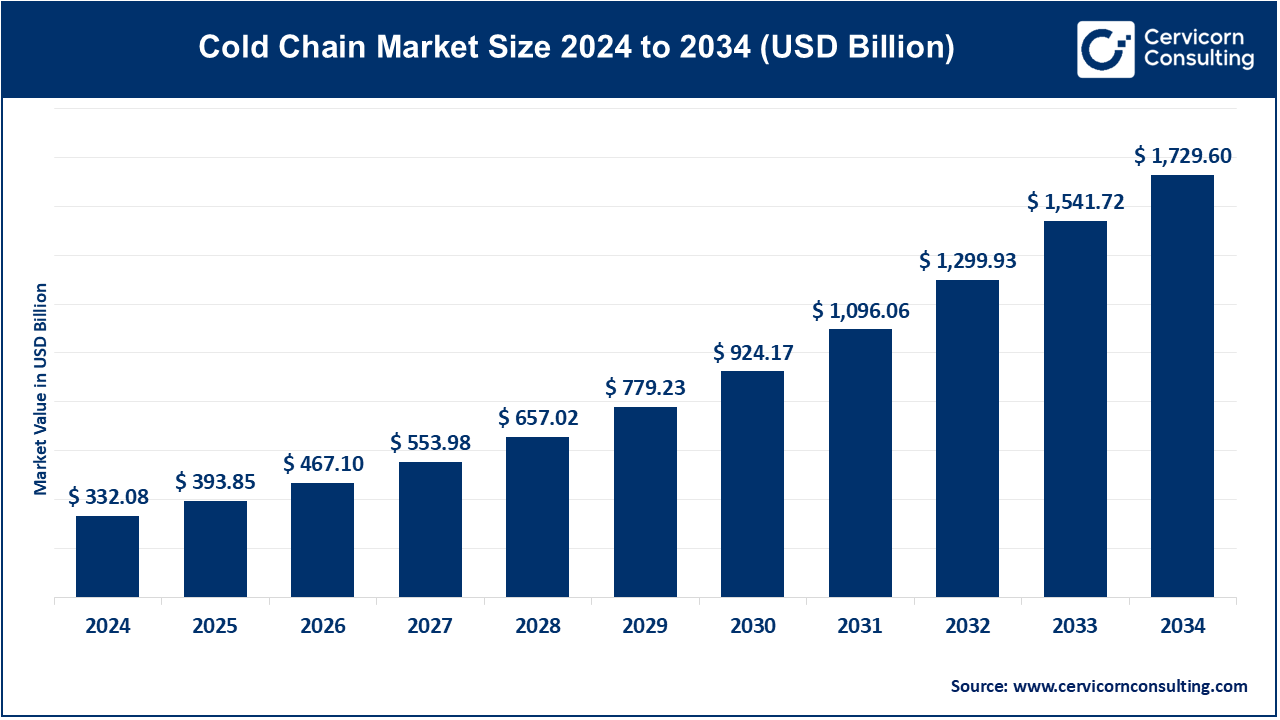

Cold Chain Market Size

The global cold chain market size was valued at approximately USD 332.08 billion in 2024 and is projected to reach around USD 1,729.60 billion by 2034, growing at a CAGR of 18.06% between 2025 and 2034.

What is the Cold Chain Market?

The cold chain market refers to the temperature-controlled supply chain system used to store, transport, and distribute perishable goods such as food, pharmaceuticals, and biologics, while maintaining their quality and safety. This market encompasses refrigerated storage facilities, temperature-controlled transportation, and advanced monitoring technologies to ensure optimal conditions throughout the supply chain. Key applications include food and beverages, pharmaceuticals and healthcare, chemicals, and others.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2337

Market Trends

1. Technological Advancements

The integration of Internet of Things (IoT) sensors, artificial intelligence (AI), and blockchain technology is revolutionizing cold chain logistics. These innovations enable real-time monitoring, predictive maintenance, and enhanced traceability, ensuring the integrity of temperature-sensitive products.

