Internal Combustion Engine Market Overview

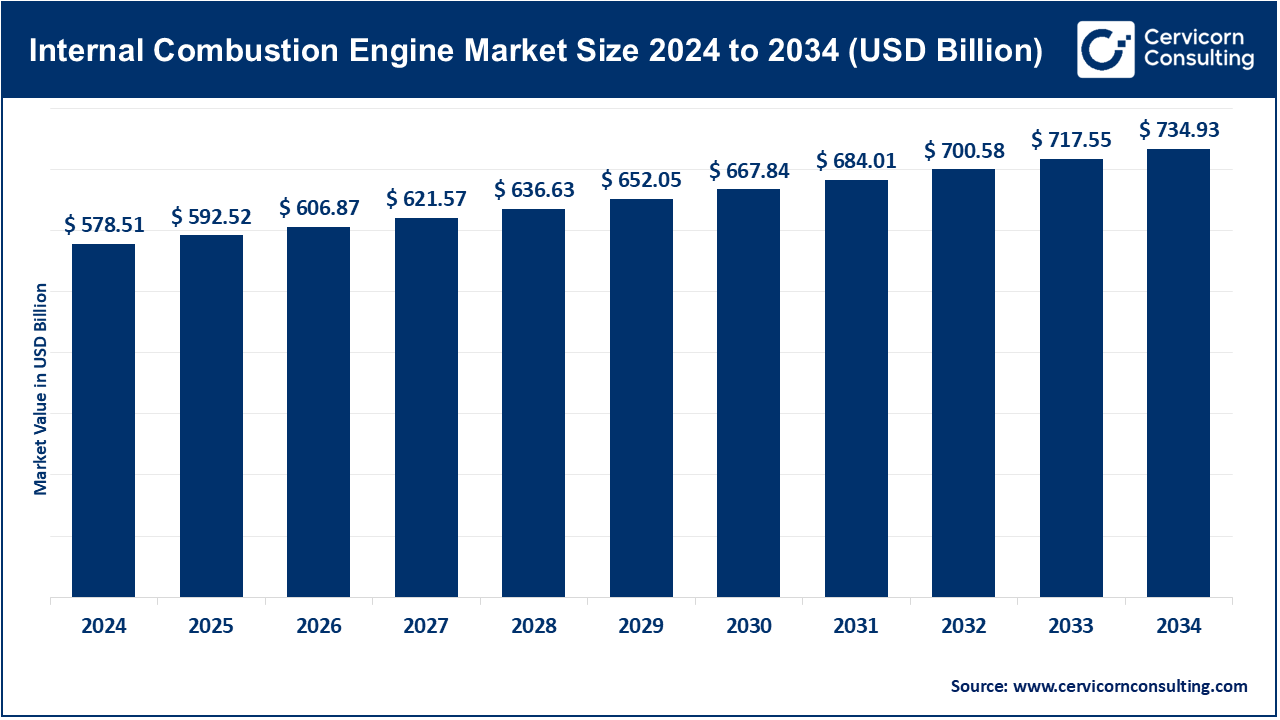

The global internal combustion engine market was valued at approximately USD 578.51 billion in 2024 and is expected to reach around USD 734.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.42% between 2025 and 2034. ICEs remain a vital power source across transportation, industrial machinery, agriculture, marine vessels, and energy generation. Even with the growing shift toward electric vehicles (EVs), ICEs continue to be essential in regions where EV infrastructure is limited, serving as transitional technology in hybrid and range-extender applications. Continuous improvements in fuel efficiency, emission reduction, and hybrid integration are driving the market toward higher performance and stricter environmental compliance.

Key Market Trends

-

Hydrogen-Powered ICEs: Hydrogen as a fuel is transforming ICE applications, offering near-zero-emission solutions for commercial and heavy-duty vehicles. For instance, in 2025, Cummins launched a hydrogen-optimized turbocharger in Europe, enabling cost-efficient fleet decarbonization while leveraging existing engine designs.

-

Collaborative OEM Ventures: Automakers are increasingly forming partnerships to consolidate ICE development and reduce R&D costs. In 2024, Renault and Geely formed Horse Powertrain Limited, focusing on hybrid and conventional engines across multiple brands, showcasing a shift toward standardized, efficient ICE production.

-

Oil and Energy Sector Investments: Traditional energy companies are entering the ICE space to strengthen supply chains and support hybrid technology. Saudi Aramco’s 2024 investment in Horse Powertrain underscores the growing involvement of energy firms in ICE innovation and alternative fuel adoption.

-

Hybrid and Extended-Range Integration: ICEs are being integrated into hybrid and range-extender EVs, bridging the gap between conventional and fully electric mobility while maintaining relevance and reducing emissions.

-

Advanced Engine Technologies: Techniques such as turbocharging, direct fuel injection, cylinder deactivation, and advanced emission aftertreatment are increasingly adopted to enhance fuel economy and meet stringent global emission standards.

Get a Sample: https://www.cervicornconsulting.com/sample/2737

Market Drivers

-

Regulatory Pressures and Emission Standards: Global emission mandates, including Euro 7 in Europe and EPA regulations in the U.S., are prompting ICE manufacturers to adopt cleaner and more efficient technologies, including hydrogen ICEs and hybrid systems.

-

Growing Demand for Commercial Vehicles and Industrial Machinery: Urbanization and industrial growth in emerging markets are driving demand for trucks, buses, tractors, and construction equipment, supporting ICE market expansion.

-

Technological Innovations: Advancements in engine efficiency, hybridization, and alternative fuels allow ICEs to remain competitive alongside EVs.

-

Strategic Diversification by OEMs and Energy Companies: Automaker and oil-major investments are strengthening supply chains and promoting hybrid and alternative-fuel ICEs.

Quantitative Insight: In 2024, the Asia-Pacific region contributed 42.2% of global ICE revenue, gasoline engines accounted for 60.38% of total revenue, and V-type engines represented 55.33% of engine-type revenue, highlighting widespread adoption across passenger and heavy-duty vehicles.

Impact of Trends and Drivers

-

Passenger Vehicles: Hybridization and smaller ICEs are dominating, delivering fuel-efficient and emission-compliant solutions.

-

Commercial and Heavy-Duty Vehicles: Hydrogen and hybrid engines enhance efficiency in trucking, logistics, and construction machinery.

-

Marine and Industrial Applications: OEM partnerships and alternative-fuel ICEs support sustainable operations and reduce lifecycle emissions in shipping, power generation, and manufacturing.

-

Regional Differences: Europe and China are aggressively promoting electrification and hybrid adoption, whereas South Asia, Africa, and Latin America continue to rely on conventional ICEs due to cost and infrastructure limitations.

Challenges & Opportunities

Challenges:

-

High R&D and development costs

-

Limited infrastructure for alternative fuels

-

Increasing EV adoption in developed markets potentially reducing ICE demand

Opportunities:

-

Growth potential for hydrogen ICEs, hybrid powertrains, and range-extender applications in commercial, marine, and industrial sectors

-

Collaborative ventures among OEMs and energy companies for technology leadership and market expansion

Future Outlook

Emerging technologies such as hydrogen-powered engines, hybrid integration, and alternative fuels are expected to extend ICE relevance, particularly in regions facing EV adoption challenges. Manufacturers investing in fuel efficiency, emission reduction, and hybrid technologies are positioned to capture the largest market share over the next decade.

Contact Us for a Detailed Overview: https://www.cervicornconsulting.com/contact-us