Market Overview

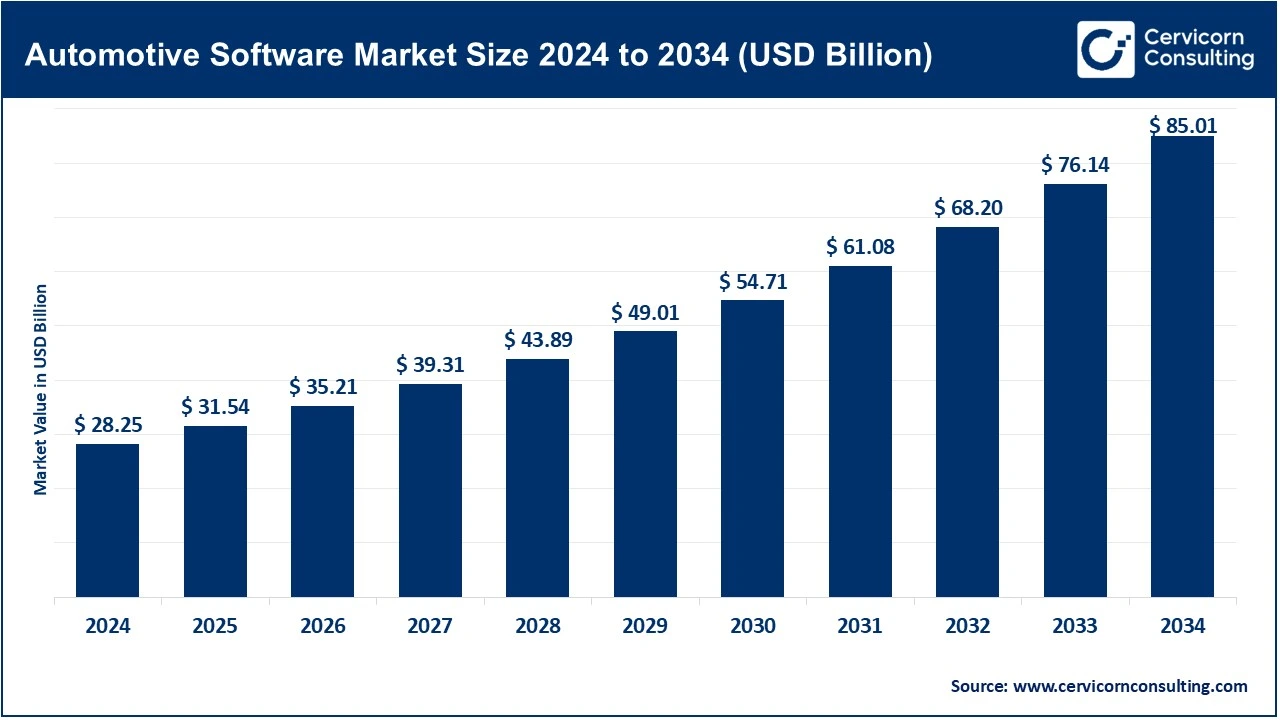

The global automotive software market is experiencing a strong growth trajectory. In 2024, the market was valued at approximately USD 28.25 billion, and it is expected to reach around USD 85.01 billion by 2034, representing a compound annual growth rate (CAGR) of roughly 11.6% between 2025 and 2034.

This growth is driven by the rapid evolution of vehicle electronics, connected technologies, cloud integration, and software-defined vehicle (SDV) architectures, which are shifting the industry from a traditional hardware-centric model to a software-driven ecosystem. Software now underpins essential vehicle functions, connectivity, user experience, lifecycle management, and monetized services.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2803

Key Market Trends

Several emerging trends are reshaping the automotive software landscape:

1. Software-Defined Vehicles (SDVs) & Domain/Zonal Architectures

Automakers are moving from traditional distributed ECUs to zonal or domain controllers, consolidating functionality and enabling frequent updates. Software is increasingly viewed as the vehicle’s “brain,” driving demand for middleware, real-time operating systems, OTA update frameworks, and validation tools.

2. Over-The-Air (OTA) Updates & Vehicle Connectivity Services

With growing vehicle connectivity via telematics, 5G, and V2X communication, OEMs are enabling OTA updates to deliver new features, fix bugs, and optimize performance. This trend expands software monetization opportunities while heightening the focus on cybersecurity, data management, and connectivity platforms.

