Market Overview

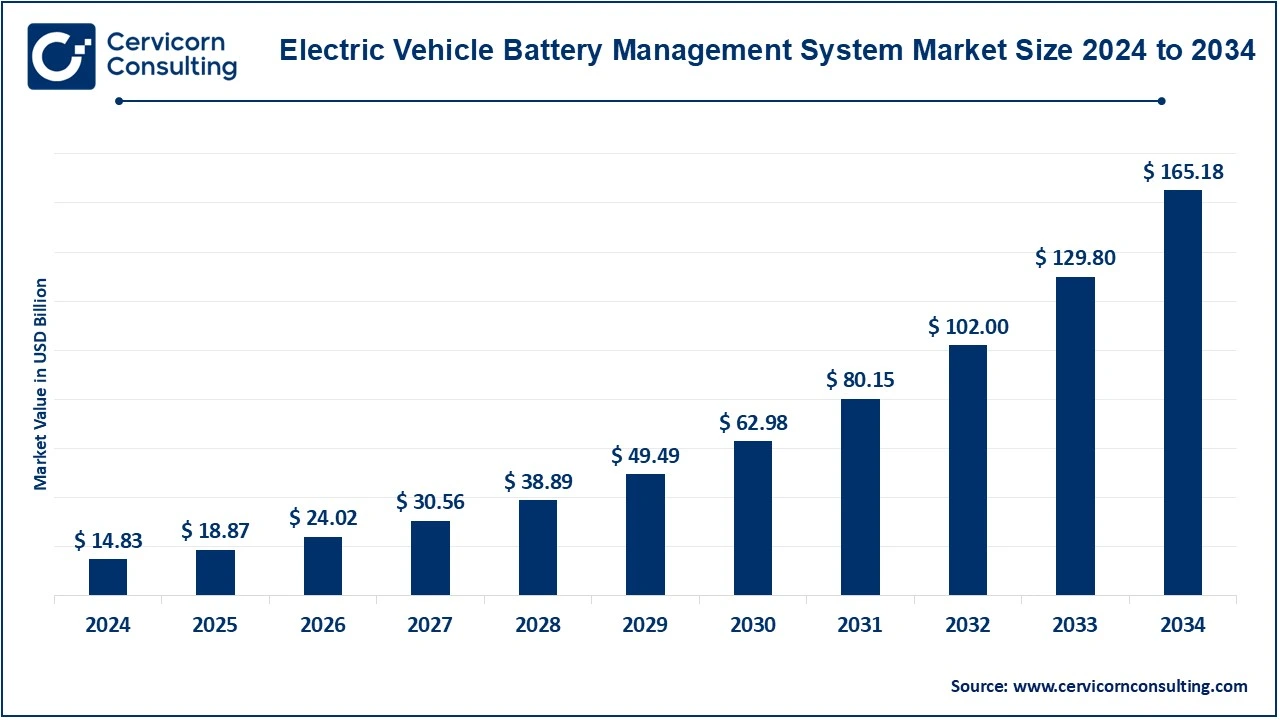

The global electric vehicle battery management system market was valued at USD 14.83 billion in 2024 and is projected to reach nearly USD 165.18 billion by 2034, expanding at a strong CAGR of 30.12% during the forecast period (2025–2034). This rapid growth underscores the ongoing transformation of the automotive industry, fueled by the widespread adoption of electric mobility, stricter emission standards, and continuous advancements in smart battery technologies.

A Battery Management System (BMS) acts as the intelligent control center of an EV battery, overseeing parameters such as voltage, temperature, current, and state of charge (SoC). It ensures battery safety, efficiency, and longevity. With the global electric vehicle (EV) market expanding exponentially, the BMS has evolved from a basic monitoring tool into a sophisticated system combining hardware, software, and analytics to deliver optimized energy management and predictive maintenance capabilities.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2556

Key Market Trends

1. Software-Defined and Cloud-Connected BMS Platforms

The EV industry is increasingly transitioning to software-defined BMS architectures integrated with cloud computing and artificial intelligence. These advanced systems enable real-time diagnostics, over-the-air (OTA) updates, and predictive analytics, optimizing battery efficiency and reliability. Major EV manufacturers such as Tesla and NIO leverage cloud-based BMS solutions to enhance vehicle performance, safety, and lifespan through continuous software improvements.

2. Distributed and Modular BMS Designs

Automakers are embracing distributed and modular BMS configurations, where each module independently manages its respective cell cluster. This design ensures scalability, redundancy, and improved fault tolerance—crucial for high-capacity batteries in electric buses, trucks, and performance vehicles. Such architectures are reshaping how manufacturers design large-scale EV energy systems.

