Market Overview

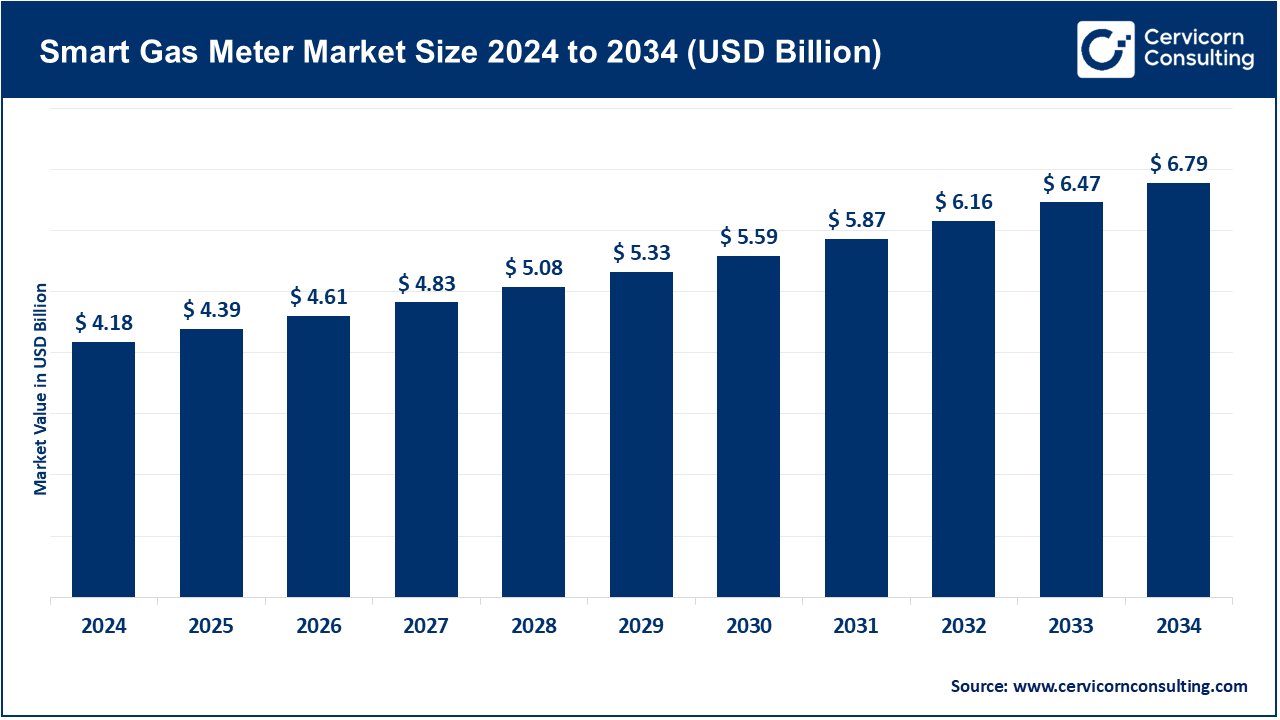

The global smart gas meter market was valued at approximately USD 4.18 billion in 2024 and is projected to reach around USD 6.79 billion by 2034, registering a CAGR of 4.97% during the forecast period (2025–2034). Smart gas meters are transforming the gas utility sector by enabling real-time monitoring, two-way communication, and automated billing. As integral components of Advanced Metering Infrastructure (AMI) and the broader Internet of Things (IoT) ecosystem, these meters help gas companies optimize operations, detect leaks, reduce energy losses, and ensure accurate, transparent billing for consumers.

Increasing emphasis on energy efficiency, regulatory compliance, and carbon emission reduction is driving the adoption of smart gas meters in both developed and emerging markets. Governments worldwide are launching initiatives and policies to encourage intelligent metering as part of their smart grid modernization strategies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2802

Key Market Trends

1. Integration of IoT and AI Technologies

Smart gas meters are evolving into intelligent nodes within IoT networks, enhanced by artificial intelligence (AI). This integration allows utilities to analyze consumption patterns in real-time, forecast demand, and detect potential faults early. AI-powered analytics can identify gas leaks or irregularities within minutes, improving both operational safety and service quality.

