Carbon Capture, Utilization, and Storage Market Overview

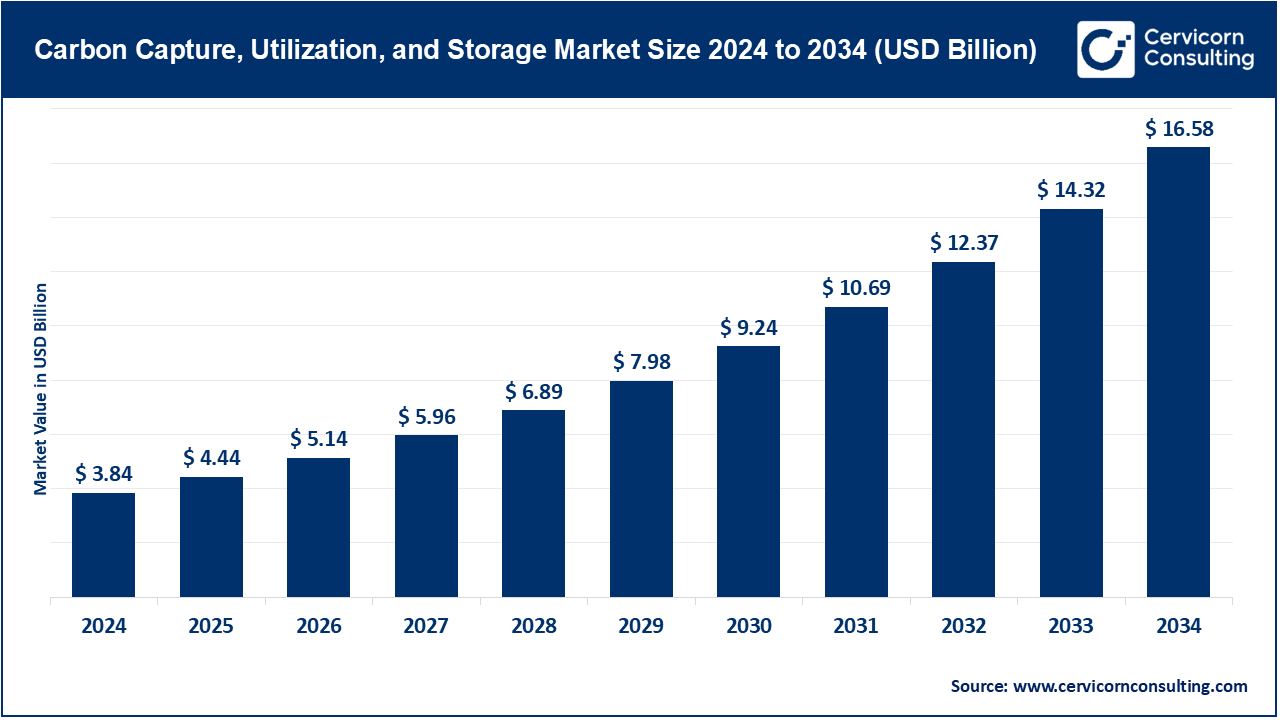

The global carbon capture, utilization, and storage (CCUS) market was estimated at USD 3.84 billion in 2024 and is projected to reach nearly USD 16.58 billion by 2034, growing at a CAGR of 24.5% during 2025–2034. This surge is being driven by tighter emission regulations, growing decarbonization commitments, and the accelerated adoption of sustainable technologies across energy and industrial sectors. With heavy emitters like cement, steel, oil & gas, and power generation seeking cleaner solutions, CCUS has become a cornerstone in supporting global net-zero goals.

Key Market Trends

1. Integration of CCUS with Renewable Energy and Hydrogen

The increasing focus on blue hydrogen production (hydrogen generated from natural gas coupled with carbon capture) is boosting CCUS deployment. A prime example is the Northern Lights Project in Norway, led by Equinor, Shell, and TotalEnergies, which integrates CCUS with hydrogen to establish scalable decarbonization models.

👉 Get a Free Sample: https://www.cervicornconsulting.com/sample/2713

2. Growth of Direct Air Capture (DAC)

Technologies that directly extract CO₂ from the air are gaining momentum. Companies such as Climeworks and Carbon Engineering are developing large-scale DAC facilities, each with the capacity to capture over 1 million tons of CO₂ annually.

3. Supportive Policies and Regulatory Incentives

Governments are actively supporting CCUS through financial incentives. In the U.S., the Inflation Reduction Act (IRA) raised the 45Q tax credit to USD 85 per ton of CO₂ stored, enhancing project viability.

4. Development of Carbon Hubs and Industrial Clusters

Shared CCUS hubs are enabling industries to cut costs by pooling resources for carbon capture, transport, and storage. For instance, the UK’s East Coast Cluster aims to store 27 million tons of CO₂ annually by 2030.

5. Digitalization and AI Applications

The use of AI-powered monitoring systems is improving efficiency and safety in storage and transport networks. Meanwhile, digital twins are being leveraged to model and optimize CCUS plant performance in real time.

Market Drivers

1. Rising CO₂ Emissions Globally

The IEA reported that global energy-related CO₂ emissions climbed to 37.4 gigatons in 2023, underscoring the need for large-scale carbon reduction initiatives.

2. Net-Zero Targets and Government Support

With over 140 nations (representing 91% of global GDP) committing to net-zero, governments are providing major financial backing. Examples include the EU Innovation Fund (USD 38 billion) and the U.S. DOE’s USD 3.7 billion CCUS demonstration program.

3. Advances in Capture Efficiency

Innovations in amine-based solvents, membranes, and cryogenic capture are helping lower costs. Large-scale capture costs have fallen from USD 120–140 per ton a decade ago to about USD 60–80 per ton today.

4. ESG Commitments from Corporates

Energy giants like ExxonMobil, Chevron, and BP have pledged multi-billion-dollar investments in CCUS. Furthermore, over 60% of Fortune 500 firms now have carbon neutrality commitments, accelerating CCUS uptake.

Impact of Trends and Drivers

By Region:

-

North America dominates due to favorable policies like the IRA and investments in oil & gas CCUS projects.

-

Europe is expanding quickly with industrial carbon clusters in the UK, Norway, and the Netherlands.

-

Asia-Pacific (China, Japan, South Korea) is scaling CCUS for heavy industries and hydrogen initiatives.

By Industry:

-

Power generation is being transformed as coal and gas plants are retrofitted for carbon capture.

-

Cement and steel sectors, some of the most challenging industries to decarbonize, are projected to drive 25–30% of CCUS demand by 2030.

-

Hydrogen production is expected to account for 15–20% of global CCUS capacity by 2034.

Challenges & Opportunities

Challenges: High capital costs for infrastructure (pipelines and storage), public concerns over CO₂ storage safety, and slow scaling of pilot projects.

Opportunities: Growth in carbon utilization markets (chemicals, synthetic fuels, and building materials), the rise of carbon credit trading through voluntary markets, and the formation of regional CCUS hubs through industry-government collaboration.

Future Outlook

With innovations in direct air capture, hydrogen integration, and AI monitoring, the CCUS market is set to grow rapidly, reaching USD 16.58 billion by 2034 at a 24.5% CAGR. While North America and Europe will remain key markets due to policy strength, Asia-Pacific is emerging as the next growth hotspot.

CCUS is shifting from being viewed solely as a climate solution to becoming a key driver of the energy transition, offering significant environmental and economic advantages.

👉 Contact for Detailed Market Insights: https://www.cervicornconsulting.com/contact-us