Metal Recycling and Recovery Market Overview

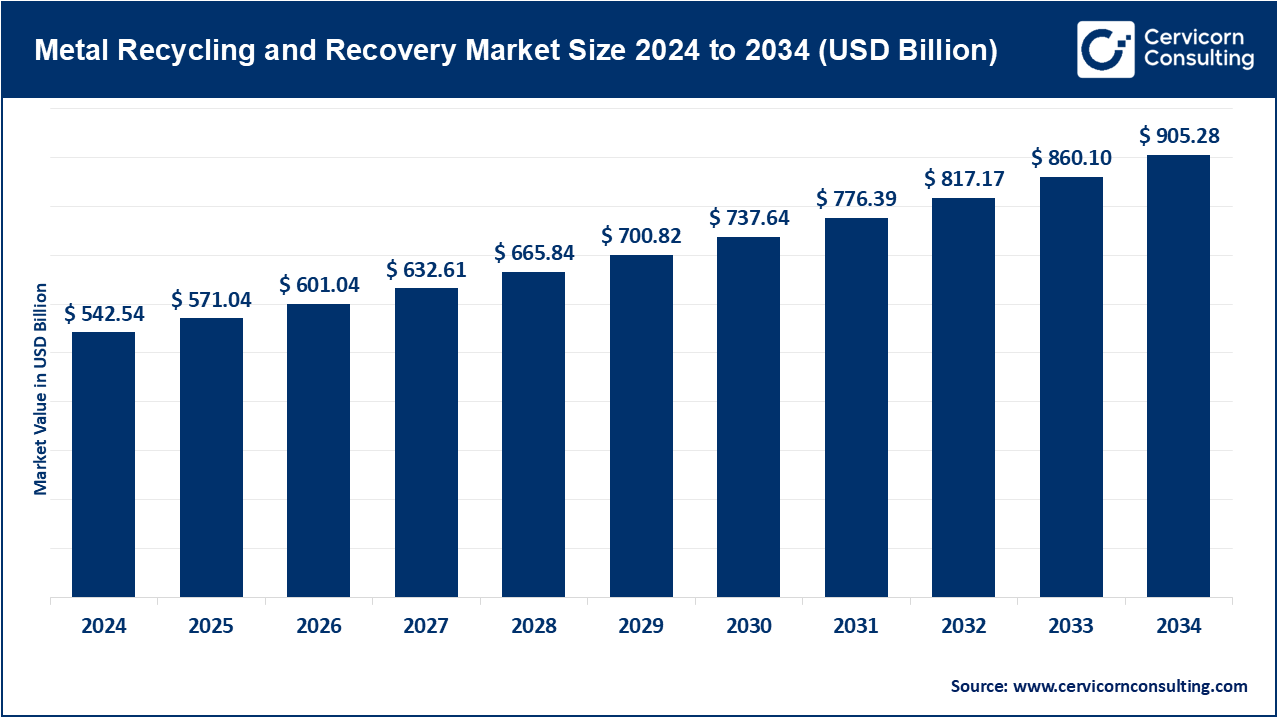

The global metal recycling and recovery market is central to advancing sustainable resource management and mitigating environmental impact. In 2024, the market size reached USD 542.54 billion and is forecasted to climb to USD 905.28 billion by 2034, expanding at a CAGR of 5.25% between 2025 and 2034. The market covers activities such as collecting, processing, and reusing scrap metals derived from industrial, consumer, construction, and electronic waste streams. By recycling metals, industries not only conserve energy and cut greenhouse gas emissions but also reduce reliance on landfills and the depletion of natural resources, making this practice indispensable to the circular economy.

Key Market Trends

The landscape of metal recycling and recovery is rapidly changing, shaped by evolving technologies, policies, and consumer preferences:

-

AI-Driven Sorting and Multi-Sensor Recovery

Artificial intelligence, paired with tools like Laser-Induced Breakdown Spectroscopy (LIBS) and X-ray fluorescence, is transforming the precision of alloy detection and separation. This innovation boosts recovery efficiency, produces higher-purity outputs, and makes the processing of low-grade scrap financially viable. -

Urban Mining and E-Waste Utilization

With urban centers producing rising volumes of electronic waste, valuable resources such as lithium, cobalt, and rare-earth elements are increasingly recovered from discarded devices. These urban mining efforts contribute to resilient supply chains while reducing the ecological toll of traditional mining. -

Blockchain for Transparency and Digital Trade

Blockchain solutions enable tamper-proof tracking of recycled metals, ensuring compliance with sustainability standards. Additionally, digital trading platforms simplify transactions, provide liquidity, and authenticate provenance—vital for industries like automotive and aerospace. -

Regulatory Drive Toward Circular Economy

Governments worldwide are tightening recycling regulations and introducing extended producer responsibility (EPR) schemes. These measures push industries to adopt recovery and reuse while spurring investments in new infrastructure and technologies. -

Growing Role in the Automotive Industry

The adoption of electric vehicles (EVs) and demand for lightweight materials are propelling automakers to integrate recycled metals in components such as battery housings and structural parts. This dynamic supported the industrial scrap segment, which held 47.6% of the market share in 2024.

Market Drivers

Several factors underpin the sustained growth of this market:

-

Rising Need for Eco-Friendly Raw Materials: Companies are increasingly replacing virgin metals with recycled alternatives to lower energy use and carbon output.

-

Innovation in Recovery Technologies: Advanced processes such as hydrometallurgy, pyrometallurgy, and electrochemical methods expand the scope of recoverable metals and raise efficiency levels.

-

Supportive Government Policies: Regulations and recycling incentives encourage scrap collection and metal recovery from both industrial and consumer sources.

-

Urbanization and Construction Boom: Expanding infrastructure projects—especially in Asia-Pacific, which represented 46.3% of global revenues in 2024—are producing vast amounts of recoverable scrap.

-

Shift in Consumer Behavior: Growing preference for sustainable products compels manufacturers to integrate recycled metals into their production lines.

Impact of Trends and Drivers

-

By Metal Type: Ferrous metals dominated in 2024 with 64.2% of market revenues, fueled by heavy usage in construction and automotive applications.

-

By Source: Industrial scrap leads as the most reliable feedstock, offering consistent quality and minimal contamination.

-

By Region: Asia-Pacific continues to be the growth engine, driven by rapid industrialization and urban development.

-

By End-Use: Key industries such as automotive, construction, packaging, and electronics are adopting recycled metals to meet sustainability goals and cost efficiency.

Challenges & Opportunities

Challenges:

-

High upfront costs for advanced recycling technologies

-

Fluctuations in scrap metal prices affecting margins

-

Technical complexities in separating multi-material composites

Opportunities:

-

Growing potential in e-waste recovery and urban mining projects

-

Strengthening OEM-recycler collaborations

-

Adoption of AI and blockchain for traceable, high-purity recycling

Future Outlook

The future of the metal recycling and recovery market will be defined by the adoption of AI-powered processing, urban mining initiatives, and blockchain-enabled traceability. These advancements are set to elevate efficiency, ensure supply chain transparency, and optimize material quality. With stringent regulations and increasing industrial demand, metal recycling and recovery will remain a cornerstone of the global circular economy.

👉 For more details, insights, and access to a free sample report, visit Cervicorn Consulting – Metal Recycling and Recovery Market.