Battery Cell Component Market Overview

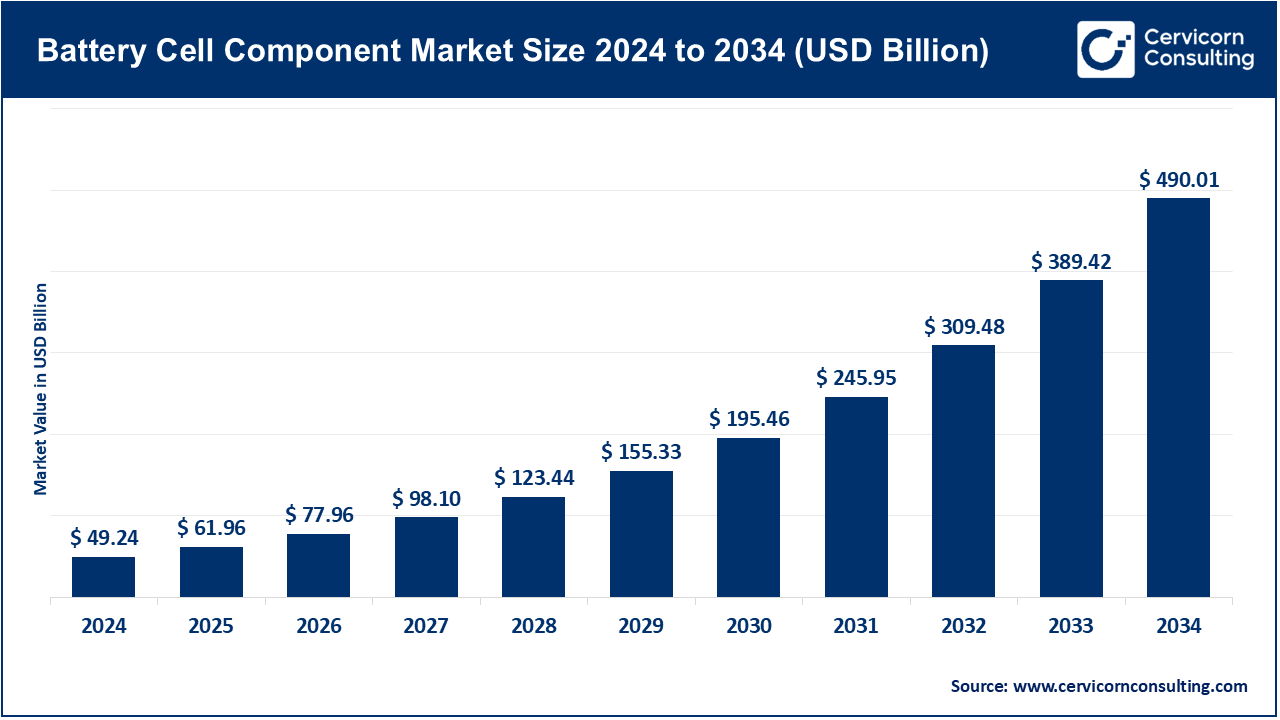

The global battery cell component market has witnessed remarkable growth in recent years, driven by the surge in electric vehicle (EV) adoption, expanding renewable energy storage infrastructure, and the proliferation of consumer electronics. In 2024, the market was valued at around USD 49.24 billion, with projections indicating it could reach approximately USD 490.01 billion by 2034, achieving a strong CAGR of 25.83% over the forecast period. This growth is largely fueled by increasing energy storage demands, continuous innovations in battery chemistry, and rising investments in electrification across multiple sectors.

Battery cell components—including cathodes, anodes, separators, electrolytes, and current collectors—are fundamental to battery efficiency, performance, and safety.

Key Market Trends

Several pivotal trends are currently shaping the battery cell component market:

-

Transition to High-Energy-Density Batteries

Battery manufacturers are prioritizing high-energy-density lithium-ion technologies to extend EV range and optimize energy storage. Notably, solid-state batteries are gaining attention for their superior energy density and enhanced safety compared to traditional lithium-ion solutions. -

Sustainable and Green Manufacturing

Environmental sustainability is becoming central to battery production. Recycling battery materials and minimizing the ecological impact of lithium and cobalt extraction are key initiatives. Companies such as Tesla and CATL are investing significantly in recycling facilities to reclaim valuable materials. -

Government Incentives for EVs and Energy Storage

Policy support and subsidies aimed at promoting electric mobility and renewable energy adoption are accelerating market demand. For instance, the U.S. Inflation Reduction Act and the EU Green Deal provide incentives for local battery production and sustainable supply chains. -

Adoption of Smart Battery Management Systems (BMS)

Advanced BMS technologies are increasingly implemented to optimize battery safety, lifespan, and performance. These systems monitor and balance individual cells, improving efficiency for EVs and grid-scale storage applications. -

Supply Chain Localization and Strategic Collaborations

To reduce dependency on global supply chains, manufacturers are establishing regional supply networks and forming partnerships with raw material suppliers. For example, North American and European automakers are collaborating with local cathode and anode producers to strengthen supply resilience.

Market Drivers

Key factors fueling market growth include:

-

Rising EV Adoption: Global EV sales are projected to surpass 40 million units by 2030, driving demand for high-quality battery components.

-

Government Support: Incentives for EVs, renewable energy storage, and domestic battery manufacturing are bolstering market expansion.

-

Technological Advancements: The development of high-performance cathode and anode materials, solid-state batteries, and efficient BMS solutions is enhancing battery capabilities.

-

Growing Consumer Demand for Portable Energy: The rising usage of consumer electronics, wearables, and home energy storage systems is contributing to increased demand for battery components.

The CAGR of 25.83% underscores the strong influence of these drivers, indicating a tenfold increase in market value by 2034.

Impact of Trends and Drivers

By Segment:

-

High-energy-density and solid-state battery technologies are driving demand for advanced cathode and anode materials.

-

BMS innovations are supporting the adoption of smart energy storage in both consumer electronics and EV applications.

By Region:

-

North America and Europe: Growth is backed by government incentives, EV adoption, and domestic battery production initiatives.

-

Asia-Pacific: Continues to dominate due to established lithium-ion battery manufacturing hubs in China, South Korea, and Japan.

By Application:

-

EVs, grid storage systems, and consumer electronics are the primary beneficiaries of advancements in battery components and supportive regulatory frameworks.

Challenges & Opportunities

Challenges:

-

Price volatility of raw materials and supply chain disruptions.

-

Environmental concerns linked to mining and disposal of battery materials.

Opportunities:

-

Expansion of solid-state and next-generation battery technologies.

-

Growth in recycling and second-life battery solutions for sustainable energy storage.

-

Strategic collaborations between automakers and component suppliers to fortify regional supply chains.

Future Outlook

The battery cell component market is set for continued expansion, driven by trends such as solid-state battery adoption, sustainable manufacturing, and smart BMS integration. Regions investing in localized supply chains and benefiting from government-backed incentives are expected to lead growth. Technological innovations will continue enhancing battery performance across EVs, grid storage solutions, and consumer electronics applications.