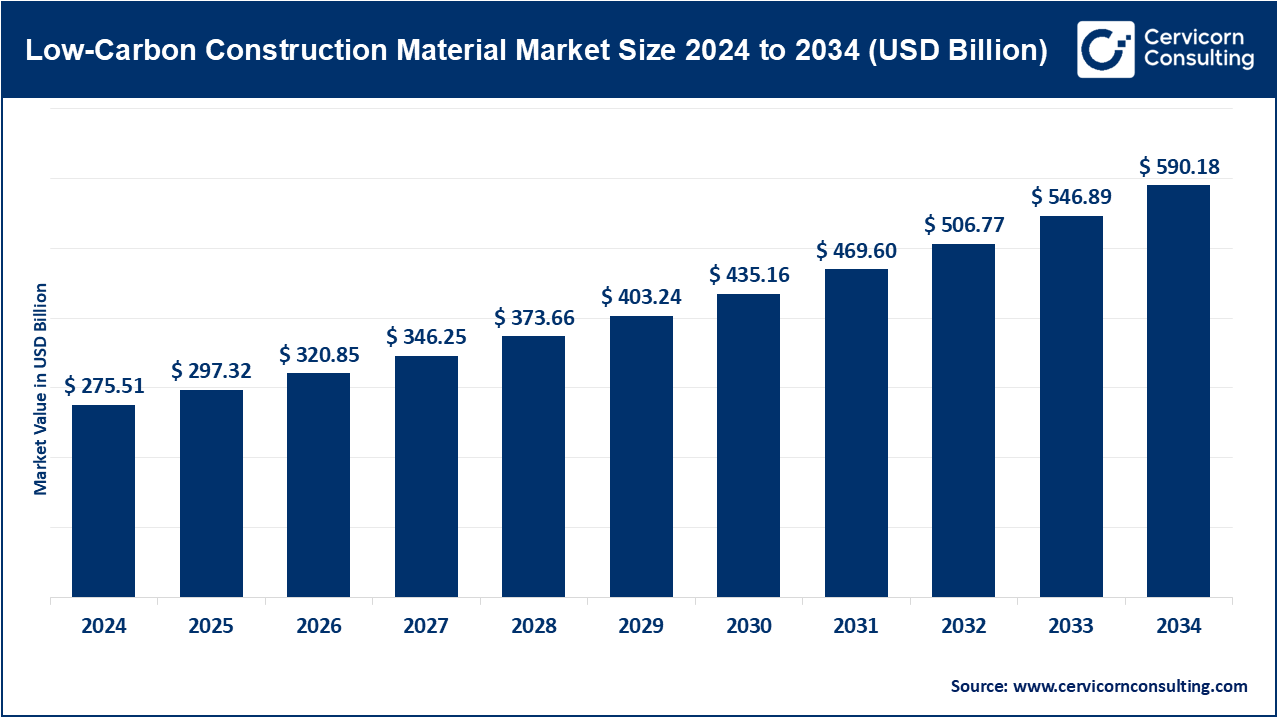

Low‑Carbon Construction Material Market Overview

The global low-carbon construction material market was estimated at USD 275.51 billion in 2024 and is projected to grow to approximately USD 590.18 billion by 2034, registering a CAGR of around 8% between 2025 and 2034.

This market encompasses construction materials and techniques designed to reduce embodied carbon, including recycled content, bio-based products, low-clinker cement, and carbon-efficient production methods. It serves various sectors, such as residential, commercial, industrial, and infrastructure projects. Key market segments cover material types (e.g., recycled steel, cross-laminated timber, bio-based insulation), construction methods (new construction, retrofit/renovation, green roofing), applications (insulation, flooring, paving, and more), and geographical regions including North America, Europe, Asia-Pacific, and LAMEA.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2732

