Green Steel Market Size

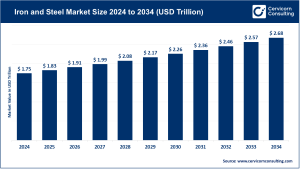

The global green steel market was valued at approximately USD 3.70 billion in 2024 and is forecast to surge to nearly USD 279.40 billion by 2034. This exceptional expansion reflects a remarkable Compound Annual Growth Rate (CAGR) of 54.10% throughout the 2025–2034 period.

This rapid growth trajectory highlights the accelerating global transition toward low-carbon industrial materials, supported by sustainability mandates, technological advancements, and increasing demand for environmentally responsible steel solutions.

What Is the Green Steel Market?

The green steel market represents the portion of the steel industry focused on manufacturing steel through processes designed to substantially reduce or eliminate carbon emissions relative to conventional production methods. Traditional steelmaking remains a significant contributor to global greenhouse gas emissions, largely due to its dependence on coal-based blast furnace operations.

In contrast, green steel production relies on cleaner alternatives such as hydrogen-based direct reduced iron (H-DRI), electric arc furnaces (EAFs) powered by renewable energy, and carbon capture utilization and storage (CCUS) technologies. These innovations are transforming steel from a carbon-intensive commodity into a critical material supporting global decarbonization efforts.

The market includes multiple product categories, including flat steel, long steel, tubular steel, and specialty steel products. These materials serve essential roles across industries such as automotive, construction, energy, infrastructure, and manufacturing, where sustainability objectives are increasingly shaping procurement strategies.

Get a Free Sample:

https://www.cervicornconsulting.com/sample/2685

Market Trends

Several influential trends are driving the evolution of the global green steel market:

Widespread Adoption of Electric Arc Furnace (EAF) Technology

Electric Arc Furnace technology has become a cornerstone of green steel production. When powered by renewable electricity, EAFs deliver significant emission reductions while enabling efficient utilization of recycled scrap steel. Their operational flexibility and scalability continue to encourage adoption among steel manufacturers transitioning toward cleaner production models.

Growth of Hydrogen-Based Steelmaking

Hydrogen-based steel production is emerging as one of the most transformative advancements in the industry. By replacing carbon-heavy reductants with green hydrogen, this approach facilitates deeper emission reductions and aligns closely with global net-zero targets. As hydrogen infrastructure and supply networks mature, this pathway is expected to gain substantial momentum.

Rising Sustainability-Driven Demand

Demand for green steel is increasingly shaped by sustainability commitments across end-use sectors. Automotive manufacturers, construction firms, and infrastructure developers are incorporating low-carbon materials into their supply chains to meet ESG objectives, regulatory requirements, and shifting market expectations.

Integration of Circular Economy Principles

The growing emphasis on recycling and resource efficiency has positioned circular economy strategies at the center of green steel production. Expanded use of scrap steel and recycled inputs contributes not only to emission reductions but also to enhanced material efficiency and sustainability.

Market Dynamics

Key Drivers

Several factors are accelerating market expansion:

-

Global Net-Zero Objectives: Governments and corporations worldwide are adopting aggressive decarbonization targets, increasing demand for low-emission industrial materials.

-

Policy Support and Incentives: Subsidies, tax incentives, renewable energy programs, and research funding are promoting investment in cleaner steelmaking technologies.

-

Investor and ESG Considerations: Financial markets increasingly reward companies with strong sustainability credentials, encouraging steel producers to prioritize green transformation.

Market Restraints

Despite strong momentum, certain constraints remain:

-

Limited Availability of Green Hydrogen: Green hydrogen remains costly and insufficiently available at industrial scale, restricting broader deployment of hydrogen-based steelmaking.

-

High Capital Investment Requirements: The transition from conventional steel production to low-carbon technologies demands substantial investments in infrastructure, equipment, and process innovation.

Market Opportunities

-

Premium Pricing Potential: Green steel products often achieve higher margins due to growing sustainability-focused demand.

-

Technological Advancements: Continued innovation in hydrogen production, renewable energy integration, and CCUS technologies presents significant long-term growth opportunities.

Market Challenges

-

Cost Competitiveness: Achieving economic parity with traditional steelmaking remains a key challenge.

-

Supply Chain Evolution: Scaling green steel production requires coordinated development across energy systems, logistics networks, and raw material sourcing.

Regional Analysis

North America

North America has established itself as a leading market for green steel adoption. Strong regulatory frameworks, expanding hydrogen investments, and increasing sustainability commitments from automotive and construction industries are driving regional growth. The region benefits from technological innovation and supportive policy environments.

Europe

Europe continues to lead advancements in green steel technologies. Strict environmental regulations, carbon pricing mechanisms, and aggressive decarbonization initiatives are accelerating the transition toward low-carbon steel production. Industrial transformation strategies remain central to regional market expansion.

Asia-Pacific

Asia-Pacific represents a major engine of growth for the green steel market. Rapid industrialization, infrastructure development, and rising environmental awareness are fueling investments in cleaner steelmaking technologies. Key economies are actively pursuing emissions reduction strategies while maintaining large-scale production capacity.

LAMEA (Latin America, Middle East & Africa)

The LAMEA region is progressively gaining momentum in green steel initiatives. Increasing investments in renewable energy, green hydrogen projects, and industrial diversification strategies are generating new opportunities. Although adoption is still emerging, long-term growth potential remains significant.

Recent Developments

The green steel market continues to evolve rapidly, shaped by regulatory shifts, technological innovation, and industry collaboration.

-

Regulatory Progress: Carbon reduction policies and emerging trade mechanisms are influencing global steel production strategies.

-

Industrial Investments: Major steel producers are accelerating decarbonization programs and expanding hydrogen-based initiatives.

-

Strategic Partnerships: Collaborations between steelmakers, renewable energy providers, and hydrogen developers are driving innovation and commercialization.

These developments underscore the growing importance of green steel within global industrial transformation efforts.

Conclusion

The green steel market is experiencing a profound transformation, driven by climate commitments, technological progress, and sustainability-oriented demand. As regulatory pressures intensify and low-carbon production technologies advance, green steel is evolving from an emerging concept into a foundational element of future industrial manufacturing.

While challenges such as hydrogen availability and cost efficiency remain, continued investments, supportive policies, and expanding demand indicate strong long-term growth prospects.

To Get Detailed Overview, Contact Us:

https://www.cervicornconsulting.com/contact-us