2. Sustainability Initiatives

There is a growing emphasis on adopting eco-friendly refrigerants, energy-efficient storage solutions, and waste reduction methods. These sustainability efforts are not only addressing environmental concerns but also aligning with regulatory pressures and consumer preferences for green practices.

3. E-Commerce Growth

The rise of online grocery shopping and direct-to-consumer delivery models is increasing the demand for efficient last-mile cold chain solutions. This trend is particularly evident in urban areas where consumers expect quick and reliable delivery of perishable items.

4. Regulatory Compliance

Stricter regulations in the food and pharmaceutical industries are pushing companies to invest in advanced cold chain infrastructure. Compliance with standards such as the Food Safety Modernization Act (FSMA) and Good Distribution Practice (GDP) guidelines is becoming essential for market participation.

Market Dynamics

Drivers

-

Increasing Demand for Perishable Goods: The growing global population and changing dietary habits are leading to higher consumption of perishable items, thereby driving the need for robust cold chain systems.

-

Global Trade Expansion: The globalization of trade is facilitating the movement of temperature-sensitive products across borders, necessitating the development of international cold chain networks.

-

Pharmaceutical Industry Growth: The rise in demand for vaccines, biologics, and temperature-sensitive medications is a significant driver for the cold chain market. These products require stringent temperature controls to maintain efficacy and safety.

Restraints

-

Infrastructure Costs: The high capital investment required for establishing and maintaining cold chain facilities can be a barrier, especially for small and medium-sized enterprises.

-

Energy Consumption: Cold chain operations are energy-intensive, leading to high operational costs and environmental concerns.

Opportunities

-

Technology Integration: Investing in advanced technologies such as IoT, AI, and blockchain can improve efficiency, reduce costs, and enhance traceability.

-

Sustainable Practices: Adopting eco-friendly refrigerants and energy-efficient systems can reduce environmental impact while aligning with regulatory requirements and consumer expectations.

Challenges

-

Regulatory Compliance: Navigating the complex and varying regulations across different regions can be challenging for companies operating in the cold chain market.

-

Supply Chain Disruptions: Global events such as pandemics or geopolitical tensions can disrupt supply chains, affecting the timely delivery of perishable goods.

Regional Analysis

North America

North America holds a significant share of the cold chain market, driven by the presence of major logistics companies and a well-established infrastructure. The region is witnessing increased investments in cold storage facilities and transportation fleets to meet the growing demand for perishable goods.

Europe

Europe is experiencing a rise in demand for traceability and transparency due to stringent regulations. Countries like Germany, the U.K., and France are focusing on regulatory compliance and advanced cold chain practices to ensure the safety and quality of perishable products.

Asia-Pacific

The Asia-Pacific region is witnessing significant investment in infrastructure development and modernization of cold chain facilities. Countries such as China, India, Japan, and Australia are experiencing rapid economic growth, leading to increased consumer demand for high-quality perishable products.

Latin America, Middle East & Africa (LAMEA)

The LAMEA region is experiencing growth in cold chain infrastructure, driven by increasing urbanization and a demand for higher-quality goods. Countries in Latin America and the Middle East & Africa are investing in cold storage and transportation solutions to support industries such as agriculture and pharmaceuticals.

Recent Developments

-

Americold’s Investment in Cold Storage Facilities: In March 2025, Americold Realty Trust invested $127 million to acquire a 10.7-million-cubic-foot cold storage facility in Houston’s Cedar Port Industrial Park.

-

Technavio’s Market Research Report: Technavio announced its latest market research report titled “Cold Chain Market by Type, Application, and Geography – Forecast and Analysis 2020-2024,” highlighting growth prospects and trends in the cold chain industry.

-

CMA CGM’s Partnership with Mistral AI: In April 2025, shipping giant CMA CGM announced a €100 million, five-year partnership with French AI startup Mistral AI to enhance logistics operations through artificial intelligence technologies.

For more detailed insights, contact us: Contact Us