Hydrogen Buses Market Overview

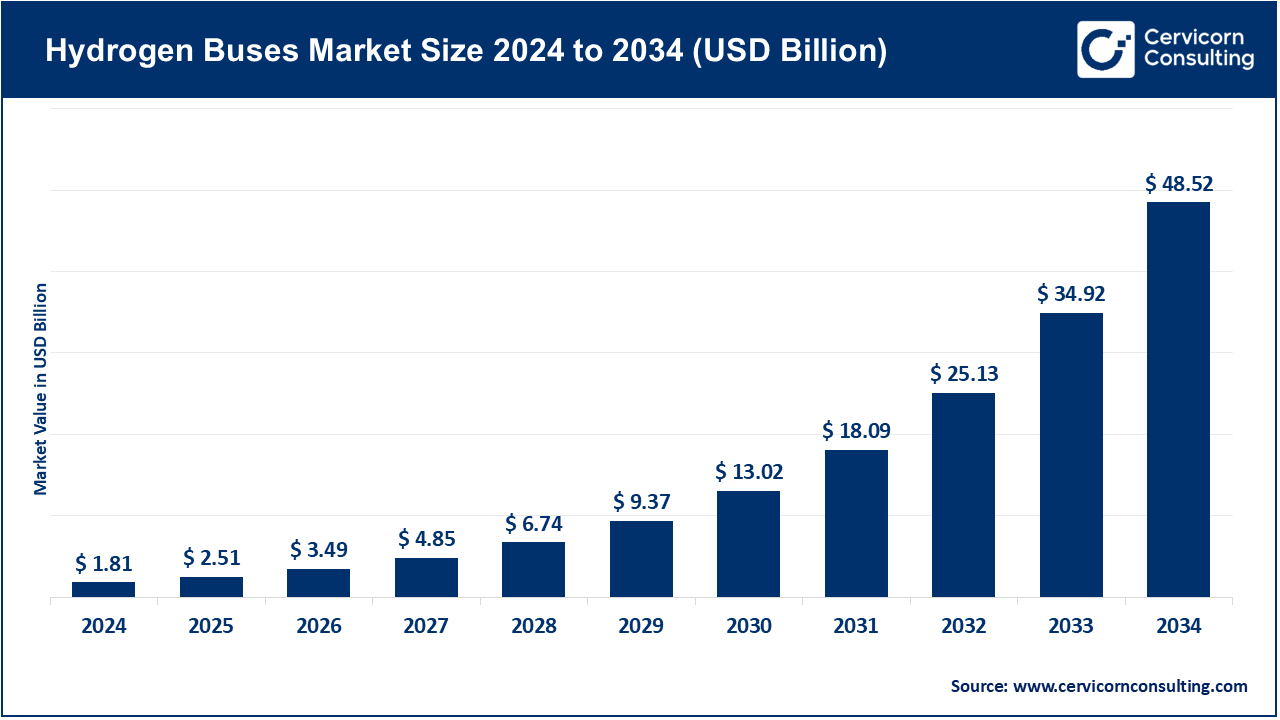

The global hydrogen buses market was valued at approximately USD 1.81 billion in 2024 and is projected to grow significantly to around USD 48.52 billion by 2034, reflecting a strong CAGR of 49.1% from 2025 to 2034. This rapid expansion is being driven by rising government mandates for zero-emission public transport, increased investment in green hydrogen infrastructure, escalating urban air pollution challenges, and ongoing advancements in fuel cell technologies. Hydrogen buses are gaining attention as a viable alternative to battery-electric buses, particularly for long-range, high-frequency urban routes, offering zero emissions, fast refueling, and extended operational range.

Key Market Trends

Integration with Renewable Hydrogen Production

Governments and operators are increasingly pairing bus fleets with green hydrogen sourced from renewable energy such as solar and wind. Projects in regions like California and Spain exemplify large-scale hydrogen electrolyzers integrated with public transport systems, supporting sustainability and net-zero goals.

Fleet Electrification by Public Transit Agencies

Cities including Cologne, Tokyo, and Los Angeles are committing to fully electrify their bus fleets using hydrogen fuel cells by 2030. This trend is reshaping procurement practices and accelerating long-term agreements with hydrogen bus manufacturers.

Collaborations Between OEMs and Energy Providers

Strategic alliances between vehicle manufacturers (e.g., Toyota, Hyundai) and hydrogen infrastructure companies (e.g., Shell, Air Liquide) are creating integrated ecosystems. These partnerships ensure vehicle-to-refueling compatibility, optimize supply chains, and lower deployment barriers for transit operators.

Expansion of Rapid Refueling Infrastructure

Deployment of fast hydrogen refueling stations in urban areas allows buses to operate for extended hours without interruption, directly addressing one of the main adoption barriers faced by battery-electric buses.

Adoption of Advanced Fuel Cell Technologies

Innovations in PEM fuel cells and hybrid fuel cell-battery systems are enhancing energy efficiency, reducing cold-start times, and increasing power density, improving reliability for intensive urban and intercity operations.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2736

Market Drivers

Government Policies and Financial Incentives

Global initiatives like the Clean Hydrogen Partnership in Europe and China’s Fuel Cell Vehicle Pilot Cities Program are providing funding and incentives to manufacturers and fleet operators, reducing upfront investment risks.

Environmental and Air Quality Concerns

Hydrogen buses generate zero tailpipe emissions, helping to lower NOx and particulate levels in cities, contributing to both climate mitigation and public health improvement.

Operational Advantages

Compared to battery-electric buses, hydrogen buses provide longer operational ranges and faster refueling, making them ideal for high-frequency and long-distance routes.

Technological Advancements

Continuous progress in fuel cell efficiency, hydrogen storage systems, and electrolyzer production is reducing costs while improving bus performance and reliability.

Growing Demand for Sustainable Transit Solutions

Rapid urbanization and increasing demand for eco-friendly public transportation are driving transit agencies to adopt hydrogen buses as part of fleet modernization strategies.

Impact of Trends and Drivers

-

Regional Impact: Asia-Pacific dominates the market, contributing approximately 86% of global revenue in 2024, largely due to government subsidies and large-scale deployment programs. Europe follows, supported by EU funding and electrification mandates.

-

Application Segments: Public transportation represents the largest segment with a 43% revenue share in 2024, while school, private, and tourism transport sectors are gradually adopting hydrogen solutions.

-

Bus Type: Single-decker buses dominate urban transit, whereas double-deckers and hybrid fuel cell buses are expanding in intercity and specialized routes.

-

Technology Adoption: PEM fuel cells hold a leading market share of 48.5%, favored for their compact design and fast-start capabilities.

Challenges & Opportunities

Challenges

High initial investment, limited hydrogen refueling infrastructure in some regions, and reliance on green hydrogen availability may slow adoption in nascent markets.

Opportunities

Technological advancements, strategic partnerships, government subsidies, and the integration of renewable hydrogen production present substantial growth opportunities, enabling fleet expansions and enhanced infrastructure development.

Future Outlook

The hydrogen buses market is set for explosive growth over the next decade. Large-scale fleet electrification, renewable hydrogen integration, and advanced fuel cell technologies are expected to drive global adoption. Asia-Pacific will continue to lead, while Europe, North America, and select Middle Eastern countries are anticipated to increase hydrogen bus deployments, shaping the future of sustainable and zero-emission urban mobility.