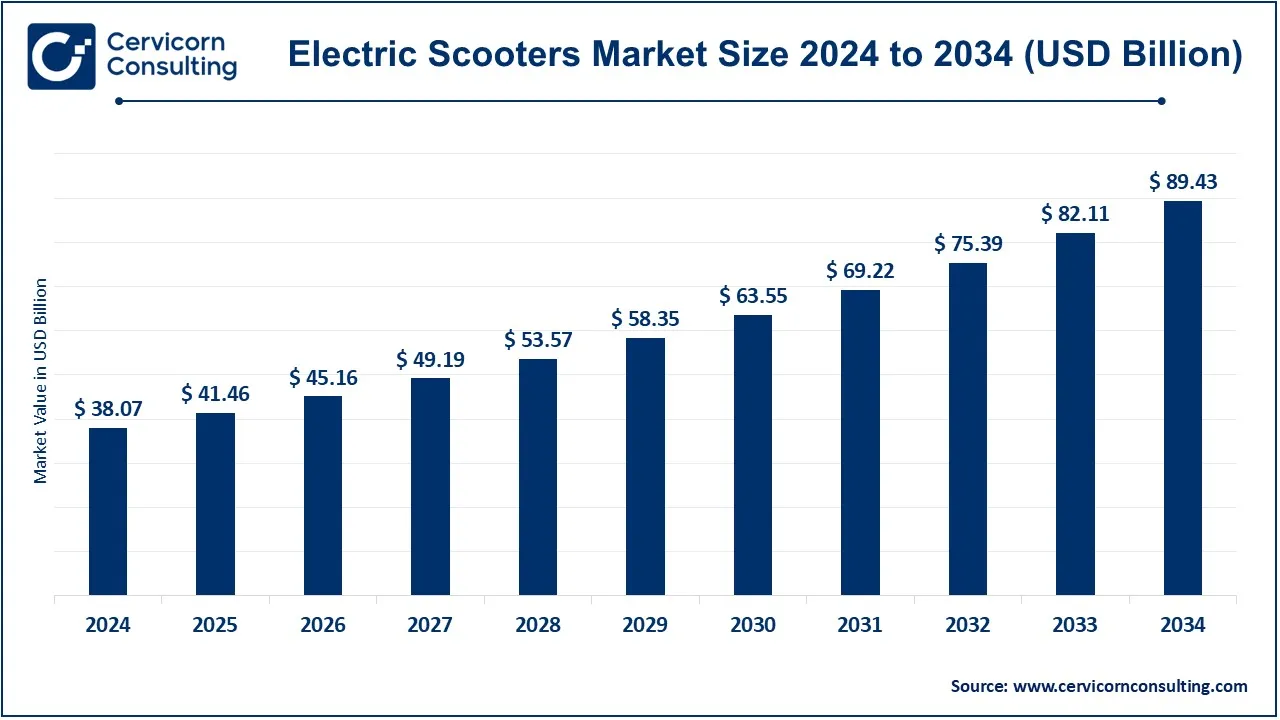

Electric Scooters Market Overview

The global electric scooters market was valued at USD 38.07 billion in 2024 and is expected to grow to USD 41.46 billion in 2025. Looking ahead, the industry is projected to reach USD 89.43 billion by 2034, expanding at a CAGR of 9.7% during 2025–2034. This growth is being propelled by rapid urbanization, environmental sustainability targets, falling battery prices, and the rising adoption of shared mobility services.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2469

Key Market Trends

1. Battery innovation (Li-ion, sodium-ion) & swappable batteries

Advancements in lithium-ion technology and emerging sodium-ion solutions are extending range and cutting costs. China is leading in sodium-ion deployment, with expectations of significant adoption by 2030. Battery-swapping ecosystems — pioneered by companies like Gogoro and Honda-led consortiums — are expanding across Taiwan, India, and Indonesia, improving convenience for both private users and commercial fleets.

2. Expansion of swapping and charging infrastructure

Large-scale deployment of swap stations and fast chargers is reducing downtime and addressing range anxiety. Taiwan, for instance, has witnessed rapid adoption, while companies like Yadea are investing heavily in fast-charging points. These developments enhance the feasibility of delivery fleets and shared mobility operators.

3. Smart integration & IoT-enabled fleet management

E-scooters are increasingly connected via mobile apps, GPS, remote locking, and telematics. Fleet operators benefit from real-time analytics for route planning, predictive maintenance, and improved utilization. New-age models such as the Chetak Urbane demonstrate these integrated features, boosting both safety and efficiency.

4. Regulation, safety & compliance

Governments are standardizing rules on speed limits, helmet use, parking, and insurance. For example, several European markets require registration and insurance for e-scooters. Stricter policies not only curb misuse but also help stabilize the market for sustainable long-term growth.

5. Sustainable design & circular economy practices

Manufacturers are increasingly using recyclable plastics, eco-friendly alloys, and modular designs that simplify repair and recycling. This aligns with global sustainability goals and addresses the critical issue of battery waste management.

Market Drivers

-

Rising fuel costs and cost-efficiency: Volatile oil prices are making e-scooters an attractive low-cost alternative, especially for delivery and commuting.

-

Urban congestion & last-mile demand: Growing traffic congestion is pushing cities and commuters toward compact, efficient mobility solutions, with e-scooters bridging gaps in public transit.

-

Government policies & subsidies: Programs like India’s FAME II, local state incentives, and city-level infrastructure initiatives are accelerating adoption. Shared mobility services already operate in more than 600 cities worldwide, with adoption in some regions growing nearly 30% annually.

-

Technological advancements: Improvements in battery density, energy management, and telematics have cut charging times by ~40% over the past five years, making e-scooters more practical.

-

Commercial adoption: E-commerce and food delivery players are increasingly shifting to e-scooters for operational efficiency, while shared fleets offer recurring revenue opportunities across major cities.

Impact of Trends & Drivers

-

Personal vs. Commercial Use:

Detachable batteries and portability drive personal ownership, while swappable systems and telematics favor commercial fleets. -

Product Segmentation:

Folding scooters dominate among urban commuters, maxi and three-wheel scooters serve delivery/logistics, while self-balancing models remain a premium niche. -

Regional Outlook:

Asia-Pacific leads the market, driven by strong OEM presence, rising demand, and government-backed incentives. China excels in battery innovation, India benefits from subsidy-led adoption, and Southeast Asia is emerging as a hub for shared mobility. Meanwhile, North America and Europe show rapid growth in shared services but face tighter regulatory frameworks. -

Application Areas:

Shared mobility programs are flourishing in city centers, while delivery services adopt e-scooters for faster, more cost-efficient operations. Expanding swap and charging networks directly support these use cases.

Challenges & Opportunities

Challenges

-

Lack of standardized charging ports limiting interoperability.

-

Rising concerns about battery recycling and e-waste.

-

Lingering negative perceptions from earlier low-quality scooter models.

Opportunities

-

Investment in swappable battery ecosystems that support commercial fleets and heavy users.

-

Integration with public transport systems for seamless first/last-mile solutions.

-

Adoption of circular economy practices, from sustainable materials to battery take-back programs, creating new business opportunities.

Future Outlook

The electric scooters market is poised for strong expansion, nearly doubling in size by 2034. Asia-Pacific will remain the growth engine, while advanced battery technologies, smart integration, and recycling initiatives will define the next wave of innovation. With regulatory frameworks maturing, the market is expected to become more stable, investable, and consumer-friendly.

Contact for Detailed Market Insights: https://www.cervicornconsulting.com/contact-us