Market Overview

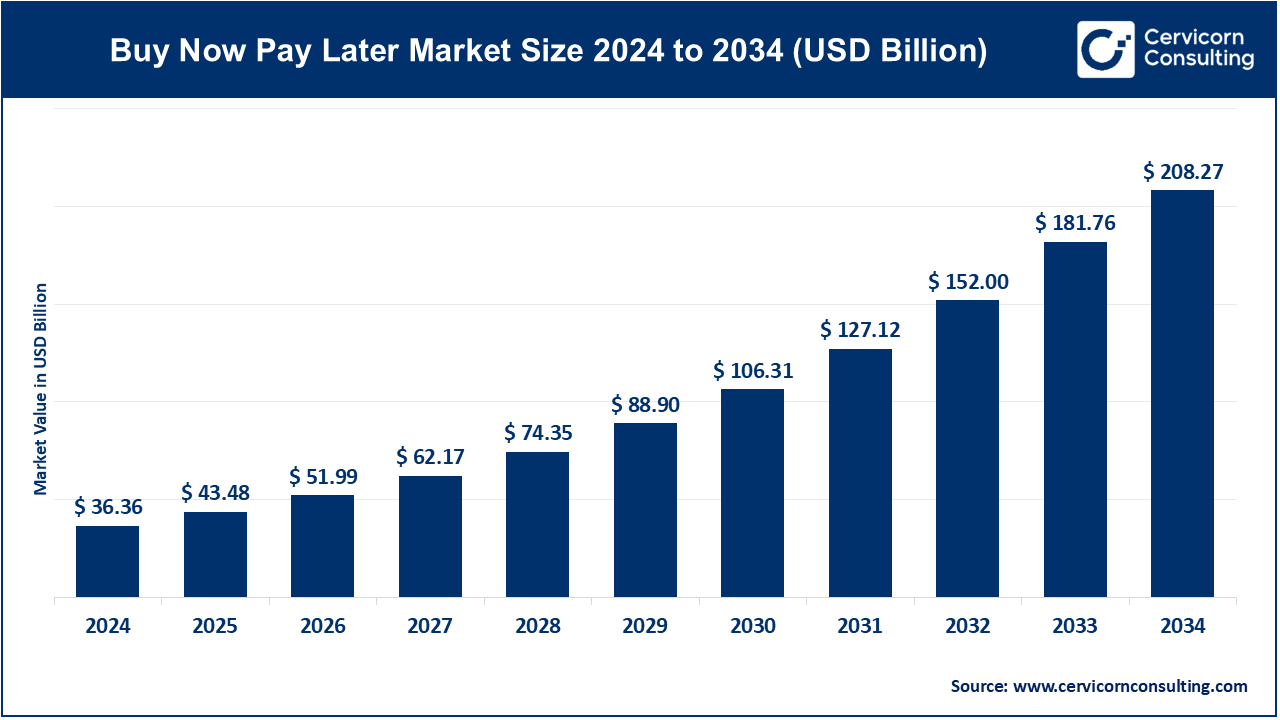

The global buy now pay later market has grown significantly in recent years, reaching an estimated value of USD 36.36 billion in 2024. Fueled by the digital shift in payments and retail, the market is on track to hit USD 208.27 billion by 2034, expanding at a notable CAGR of 19.07% between 2025 and 2034. BNPL models allow users to split purchases—online or in-store—into multiple zero-interest installments, positioning themselves as a convenient alternative to traditional credit cards.

This surge in adoption is closely linked to the booming e-commerce industry, rising consumer inclination toward short-term, transparent financing options, and the increasing integration of BNPL services into merchants’ checkout processes. Younger demographics such as Millennials and Gen Z continue to be the largest user groups, driven by the simplicity and clarity offered by BNPL solutions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2413

Key Market Trends

1. Advanced Fintech and AI Integration

BNPL platforms are rapidly embedding AI, machine learning, and automated workflows to support instant credit decisions, improve risk modeling, and strengthen fraud prevention. Notable developments—such as Affirm’s USD 4 billion investment partnership with Sixth Street—highlight how leading BNPL firms are enhancing their lending capacity through sophisticated technology.

