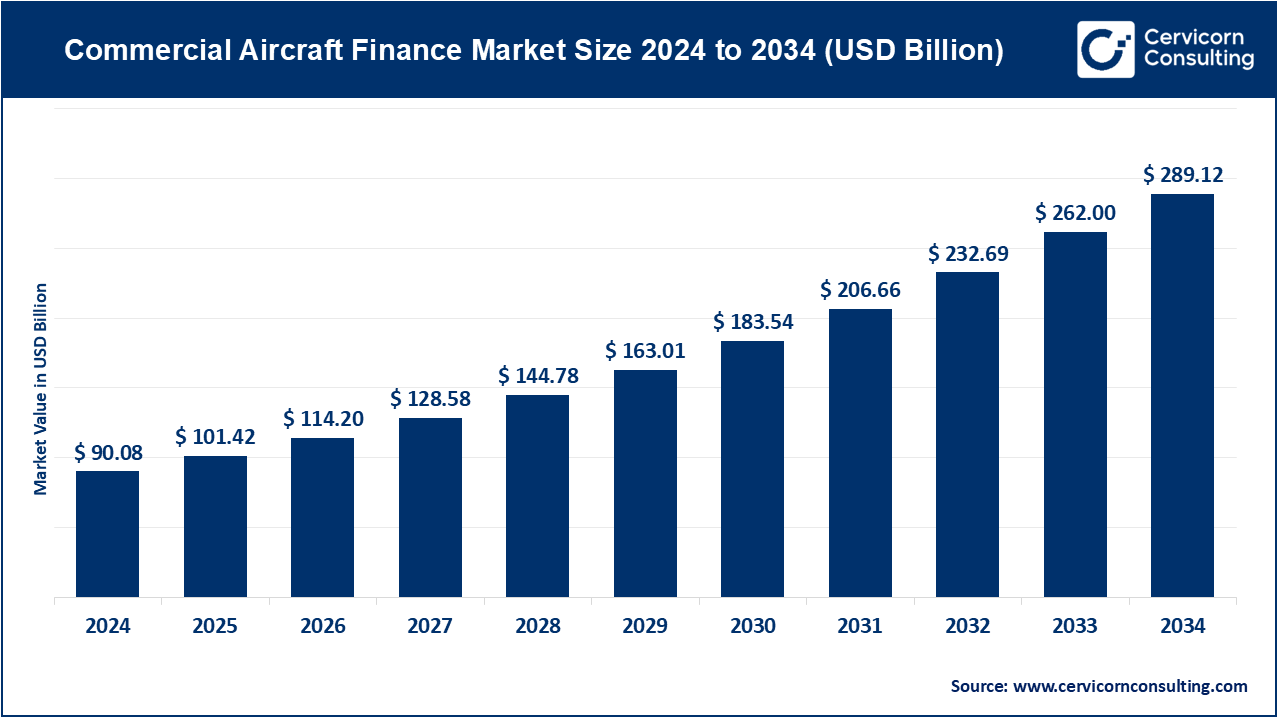

Commercial Aircraft Finance Market Size

The global commercial aircraft finance market size was valued at approximately USD 90.08 billion in 2024 and is projected to reach around USD 289.12 billion by 2034, growing at a CAGR of 12.59% between 2025 and 2034.

What is the Commercial Aircraft Finance Market?

The commercial aircraft finance market encompasses the financial mechanisms and institutions that support the acquisition, leasing, and operation of commercial aircraft. This specialized sector enables airlines and aviation operators to access fleets without bearing the full upfront costs, thereby facilitating fleet expansion and modernization. Financing options within this market include:

-

Loans: Traditional bank loans provided to airlines for aircraft purchases.

-

Leases: Agreements allowing airlines to use aircraft for a specified period.

-

Operating Leases: Short-term leases offering flexibility.

-

Finance Leases: Long-term leases with an option to purchase.

-

-

Export Credit: Government-backed financing to support aircraft exports.

-

Asset-Backed Securitization: Financial instruments backed by aircraft assets.

