1. Executive Summary

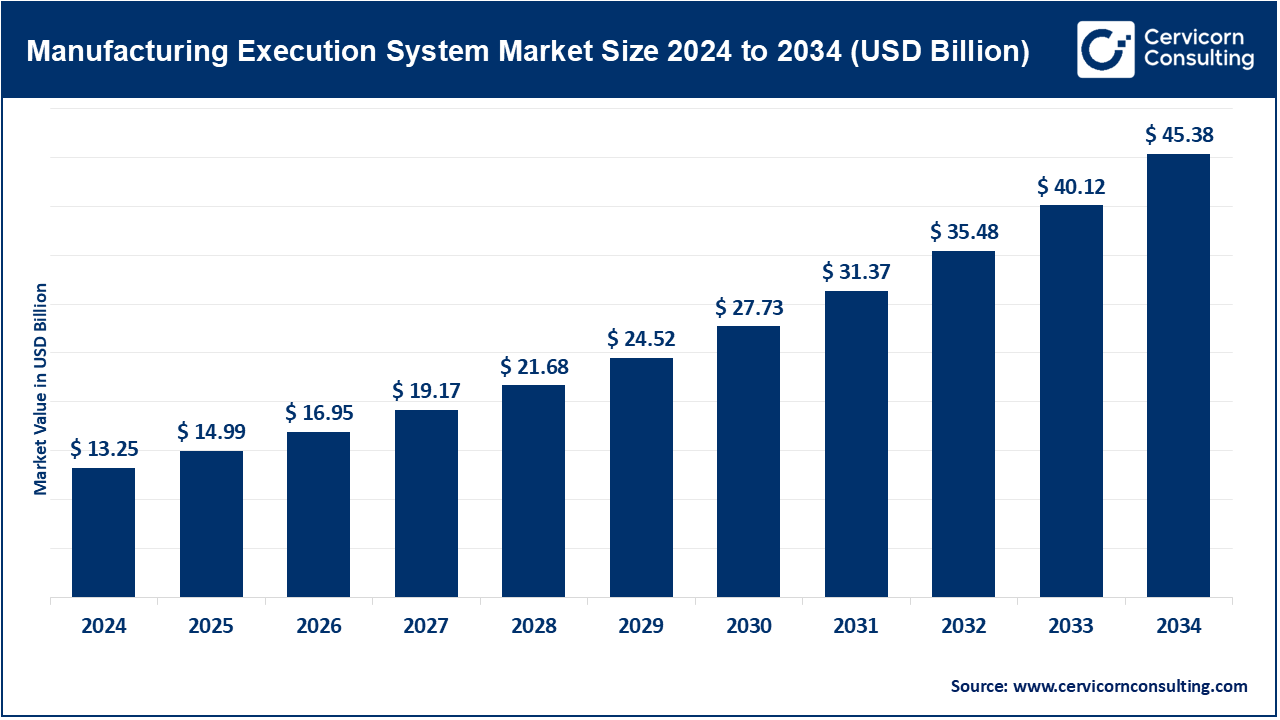

The global manufacturing execution system (MES) market is experiencing significant growth, with its value expanding from approximately USD 13.25 billion in 2024 to an expected USD 45.38 billion by 2034—a projected CAGR of 13.10%. This growth trajectory underscores MES’s pivotal role in driving operational efficiency, enabling digital manufacturing strategies, and delivering real-time visibility across production floors.

2. Understanding the MES Market

Definition & Scope

MES solutions serve as the operational bridge that connects enterprise-level planning systems (ERP/PLM/QMS) with shop-floor control systems (PLC/SCADA). They manage critical manufacturing functions such as:

-

Work order execution

-

Resource and material tracking

-

Batch and recipe management

-

Electronic batch/device history records (eBHR/EBR)

-

Quality control and real-time operator guidance

-

OEE tracking, downtime logging, traceability, and compliance reporting

MES may be deployed as standalone software, modules within comprehensive Manufacturing Operations Management (MOM) suites, or as embedded tools within ERP or process control systems, making them versatile for a range of manufacturing environments.

Key Vendors include Siemens Opcenter, Emerson DeltaV/Syncade, ABB Ability MOM, Oracle Fusion Cloud Manufacturing, and GE Digital.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2695

3. Why MES Is a Strategic Imperative

-

Operational Control & Speed

MES translates production plans into actionable shop-floor processes, ensuring consistency, safety, and rapid throughput. -

Quality & Regulatory Compliance

Electronic records, traceability, and audit features minimize recalls, enforce standards, and accelerate approvals—crucial in heavily regulated industries. -

Data-Driven Optimization

By serving as a central source for real-time performance data (OEE, yield, scrap rates), MES enables predictive analytics, faster troubleshooting, and leaner operations.

