Table of Contents

ToggleMarket Overview

The global pharmaceutical REMS market was valued at approximately USD 1.73 billion in 2024 and is projected to expand at a robust CAGR of nearly 13.64% throughout the forecast period, surpassing USD 6.12 billion by 2034.

The Pharmaceutical REMS (Risk Evaluation and Mitigation Strategies) market plays a vital role in safeguarding patient health while ensuring continued availability of medications associated with significant safety risks. Regulatory authorities mandate REMS programs for drugs with serious or long-term adverse effects, requiring structured systems to monitor usage, manage risks, and minimize potential harm.

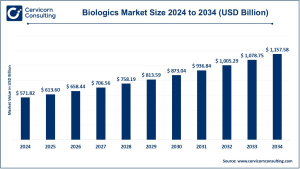

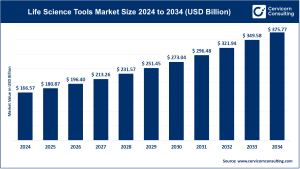

In recent years, the pharmaceutical REMS market has experienced consistent growth, driven by the increasing number of complex therapies, biologics, and specialty drugs that demand rigorous safety oversight. The market includes a broad range of services and solutions such as medication guides, provider certification programs, patient registries, communication plans, and post-marketing safety surveillance. Heightened regulatory scrutiny and the expanding role of pharmacovigilance have established REMS as an essential component of the pharmaceutical product lifecycle.

Get a Free Sample:

https://www.cervicornconsulting.com/sample/2657

Key Market Trends

1. Rising Adoption of Digital and Technology-Driven REMS Platforms

A major trend shaping the pharmaceutical REMS market is the growing use of digital technologies to improve compliance management and safety monitoring. Drug manufacturers are increasingly deploying cloud-based systems, electronic patient registries, and automated reporting tools to streamline REMS implementation. These digital solutions enhance data accuracy, reduce manual workloads, and enable near real-time monitoring of adverse events and patient outcomes.

2. Broader REMS Adoption for Specialty and Biologic Therapies

The expanding pipeline of biologics, oncology treatments, central nervous system (CNS) drugs, and gene therapies has significantly widened the scope of REMS requirements. These therapies often involve higher safety risks, extended treatment durations, or narrow therapeutic margins, necessitating comprehensive and multi-layered risk mitigation strategies. Consequently, REMS programs are becoming increasingly complex and resource-intensive.

3. Intensifying Regulatory Scrutiny and Compliance Standards

Regulatory agencies are placing greater emphasis on post-marketing surveillance and measurable REMS effectiveness. Pharmaceutical companies are now expected to demonstrate that their REMS programs achieve defined safety outcomes through ongoing assessments and detailed reporting. This trend is driving investments in real-world evidence, advanced analytics, and continuous compliance optimization.

4. Transition Toward Patient-Focused REMS Frameworks

REMS programs are evolving to place greater emphasis on patient engagement and education. Beyond prescriber compliance, manufacturers are adopting patient-friendly tools such as digital reminders, educational materials, and adherence support systems. This shift aligns with broader healthcare trends emphasizing patient-centric care and improved treatment outcomes.

5. Growing Outsourcing of REMS Operations

Pharmaceutical companies are increasingly outsourcing REMS design, execution, and monitoring to specialized third-party providers. Outsourcing allows manufacturers to reduce operational burden, maintain regulatory compliance, and concentrate internal resources on research, development, and commercialization activities.

Market Drivers

Increasing Volume of High-Risk and Specialty Drugs

The expanding pipeline of high-risk therapies is a key driver of REMS market growth. A substantial proportion of newly approved drugs—particularly in oncology, immunology, and neurology—require mandatory risk mitigation frameworks, directly fueling demand for REMS services.

Stringent Regulatory Requirements

Regulatory authorities continue to enforce strict safety standards for drug approvals and post-market monitoring. In many cases, REMS programs are mandatory for market authorization, making them an essential and ongoing requirement for pharmaceutical manufacturers.

Expansion of Global Pharmacovigilance Systems

The worldwide growth of pharmacovigilance activities is further supporting REMS market expansion. Regulators increasingly demand real-world safety data, periodic risk evaluations, and documented risk reduction outcomes, driving sustained investment in REMS infrastructure and analytics capabilities.

Heightened Emphasis on Patient Safety and Risk Reduction

Pharmaceutical companies are prioritizing REMS implementation to reduce adverse events, limit liability exposure, and protect brand reputation. Effective REMS programs help demonstrate regulatory compliance and due diligence, reinforcing their strategic importance throughout the drug lifecycle.

Impact of Trends and Drivers

Collectively, these trends and drivers are reshaping the pharmaceutical REMS market across regions and applications. North America, led by the United States, remains the largest market due to mature regulatory frameworks and strong enforcement mechanisms. At the same time, emerging markets are gradually adopting similar risk management standards, opening new avenues for growth.

From an application perspective, oncology and biologics represent the fastest-growing segments, driven by the complexity and safety sensitivity of these therapies. Digitization is accelerating adoption among large pharmaceutical companies, while smaller firms increasingly depend on outsourced REMS providers to ensure compliance.

Challenges and Opportunities

Despite strong growth potential, the market faces challenges including high implementation costs, administrative complexity, and the need for continuous regulatory alignment. Coordinating multiple stakeholders—such as healthcare providers, pharmacies, and patients—adds to operational demands.

However, these challenges also present significant opportunities. The rising demand for scalable, technology-enabled REMS platforms, advanced data analytics, and specialized service providers is creating growth prospects for solution vendors and consulting firms offering cost-effective and compliant REMS models.

Future Outlook

The pharmaceutical REMS market is expected to sustain strong momentum throughout the forecast period, supported by an increasing number of REMS-mandated therapies and heightened regulatory focus on post-market safety. As highlighted by Cervicorn Consulting, the market is projected to grow at a healthy CAGR, with steady demand extending well into the next decade.

Future advancements are expected to include deeper integration of artificial intelligence, expanded use of real-world data analytics, increased digitalization of REMS workflows, and broader adoption of patient-centric risk management approaches. As patient safety remains a top priority for both regulators and manufacturers, REMS programs will continue to serve as a foundational element of the global pharmaceutical ecosystem.

To Get Detailed Overview, Contact Us:

https://www.cervicornconsulting.com/contact-us