2. Rising Use in Daily Purchases

BNPL is no longer restricted to discretionary spending categories like fashion or electronics. The industry has seen a sharp rise in its application for groceries, gas, utilities, and other everyday needs. In fact, “daily essentials” usage skyrocketed by 434% between 2020 and 2021, reflecting a major behavioral shift among consumers.

3. Growth of Embedded Finance Ecosystems

Companies including Klarna and Afterpay are strengthening the embedded finance movement by integrating BNPL directly into e-commerce ecosystems, digital wallets, and POS systems. This seamless integration improves user experience while boosting merchant conversion rates.

4. Regulatory Reform and Compliance Focus

Governments and financial regulators are introducing tighter frameworks involving affordability assessments, disclosures, and transaction transparency. These policies aim to balance innovation with consumer protection, laying the groundwork for a more stable BNPL industry.

5. Retail and Partnership Expansion

BNPL firms are aggressively partnering with online marketplaces, SMBs, travel platforms, and service providers. These collaborations help merchants increase average order values and reduce cart abandonment, contributing to deeper market penetration.

Market Drivers

1. Growing Preference for Flexible Payment Models

Consumers increasingly favor installment-based payment structures that avoid interest charges. This preference is reflected in the strong performance of the retail segment, which accounted for 69% of total BNPL revenue in 2024.

2. Technological Progress Across Fintech

Innovations in secure digital payments, real-time scoring algorithms, and mobile-first interfaces have significantly enhanced the speed and reliability of BNPL services. These improvements enable frictionless checkout and robust merchant integration.

3. Advancing Financial Inclusion

A major growth driver is BNPL’s ability to extend credit access to individuals with limited or no credit scores. This appeals particularly to tech-savvy, younger consumers who prefer modern financing options over conventional credit channels.

4. Rising Merchant Adoption

Retailers increasingly recognize the benefits of BNPL, such as higher sales conversions and decreased checkout abandonment. As a result, merchant adoption has accelerated across categories from electronics to healthcare.

5. E-Commerce Expansion

The global expansion of e-commerce—especially in fast-growing regions like Asia-Pacific and North America—directly supports BNPL usage. In 2024, North America contributed 32.8% of total BNPL revenue, while Asia-Pacific accounted for 28.7%, underscoring the growing influence of these high-adoption regions.

Impact of Trends and Drivers

Segment-Level Impact

Retail, travel, and healthcare have emerged as major beneficiaries of BNPL adoption. The Point-of-Sale (POS) channel represented 84.3% of market revenue in 2024, showing strong preference for in-store or integrated payment options. Small and medium enterprises (SMEs) also play a critical role, generating 54% of total revenue by leveraging BNPL to drive sales and improve cash flow.

Regional Dynamics

-

North America maintains leadership due to early BNPL adoption and a mature digital payments landscape.

-

Asia-Pacific is rapidly expanding thanks to high smartphone usage and an explosive e-commerce ecosystem.

Application-Level Impact

AI-supported credit scoring and embedded finance are reshaping both everyday use cases and larger-ticket purchases. These technologies enable smoother user journeys, making BNPL an appealing choice for a wide range of consumer needs.

Challenges & Opportunities

Challenges

-

Heightened regulatory pressure and compliance expectations

-

Risk of consumer over-spending and debt accumulation

-

Macroeconomic volatility and tightening credit markets

Opportunities

-

Expanding into underpenetrated emerging economies

-

Launching subscription-based or long-term installment features

-

Linking BNPL with loyalty, rewards, and digital wallet ecosystems

-

Leveraging cross-border e-commerce to widen adoption

Future Outlook

The BNPL industry is expected to sustain high momentum over the next decade, supported by strong digital adoption, changing consumer preferences, and rapid fintech innovation. With a projected CAGR of 19.07%, the market is forecasted to reach USD 208.27 billion by 2034. Emerging shifts—including AI-powered risk analytics, more embedded BNPL solutions, and global expansion of flexible financing—are set to redefine consumer purchasing behavior and accelerate BNPL acceptance across industries and regions.

For more information or tailored insights, contact:

https://www.cervicornconsulting.com/contact-us