The market is characterized by a growing preference for asset-light business models, with airlines increasingly opting for leasing arrangements to mitigate financial risk and conserve capital.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2338

Market Trends

-

Dominance of Operating Leases: Operating leases have become the preferred financing method for airlines, accounting for over 50% of the global commercial aircraft fleet. This trend is driven by the flexibility and lower capital expenditure associated with leasing arrangements.

-

Rise of Low-Cost Carriers (LCCs): The expansion of LCCs, particularly in regions like Asia-Pacific and Latin America, has significantly boosted the demand for aircraft financing solutions tailored to their operational models, emphasizing cost-efficiency and fleet adaptability.

-

Shift Towards Sustainable Aviation: Airlines are investing in low-emission aircraft to align with environmental goals and regulations. Financial institutions are responding by offering green financing options, facilitating the transition to more sustainable fleets.

-

Innovative Financing Structures: The market is witnessing the development of novel funding structures, such as aviation collateralized loan obligations (CLOs), to cater to the evolving needs of the aviation sector.

Market Dynamics

Drivers:

-

Increasing Global Passenger Demand: The growing number of air travelers worldwide necessitates the expansion and modernization of airline fleets, driving the demand for aircraft financing.

-

Technological Advancements in Aircraft: The introduction of fuel-efficient and technologically advanced aircraft models has prompted airlines to seek financing solutions to support fleet upgrades.

-

Government Support and Export Credit: Government-backed export credit agencies play a pivotal role in facilitating aircraft purchases, especially for emerging market airlines.

-

Asset-Light Business Models: Airlines are adopting asset-light strategies to reduce financial risk, leading to a higher reliance on leasing arrangements.

Restraints:

-

Economic Volatility: Fluctuations in global economic conditions can impact airline profitability and, consequently, their ability to secure financing.

-

Regulatory Compliance: Adherence to evolving environmental and financial regulations may pose challenges for airlines and financiers.

Opportunities:

-

Green Financing: The increasing emphasis on sustainability presents opportunities for the development of green financing products.

-

Emerging Markets: The growth of the aviation sector in emerging markets offers new avenues for aircraft financing.

Challenges:

-

Infrastructure Development: The need for advanced infrastructure to support modern aircraft may pose challenges in certain regions.

-

Geopolitical Risks: Political instability and trade tensions can impact aircraft financing arrangements.

Regional Analysis

-

North America: The North American market is expected to reach around USD 17.55 billion by 2034, driven by substantial investments, advanced technological infrastructure, and supportive regulatory environments. The U.S. and Canada are seeing increasing interest from major aerospace companies and startups.

-

Asia-Pacific: The Asia-Pacific market is projected to grow around USD 7.88 billion by 2034, with a CAGR of 42.7%. Trends include the development of aircraft prototypes tailored to high-density urban environments and collaborations with technology companies to address specific regional needs.

-

Europe: The European market is expected to grow around USD 13.12 billion by 2034, with a CAGR of 39.1%. Ambitious urban air mobility projects and strong environmental regulations are driving growth, with countries like the UK, Germany, and France at the forefront.

-

LAMEA (Latin America, Middle East, and Africa): The LAMEA market is forecasted to reach around USD 2.07 billion by 2034, with a CAGR of 31.7%. The region is beginning to explore aircraft technology, with a focus on addressing transportation challenges in urban and remote areas.

Recent Developments

-

Aviation Collateralized Loan Obligations (CLOs): Ashland Place Finance closed the year by pricing an oversubscribed $324.3 million debut aviation CLO, marking the second aviation CLO to enter the public market after the $893.5 million SALT 2021-1 issuance.

-

Sustainable Aviation Fuel (SAF): Sustainable aviation fuel remains a pivotal focus as the aviation industry aims for 2050 net-zero carbon targets, addressing its current contribution to global carbon emissions.

-

Technological Advancements: The adoption of AI-driven risk assessment tools and blockchain-based smart contracts is streamlining leasing processes, reducing fraud, and enhancing transparency in aircraft ownership records.

For more detailed insights, contact us: Contact Us