Market Overview

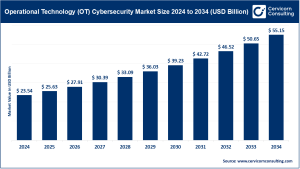

In 2024, the inland container depot market was valued at around USD 30.57 billion and is expected to reach approximately USD 52.86 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.63% between 2025 and 2034.

ICDs serve as inland extensions of seaports, facilitating container handling, storage, customs clearance, and intermodal transport. They efficiently link production centers with seaports, enabling smoother freight operations. With the rise in global trade and growing pressure on port infrastructure, these depots have become critical in reducing port congestion and ensuring seamless inland freight movement. ICDs handle diverse cargo types, including dry goods, liquids, refrigerated shipments, and hazardous materials, while offering services such as storage, handling, customs facilitation, transportation, and maintenance.

Key Market Trends

Expansion of Inland Ports to Alleviate Seaport Congestion

Developing inland ports and ICDs is increasingly seen as a strategy to relieve overcrowded coastal ports. By shifting container storage, handling, and customs processes inland, these facilities reduce vessel turnaround times and enhance overall supply chain efficiency.

Integration with Free Trade Zones

Many ICDs are now being connected with Free Trade Zones (FTZs). This model allows importers and exporters to conduct manufacturing, storage, and transshipment in tariff-advantaged zones, helping eliminate regulatory bottlenecks and streamline trade operations. This approach is gaining traction in regions such as the Middle East, Asia, and Africa.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2624

Adoption of Smart & Digital Technologies

Technological advancements are transforming ICDs into smart logistics centers. Solutions such as AI-driven cargo tracking, IoT monitoring, RFID container tagging, automated cranes, and predictive analytics are enhancing operational visibility, reducing dwell times, and increasing throughput. Terminal operators are heavily investing in automation and digital platforms to speed up container handling and customs processes.

Strategic Investments by Global Port Operators

Leading port operators are expanding inland by establishing satellite ICD hubs in emerging markets. These investments create cargo corridors that connect inland industrial clusters with global trade routes, reducing dependency on congested coastal ports.

Market Drivers

Rising Global Trade & Containerization

The ICD market growth is largely fueled by the expansion of international trade. Containerized cargo dominates global freight movement, and inland depots are essential to link production hubs to maritime gateways. The increasing activity on international rail freight corridors further underscores the demand for inland handling facilities.

Government Infrastructure Initiatives

Governments are prioritizing the development of logistics infrastructure to boost economic competitiveness. Large-scale projects such as national freight corridors and port expansions are accelerating ICD growth, improving customs automation, and reducing cargo dwell times by 20–30% at key facilities.

Private Sector Investments and Public-Private Partnerships

Public-private partnerships (PPPs) and private investments are playing an increasingly significant role in ICD development. Logistics companies are investing in depot networks, rail connectivity, and digital systems to enhance efficiency, profitability, and scalability.

Impact of Trends and Drivers

Regional Influence

-

Asia-Pacific: The leading market, driven by high manufacturing output, government support, and well-established inland logistics networks.

-

North America: Rapid growth due to integrated logistics ecosystems and modern infrastructure.

-

Europe: Mature market emphasizing sustainability and multimodal logistics integration.

Sectoral Impacts

-

Storage & Handling: Automation and advanced equipment like automated cranes and reach stackers enhance efficiency and reduce costs.

-

Customs & Transportation: Digital customs platforms and improved rail-road integration shorten clearance times and enhance last-mile connectivity.

-

Reefer & Hazardous Cargo: Rising demand for perishable and specialized goods is prompting ICDs to expand cold chain capabilities and compliant hazardous material handling.

Challenges & Opportunities

Challenges

-

Significant capital investment required to establish ICDs.

-

Limited road and rail connectivity in some regions.

-

Complex customs and regulatory procedures that can slow operations.

Opportunities

-

ICDs in landlocked economies can facilitate international trade more effectively.

-

Growth in e-commerce fulfillment is driving demand for regional logistics hubs.

-

Adoption of smart logistics services and digital platforms provides competitive advantages and operational efficiencies.

Future Outlook

The inland container depot market is poised for steady growth over the next decade. With a projected CAGR of 5.6% between 2025 and 2034, the market is expected to reach close to USD 53 billion by 2034. Emerging trends such as multimodal integration, sustainability initiatives, and smart automation are set to continue shaping the strategic landscape of ICDs. These inland hubs are increasingly functioning not only as cargo processing centers but also as integrated logistics ecosystems within global supply chains.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us