Outcomes include higher efficiency, reduced waste, quicker changeovers, improved delivery performance, and verifiable compliance.

4. Market Sizing & Growth Trends

-

2024 Value: USD 13.25 billion

-

2034 Projection: USD 45.38 billion

-

CAGR (2025–2034): 13.10%

Driving Factors:

-

Digital transformation mandates (Industry 4.0)

-

Demand for flexible, high-mix manufacturing

-

Regulatory and sustainability mandates

-

Explosion of IIoT and edge data sources

-

Cloud/SaaS models democratizing MES access

-

M&A consolidating vendor capabilities

-

AI-enhanced analytics for smarter shop-floor decisions

These elements combine to drive multi-year, double-digit growth across both service and product segments.

5. Industry Segmentation & Deployment Models

By Component

-

Software Solutions (MES platforms) dominate ~60%

-

Services (implementation, consulting, support) make up remaining share

By Deployment

-

On-Premises (~40-45%): preferred for customization and regulatory control

-

Cloud-Based / SaaS (fastest growth): offers agility, simplified upgrades, and remote deployment capabilities

By Industry

-

Automotive (approx. 36%): complexity and precision drive heavy MES adoption

-

Electronics & Semiconductors

-

Pharma & Life Sciences

-

Food & Beverage

-

Chemical & Heavy Manufacturing

By Geography

-

Asia-Pacific: ~37% market share; fastest growth due to industrialization

-

North America & Europe: leadership in maturity and innovation

-

Latin America & MEA: growing interest in niche manufacturing sectors

6. Competitive Landscape

Major MES vendors invest heavily in automation, AI, and analytics:

-

Emerson Electric Co. – Deep control-system integration (DeltaV/Syncade)

-

General Electric (GE) – Digital asset performance and manufacturing optimization

-

Oracle – Cloud-native MES as part of integrated ERP/SCM

-

Siemens – Opcenter platform with digital thread and automation ties

-

ABB Ltd. – MES/MOM integrated with robotics and automation

-

Additional leaders: Rockwell Automation, Dassault Systèmes, Honeywell, AVEVA, SAP

7. Industry Trends Shaping the Future

| Trend | Impact |

|---|---|

| Cloud & SaaS MES | Scalability and multi-site rollout speed |

| Edge-to-Cloud & IIoT | Deeper, faster real-time monitoring |

| AI & Advanced Analytics | Transition from descriptive to prescriptive MES |

| Industry Templates | Reduced implementation time, faster ROI |

| Digital Thread | Seamless data flow from design to execution |

| Connected Worker Tools | AR, mobile SOPs reduce errors & training time |

| Sustainability Metrics | Enables reporting on energy, emissions per unit |

8. Global Case Studies

-

Siemens Opcenter – Reduced WIP and lead time at electronics/manufacturing sites

-

Oracle Cloud MES – Real-time ERP-MES integration streamlining analytics

-

Emerson Syncade – Automated batch records cut product release time in pharma

-

ABB Ability MOM – Boosted throughput in paper and continuous industries

-

Cloud MES (e.g., 42Q, Critical Manufacturing) – Provided rapid deployment and ROI via cloud

9. Regional Government Policies & Adoption Drivers

-

Europe: Industry 4.0 funding and harmonization standards (Plattform Industrie 4.0)

-

China: Smart manufacturing investments via national programs

-

India: MES adoption propelled by PLI and Make-in-India incentives

-

USA: Manufacturing USA, clean tech tax credits, semiconductor onshoring

-

Japan, Korea, Southeast Asia: Smart factory pilots in automotive and electronics

-

Latin America & Africa: MES deployed in key industrial zones and agro-processing

10. MES Vendor Selection Guide

-

Look for vertical-specific templates (e.g., pharma, semiconductor)

-

Ensure PLC/SCADA compatibility and data model alignment

-

Adopt a phased rollout: pilot high-impact lines, measure, then scale

-

Clarify cloud vs. on-prem with attention to data residency and validation

-

Emphasize operator training and change management for adoption

-

Choose vendors with strong local support and integrator networks

11. The Road Ahead

By 2034, MES will evolve into:

-

AI-Driven Systems: Predicting issues and prescribing actions

-

Integrated Digital Workflows: MES tightly linked with ERP, PLM, SCM

-

Connected Worker Ecosystems: Real-time instructions via AR/VR

-

Edge-Enabled Architectures: Faster insights with lower latency

-

Sustainability Dashboards: Tracking environmental KPIs live on the shop floor

MES isn’t just a production system—it will serve as the command center for tomorrow’s smart factories.

12. Final Thoughts

The MES market is on a transformative growth path, shaped by smart manufacturing demands, digital integration, and real-time optimization needs. Organizations that invest in robust, future-ready MES solutions today will stand ahead in the manufacturing landscape of tomorrow.