Fast Fashion Market Overview

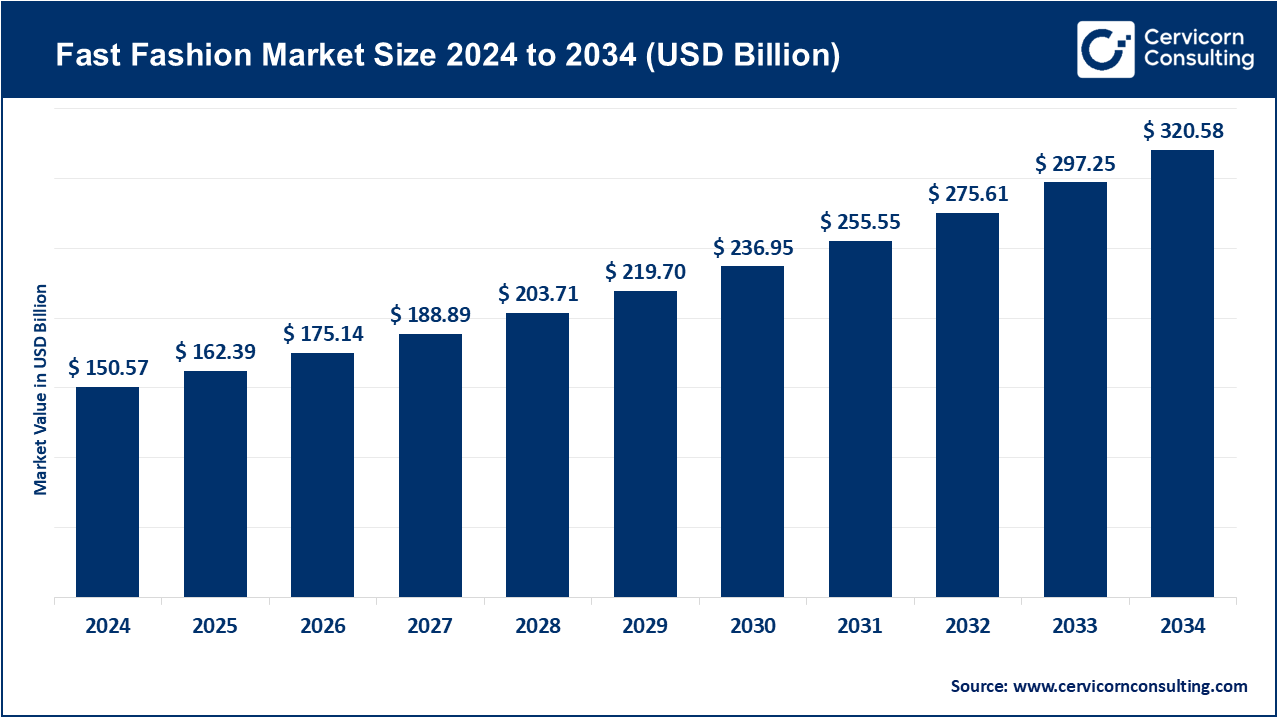

The global fast fashion market stood at USD 150.57 billion in 2024 and is forecasted to nearly double, reaching USD 320.58 billion by 2034, advancing at a CAGR of 10.8% between 2025 and 2034. This rapid growth reflects the sector’s ability to combine affordability with speed, appealing strongly to younger demographics and digital-first consumers.

Fast Fashion Market Trends

1. Sustainability and eco-friendly materials

Driven by consumer awareness and stricter regulations, brands are integrating recycled fibers, eco-certified fabrics, and water-efficient processes. Noteworthy examples include H&M’s 100% recycled denim collection (April 2025) and Uniqlo’s large-scale roll-out of recycled fabric products (October 2023). These initiatives show how brands are balancing affordability with sustainability.

