Market Overview

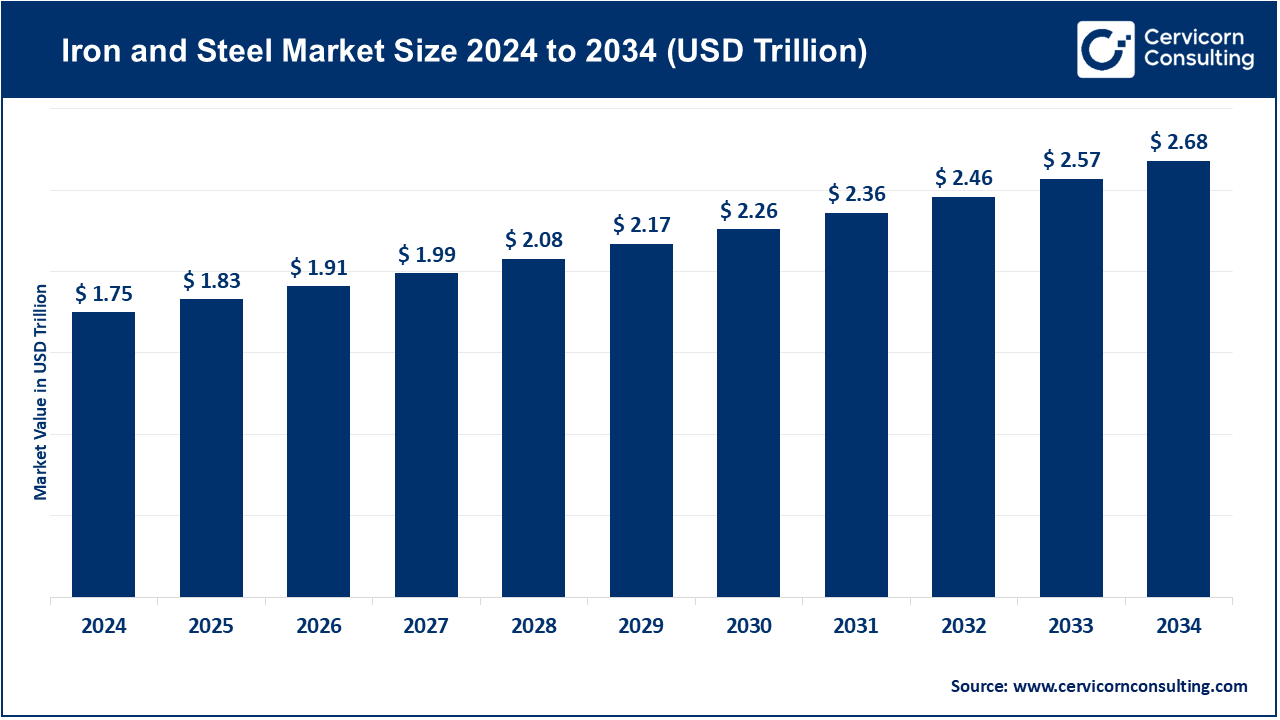

The global iron and steel market is a cornerstone of industrial growth, underpinning sectors such as construction, automotive, manufacturing, and energy. As per Cervicorn Consulting, the market was valued at USD 1,899.5 billion in 2024 and is anticipated to reach nearly USD 2,968.4 billion by 2034, reflecting a CAGR of 4.6% between 2025 and 2034.

This expansion is largely fueled by urbanization, large-scale infrastructure initiatives, and rising demand in emerging markets including India, China, and Brazil. Steel’s critical role in renewable energy infrastructure—ranging from wind turbines and solar panel frameworks to electric vehicle components—further emphasizes its importance in the global shift toward sustainable industrialization. The market spans a wide array of products such as flat steel, long steel, and specialty alloys, serving diverse applications from construction materials to advanced machinery.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2801

Key Market Trends

The iron and steel sector is undergoing significant technological and structural evolution. Key trends shaping its future include:

-

Shift Toward Green Steel Production

Sustainability is now central to steelmaking. With increasing pressure to reduce carbon emissions, manufacturers are adopting low-carbon technologies like hydrogen-based Direct Reduced Iron (DRI) and Electric Arc Furnace (EAF) methods. Companies such as ArcelorMittal and SSAB are piloting hydrogen-based “green steel” production, targeting net-zero emissions by 2050. Government incentives under frameworks like the EU Green Deal and the U.S. Inflation Reduction Act support these efforts. -