3. Cloud Adoption & Data Analytics for Vehicles and Mobility Services

The market is seeing increased use of cloud platforms for vehicle data, predictive maintenance, remote diagnostics, and mobility services. Software-as-a-service (SaaS) and platform-based models are increasingly blurring the line between automotive and enterprise/consumer digital ecosystems.

4. Regulatory and Safety Pressures – ADAS & Autonomous Driving

Stricter regulations for advanced driver-assistance systems (ADAS), functional safety, and autonomous driving make software safety-critical. This drives OEMs and suppliers to invest in validation, calibration, safety frameworks, and lifecycle management, boosting per-vehicle software spend.

5. Consumer Expectations for Digital Experiences & Subscriptions

Consumers expect vehicles to deliver smartphone-like experiences, including updates, new features, and app-based services. OEMs are responding with subscription models for infotainment, connectivity, and advanced functions, increasing reliance on OTA platforms and back-end software systems.

Market Drivers

Key forces propelling automotive software market growth include:

-

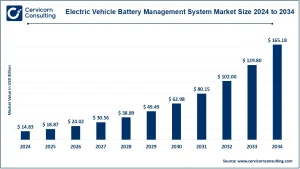

Electrification and Connected/Autonomous Vehicles: EVs and connected vehicles require more software for battery management, vehicle control, infotainment, and telematics.

-

Software-Defined Vehicle Architectures: As vehicles become software platforms, OEMs invest in embedded software, middleware, application layers, and lifecycle tools, generating additional revenue streams for suppliers.

-

Regulatory Compliance: Functional safety (ISO 26262 / SOTIF), cybersecurity, data privacy, and emissions compliance demand sophisticated software solutions.

-

Connectivity & Data Monetization: Telematics, V2X communication, remote diagnostics, and predictive maintenance create new revenue opportunities.

-

Consumer Demand for Digital Features: OTA updates, new apps, and seamless connectivity push OEMs to invest in software platforms and back-end services.

-

Increasing Electronic Complexity: Electrification, autonomy, and connectivity raise the number of ECUs, software modules, and code lines, driving demand for development, integration, testing, and lifecycle management.

The projected growth from USD 28.25 billion (2024) to USD 85.01 billion (2034) at ~11.6% CAGR reflects the cumulative effect of these drivers.

Impact of Trends and Drivers

-

Embedded vs Application Software: SDVs shift spend toward embedded and middleware, while OTA and connectivity boost application software spending.

-

Regional Outlook: North America and Europe are early adopters of SDVs and SaaS models; Asia-Pacific is growing rapidly with EV adoption in China, India, and other markets.

-

Market Players: OEMs may internalize software capabilities but also rely on Tier-1 and IT/cloud suppliers, expanding service opportunities.

-

Vehicle Segmentation: EVs, connected/autonomous vehicles, and passenger cars with advanced features will see higher software spend; commercial vehicles and fleets benefit from telematics and lifecycle management solutions.

-

Business Model Evolution: Transition from one-time software sales to subscription-based services encourages investment in cloud, data analytics, and cybersecurity platforms.

Challenges & Opportunities

Challenges:

-

Fragmented software ecosystem and integration complexities

-

Cybersecurity and data privacy risks

-

Shortage of skilled software engineers and high development costs

-

Slow transition from legacy hardware/software architectures

Opportunities:

-

Monetization of software features and subscriptions

-

Expansion into emerging markets and fleet management software

-

Software platforms for shared mobility, autonomous fleets, and EVs

-

Premium software solutions for connected, autonomous, and electrified vehicles

Future Outlook

The automotive software market is expected to sustain double-digit growth, moving from USD 28.25 billion in 2024 to approximately USD 85.01 billion by 2034, implying a CAGR of ~11.6%. Key growth areas include SDV architecture deployment, connectivity and data-service monetization, OTA and cybersecurity platforms, and subscription-based business models. Asia-Pacific and emerging markets will complement growth in mature markets, with EVs, connected/autonomous vehicles, and mobility fleets driving adoption. Success for vendors will require expertise in domain-specific software, cloud/data analytics, cybersecurity, and the ability to support recurring revenue models.

To Get Detailed Overview, Contact Us