standard requirements rather than optional add-ons.

Electrification and Higher Electronics Content per Vehicle

Electric vehicles typically incorporate substantially more electronic components and software than internal combustion engine vehicles. This higher electronics content per vehicle is directly contributing to market expansion, as automakers invest heavily in power management systems, advanced control units, and digital vehicle platforms.

Regulatory Compliance and Government Support

Stringent global regulations related to vehicle safety and emissions control are accelerating the deployment of electronic and software-based solutions. Mandated technologies such as electronic stability control, driver assistance systems, and emissions monitoring continue to drive consistent demand for automotive software and electronics.

Emergence of Software-Centric Revenue Models

The shift toward software-driven business models is encouraging automakers to adopt flexible and scalable software platforms. Subscription-based services, connected vehicle analytics, and post-sale feature activation are reshaping traditional automotive revenue streams and increasing long-term value creation.

Expansion of Emerging Automotive Markets

Growing vehicle ownership across emerging economies is generating demand for affordable safety electronics, basic connectivity systems, and efficient power electronics. These regions present strong growth opportunities for suppliers capable of delivering scalable and cost-effective automotive software and electronics solutions.

Impact of Trends and Drivers

The interaction of evolving technologies and growth drivers is reshaping the automotive software and electronics market across several dimensions:

-

Segment Impact: Software is expanding faster than hardware due to higher margins and recurring revenue potential, although hardware remains essential for enabling digital vehicle functions.

-

Regional Impact: Asia-Pacific leads market growth, driven by high vehicle production volumes, rapid electrification, and expanding electronics manufacturing. North America and Europe follow closely, supported by regulatory mandates and strong demand for advanced vehicle technologies.

-

Application Impact: While ADAS continues to dominate electronics demand, rapid growth is also occurring in infotainment, connectivity, autonomous driving software, and human–machine interface systems, increasing system complexity and value per vehicle.

Challenges and Opportunities

Challenges

-

The transition to centralized computing and SDV architectures requires significant capital investment and specialized software expertise.

-

Ongoing semiconductor supply chain volatility poses risks to production continuity and cost management.

-

Rising concerns around cybersecurity and data protection compliance add complexity to software development and validation.

Opportunities

-

Software-defined vehicles and OTA update capabilities enable continuous feature upgrades and new service-based revenue streams.

-

Growth in electric and autonomous vehicles is driving demand for advanced computing platforms, sensors, and power electronics.

-

Emerging markets offer opportunities for cost-efficient and adaptable automotive electronics solutions aligned with diverse regulatory environments.

Future Outlook

The automotive software and electronics market is expected to maintain steady and sustained growth over the next decade, supported by electrification, digital transformation, and changing consumer expectations. The market is projected to grow at a consistent compound annual growth rate, reaching a substantially higher valuation by the mid-2030s.

As vehicles increasingly function as connected digital ecosystems, software and electronics will play a defining role in competitive differentiation. Companies that successfully combine advanced software platforms with robust electronics hardware will be best positioned to capture long-term value in an increasingly technology-driven automotive industry.

To Get a Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us