Rising Demand from Construction and Infrastructure

Urbanization and government-backed infrastructure projects are boosting steel consumption. Developing economies, particularly in India and Southeast Asia, are seeing strong investments in roads, bridges, metro systems, and housing. Initiatives like India’s National Infrastructure Pipeline (NIP) and China’s Belt and Road Initiative (BRI) are driving demand for long and structural steel products. -

Integration of Smart Manufacturing and Industry 4.0

Automation and digital technologies are enhancing production efficiency. Leading steelmakers employ AI, robotics, and IoT-based monitoring to optimize furnaces, minimize waste, and improve quality. Companies like Nippon Steel and POSCO are implementing predictive analytics and digital twin solutions to increase yield and sustainability. -

Growing Use of Scrap and Circular Economy Practices

Recycling steel scrap in EAFs reduces energy consumption by up to 60% compared to traditional blast furnaces. Circular economy practices—including scrap recovery, waste reduction, and material reuse—are improving the environmental footprint of steel production. -

Expansion of High-Strength and Specialty Steel Grades

Demand for Advanced High-Strength Steels (AHSS), stainless steel, and specialty alloys is rising in the automotive, aerospace, and defense sectors. AHSS is increasingly used in EVs to reduce weight and enhance safety, while renewable energy projects prefer corrosion-resistant steel for offshore wind and solar structures.

Market Drivers

Several factors are fueling the global iron and steel market:

-

Rapid Urbanization and Infrastructure Expansion

With over 68% of the global population projected to live in urban areas by 2050 (UN), demand for steel in housing, transport, and utilities is surging. Programs like India’s Smart Cities Mission and emerging African infrastructure projects are generating significant opportunities. -

Industrial Growth in Emerging Economies

Industrialization in countries such as India, Indonesia, and Vietnam, including investments in manufacturing, shipbuilding, and energy infrastructure, is directly increasing steel demand. -

Transition to Clean Energy

The renewable energy push is expanding steel applications. Wind projects require 120–180 tons of steel per megawatt, and solar farms rely on steel frames. Growing renewable capacity is thus boosting steel consumption. -

Technological Advancements in Steelmaking

Innovations like 3D printing, AI-enabled process control, and automation enhance efficiency, reduce energy use, and allow production of high-performance steel for modern industries. -

Supportive Government Policies and Incentives

Policies such as the U.S. Bipartisan Infrastructure Law and the EU Carbon Border Adjustment Mechanism are promoting domestic production and sustainable steel manufacturing.

Impact of Trends and Drivers

These trends and drivers are reshaping the market landscape:

-

Regional Transformation: Asia-Pacific dominates production (~70%), led by China, India, Japan, and South Korea. Europe and North America are increasingly investing in green steel technologies, opening avenues for collaboration and low-emission steel exports.

-

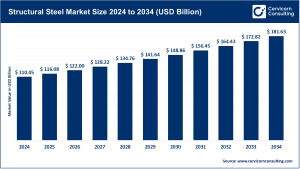

Segmental Impact: Construction remains the largest steel-consuming sector (~50%), while automotive demand for lightweight, high-strength steel rises. The energy sector is growing due to renewable infrastructure development.

-

Supply Chain and Sustainability: Digitalized supply chains, traceability, and recycling initiatives improve environmental compliance. Producers focusing on sustainable sourcing and carbon tracking gain preference among OEMs and investors.

Challenges and Opportunities

Challenges:

-

Stricter environmental regulations and carbon taxes raise production costs.

-

Volatile raw material prices affect profitability.

-

Geopolitical instability can disrupt steel trade and supply.

Opportunities:

-

Green hydrogen-based steel production expansion.

-

Growth of EAF operations powered by renewable energy.

-

Strategic M&A and joint ventures to enhance technology.

-

Rising adoption of recycled and low-carbon steel across industries.

Future Outlook

The global iron and steel market is expected to sustain steady growth through 2034, rising from USD 1,899.5 billion in 2024 to USD 2,968.4 billion. The industry will increasingly emphasize decarbonization, digitalization, and demand-driven production.

Sustainability, circularity, and innovation will define the future, with a focus on hydrogen-based furnaces, recycled steel, and smart manufacturing systems. The next decade will see the iron and steel sector evolve not only in volume but also in environmental and technological adaptability.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us