3. Integration of Thermal and Electrical Management Systems

To address thermal challenges in diverse operating conditions, manufacturers are developing integrated BMS and thermal control systems. Companies such as DENSO and GS Yuasa are at the forefront, creating technologies that maintain optimal temperature during fast charging, enhancing energy density, safety, and battery lifespan.

4. AI-Powered Predictive Maintenance

Machine learning and AI are transforming BMS capabilities by enabling predictive maintenance and battery health forecasting. Advanced BMS solutions can now predict degradation trends, optimize charging patterns, and extend battery life—reducing downtime and lifecycle costs for consumers and fleet operators alike.

5. Regulatory Push for Sustainability and Traceability

New policies such as the EU Battery Regulation and the U.S. Inflation Reduction Act are emphasizing sustainability, lifecycle traceability, and responsible sourcing. These frameworks drive demand for BMS platforms that support end-to-end traceability, from raw materials to recycling, promoting a circular economy within the EV battery value chain.

Market Drivers

1. Rapid Expansion of Electric Vehicle Adoption

The global EV market continues its explosive growth, with sales surpassing 40 million units in 2024 and expected to exceed 230 million by 2034. As every EV requires an advanced BMS for performance and safety optimization, this surge directly translates into exponential BMS demand.

2. Declining Battery Costs and Rising Energy Density

The average lithium-ion battery cost has dropped by nearly 89% since 2010, making EVs more accessible. However, as batteries grow in density and complexity, the need for intelligent BMS solutions becomes increasingly vital to manage heat, charge balance, and long-term stability.

3. Strong Policy Support and Incentives

Global initiatives such as the U.S. Inflation Reduction Act (IRA), India’s FAME-II scheme, and the European Green Deal are driving EV manufacturing and innovation. These policies encourage domestic production, technological advancements, and sustainability-focused design, all of which stimulate demand for efficient BMS platforms.

4. Advancements in Battery Chemistry and Control Algorithms

Emerging chemistries—solid-state, LFP (lithium iron phosphate), and sodium-ion—require new control algorithms for accurate monitoring. Enhanced state-of-charge (SoC) and state-of-health (SoH) estimation algorithms are improving BMS accuracy, adaptability, and reliability across diverse battery technologies.

5. Growing Demand for Second-Life and V2G Applications

The evolution of vehicle-to-grid (V2G) and second-life battery systems is opening new opportunities for BMS providers. Robust BMS solutions ensure safe operation and performance optimization in repurposed batteries used for stationary storage, renewable integration, or grid balancing, extending overall asset value.

Impact of Trends and Drivers

-

Passenger EV Segment: Advanced BMS systems are enabling longer driving ranges, faster charging, and enhanced energy efficiency, fueling mass-market EV adoption.

-

Commercial EV Segment: Fleet managers benefit from connected BMS networks that optimize charging cycles, track battery health, and minimize downtime—key for logistics and mobility operators.

-

Regional Impact:

-

North America: Witnessing strong policy-driven localization and R&D investment.

-

Europe: Focused on sustainability, recyclability, and compliance-driven innovation.

-

Asia-Pacific: Led by China, the region dominates global BMS production, leveraging scale, vertical integration, and cost leadership.

-

-

Technological Integration: Partnerships among semiconductor firms, AI developers, and automakers are accelerating the creation of next-generation BMS ecosystems.

Challenges and Opportunities

Challenges:

-

High R&D and prototyping costs for advanced BMS designs.

-

Complex compliance frameworks across different regions.

-

Cybersecurity risks linked to OTA and connected features.

Opportunities:

-

Expansion of heavy-duty and commercial EVs requiring sophisticated BMS architectures.

-

Growth of AI-driven and cloud-integrated BMS software.

-

Increased investments in open-source and interoperable BMS standards for cross-platform integration.

Future Outlook

The electric vehicle battery management system market is on the brink of a technological revolution, expected to exceed USD 165.18 billion by 2034. Its evolution will be marked by digital transformation, AI integration, and sustainability-centric design.

Future BMS platforms will act as intelligent energy orchestrators, merging real-time analytics, AI-based lifecycle optimization, and cloud connectivity. These systems will enhance battery safety, efficiency, and grid interactivity, enabling seamless integration into vehicle-to-grid (V2G) and renewable energy networks.

As automakers shift toward software-defined vehicle architectures, the BMS will remain the cornerstone of innovation—balancing performance, safety, and sustainability to power the next generation of electric mobility.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us