Low‑Carbon Construction Material Market Trends

| # | Trend | Description & Examples |

|---|---|---|

| 1. Bio-Based Materials & Mass Timber | Growing use of renewable, plant-based materials such as cross-laminated timber (CLT), bamboo, and hempcrete. These products help sequester carbon, reduce reliance on cement, and enhance thermal efficiency. | |

| 2. Circular Economy & Recycled Content | Increased focus on reuse and recycling of construction materials like steel and bricks. Many large-scale projects now prioritize materials with high recycled content to minimize embodied carbon. | |

| 3. Stricter Regulations & Policies | Governments are introducing carbon caps, lifecycle assessments, and low-emission material mandates, which drive adoption across public and private construction projects. | |

| 4. Corporate Net-Zero Commitments | Companies pursuing net-zero targets are influencing supply chains to source verified low-carbon materials, such as geopolymer concrete, recycled steel, and bio-based panels. | |

| 5. Energy Performance & Insulation | Demand for bio-based and natural fiber insulation is rising due to stricter thermal codes and green building certifications. The insulation segment accounted for ~37.2% of market revenue in 2024. |

Low‑Carbon Construction Material Market Drivers

-

Regulatory Pressure & Green Building Codes

Mandates for lower embodied carbon and carbon lifecycle reporting favor materials such as low-clinker cement, bio-based insulation, and certified timber. -

Corporate ESG / Net-Zero Goals

Corporate sustainability commitments are accelerating the procurement of low-carbon materials, particularly in infrastructure and commercial construction. -

Performance & Lifecycle Cost Benefits

Low-carbon materials, though often costlier upfront, reduce operational energy use and emissions, providing long-term savings. -

Urbanization & Infrastructure Expansion

Rapid urban growth, particularly in Asia-Pacific, is driving construction demand while encouraging adoption of green building materials. -

Consumer Awareness & Preferences

Sustainability-conscious end-users, alongside certifications such as LEED, BREEAM, and WELL, are promoting the use of low-carbon materials in new builds and renovations.

Impact of Trends & Drivers Across Segments & Regions

-

Material Type: Recycled steel leads with ~43.4% revenue share in 2024, while bio-based insulation and mass timber are gaining momentum in regions with regulatory incentives.

-

Application: Insulation is the fastest-growing segment (~37.2%), followed by flooring, interior finishes, and paving.

-

Construction Method: New construction dominates (~40.5%), while retrofit/renovation (~34.2%) is rising due to emissions reduction potential in existing buildings.

-

Regional Insights:

-

North America: Largest share (~36.9%), projected to grow from USD 101.66 billion in 2024 to USD 217.78 billion by 2034.

-

Europe: Expected to reach USD 184.14 billion by 2034, supported by circular economy initiatives and green building policies.

-

Asia-Pacific: Rapid growth from USD 67.78 billion in 2024 to USD 145.18 billion by 2034 due to urbanization and regulatory support.

-

LAMEA: Smaller share (~7.3%), reaching USD 43.08 billion by 2034 through green infrastructure adoption.

-

Challenges & Opportunities

Challenges:

-

Higher Upfront Costs: Some bio-based and low-carbon materials have higher initial expenses.

-

Supply Chain Constraints: Limited infrastructure in emerging regions may delay adoption.

-

Carbon Measurement Standards: Lack of consistent standards complicates verification.

-

Technical Skills Gap: Certain low-carbon products require new methods and trained workforce.

Opportunities:

-

Retrofit & Renovation Projects: Existing buildings offer significant carbon reduction potential.

-

Innovative Carbon-Negative Materials: Emerging products such as biochar-infused concrete and algae-based panels present new opportunities.

-

Local Manufacturing & Supply Chains: Expanding local production can reduce costs and emissions.

-

Policy Incentives & Green Financing: Subsidies, tax breaks, and grants support adoption and scale-up.

Future Outlook

The market is poised for strong growth, driven by widespread adoption of bio-based materials, stricter carbon reporting, and green building policies across North America, Europe, and Asia-Pacific. Retrofit projects and carbon-negative innovations will create additional opportunities, while standardization and supply chain development will be essential to sustain market expansion.

Contact Us for a Detailed Overview: Cervicorn Consulting