👉 Get a Free Sample: https://www.cervicornconsulting.com/sample/2718

2. Resale, second-hand, and circular fashion

To address environmental concerns and capture extended product value, leading players are moving into resale and upcycling. Shein’s “Shein Exchange” marketplace in North America (October 2022) and Boohoo’s authenticated resale platform (March 2024) are prime examples of how fast fashion is embracing the circular economy.

3. Fashion-tech innovation: AI, AR, and personalization

Artificial intelligence and augmented reality are revolutionizing how consumers shop and how brands forecast demand. ASOS launched its AI-powered Fit Assistant (July 2024), while Shein’s experiential “Caf Shein” pop-up in Sydney (May 2025) showcased smart mirrors and digital styling tools. These technologies help reduce returns and accelerate design-to-shelf cycles.

4. Ultra-fast models & social commerce

Online-first brands like Shein and Temu thrive on influencer-driven marketing, flash sales, and livestream shopping. Temu’s mobile live-shopping launch in February 2025 attracted millions of viewers, illustrating how social platforms fuel market expansion. The fact that online channels already account for ~55% of market revenue underscores this digital dominance.

5. Automation & advanced manufacturing

Automation in warehousing and production is enabling faster, cheaper supply chains. Inditex’s warehouse automation (October 2024) cut European delivery times in half, while advances in recycling tech and AI-powered textile sorting (with 98% accuracy) are beginning to address sustainability bottlenecks.

Fast Fashion Market Drivers

-

Trend-driven demand at affordable prices: Young adults (18–25 years) made up 38.01% of consumers, while women represented 40.03% of revenue in 2024, highlighting strong demand for fast, low-cost apparel.

-

Digital commerce expansion: Online channels captured 55.01% of global sales in 2024, powered by mobile-first, social commerce, and live-shopping platforms.

-

Material efficiency: Polyester dominated at 42.10% share in 2024, favored for its cost-effectiveness and adaptability to mass production.

-

Operational efficiency: Supply chain integration, logistics optimization, and automation have drastically cut costs and lead times, such as Inditex’s 50% reduction in European lead times.

-

Regional scale in Asia-Pacific: With 38.7% of revenue in 2024, APAC leads due to manufacturing dominance, cost advantages, and growing urban demand.

Impact of Trends and Drivers

-

Distribution channels: Online-native players leveraging AR and AI tools are rapidly overtaking traditional brick-and-mortar formats.

-

Product categories: Tops & shirts (~36.5% share) benefit most from algorithmic reorders and viral trends, while other apparel categories see steadier but slower growth.

-

Regional landscape: Asia-Pacific continues to dominate, but Western brands are investing in near-shoring and automation to compete more effectively.

-

Sustainability: Scaling recycled materials will challenge margins, but brands able to manage costs while meeting eco-demands will win consumer trust.

Challenges & Opportunities

Challenges

-

Tighter regulations in regions like the EU are raising compliance costs.

-

High sustainability costs — recycled fibers (e.g., greenhouse-grown cotton) can be ~25% more expensive.

-

Counterfeiting risks, with luxury cases such as Chanel vs. counterfeiters showing the scale of the issue.

Opportunities

-

Breakthrough recycling technologies (AI-driven textile sorting with 98% accuracy, chemical fiber regeneration) can unlock scalable circular fashion.

-

Fashion-tech and service startups — tools for wardrobe management, rentals, and hybrid resale models are gaining investor attention (examples: Phia’s search engine, Virgio’s funding).

Future Outlook

Looking ahead, the fast fashion industry is expected to double in size, reaching USD 320.58 billion by 2034 at a CAGR of 10.8%. Growth will be fueled by digital-first models, APAC leadership, and widespread adoption of AI/AR solutions. Circular economy initiatives will steadily expand, though their scalability will depend on lowering costs of recycled materials and adapting to evolving regulations. Brands that effectively blend affordability, digital engagement, and sustainability will shape the next era of fast fashion.

👉 Contact for Detailed Market Insights: https://www.cervicornconsulting.com/contact-us