2. Rising Adoption of Cellular LPWAN (NB-IoT and LTE-M)

Low Power Wide Area Networks (LPWANs) like NB-IoT and LTE-M are expanding connectivity for smart gas meters, including in rural and remote areas, while reducing infrastructure costs. Countries such as the UK, Italy, and India are deploying these cellular technologies in nationwide smart metering programs to boost scalability and reliability.

3. Emphasis on Sustainability and Green Metering

Sustainability is a major focus, with manufacturers and utilities developing energy-efficient meters and environmentally responsible production methods. Governments in Europe and North America are promoting eco-friendly solutions to meet net-zero emission targets and comply with initiatives like the EU Green Deal.

4. Shift Toward SaaS and Cloud Platforms

There is a notable shift from hardware-centric systems to Software-as-a-Service (SaaS) and cloud-based metering platforms. Cloud AMI management provides utilities with subscription-based access to analytics, device management, and cybersecurity tools, simplifying operations and lowering costs.

5. Growing Regulatory Mandates and National Rollouts

Governments are increasingly mandating smart meter installations to ensure energy accountability and infrastructure modernization. The UK’s national smart meter rollout and India’s Smart City Mission are examples of programs driving large-scale adoption.

Market Drivers

1. Government Initiatives and Policy Support

Supportive policies and national programs are key drivers. The EU Energy Efficiency Directive mandates smart meter deployment across member states. Similarly, initiatives like the U.S. Department of Energy programs and India’s Ujjwal Bharat drive modernization of gas infrastructure.

2. Technological Advancements in Connectivity and Analytics

Advances in IoT, AI, and cloud computing enhance the performance, reliability, and interoperability of smart gas meters. Falling costs of communication modules such as NB-IoT chips are enabling large-scale adoption.

3. Growing Demand for Energy Efficiency and Transparency

Consumers and regulators prioritize efficient energy use and accurate billing. Smart meters give consumers real-time insights into gas consumption, helping reduce costs, especially amid fluctuating energy prices.

4. Rising Urbanization and Smart City Development

Asia-Pacific countries like China, India, and South Korea are integrating smart metering into smart city initiatives. Urban infrastructure projects increasingly require smart meters for improved energy management and grid reliability.

5. Enhanced Focus on Safety and Leak Detection

Advanced monitoring solutions are being adopted to address gas safety concerns. Modern smart meters can detect leaks or tampering automatically, preventing accidents and ensuring compliance.

Impact of Trends and Drivers

The interplay of digitalization, sustainability mandates, and urbanization is reshaping market dynamics:

-

Europe: Leads adoption due to regulatory support and mature infrastructure.

-

Asia-Pacific: Fastest-growing region driven by smart city programs and energy efficiency initiatives.

-

North America: Focuses on upgrading legacy systems through modernization funding.

Residential demand is driven by energy efficiency and transparent billing, whereas industrial and commercial sectors benefit from predictive maintenance and enhanced safety.

Challenges & Opportunities

Challenges:

-

High upfront investment and installation costs

-

Data privacy and cybersecurity issues

-

Integration with existing legacy systems

Opportunities:

-

Development of cost-effective retrofit modules for existing meters

-

Growing interest in green and recyclable metering solutions

-

Use of AI-powered predictive analytics to optimize operations

Future Outlook

The global smart gas meter market is expected to reach USD 6.79 billion by 2034 at a CAGR of 4.97%. Continuous advancements in communication technologies, cloud-based management, and analytics will shape the industry’s growth. With global initiatives promoting digital and sustainable energy systems, smart gas meter adoption will accelerate across both developed and emerging regions.

Integration of IoT, AI, and big data analytics is transforming gas utilities into fully digital ecosystems, delivering actionable insights while enhancing safety, efficiency, and sustainability for the long term.

📞 To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us