Operational Technology (OT) Cybersecurity Market Overview

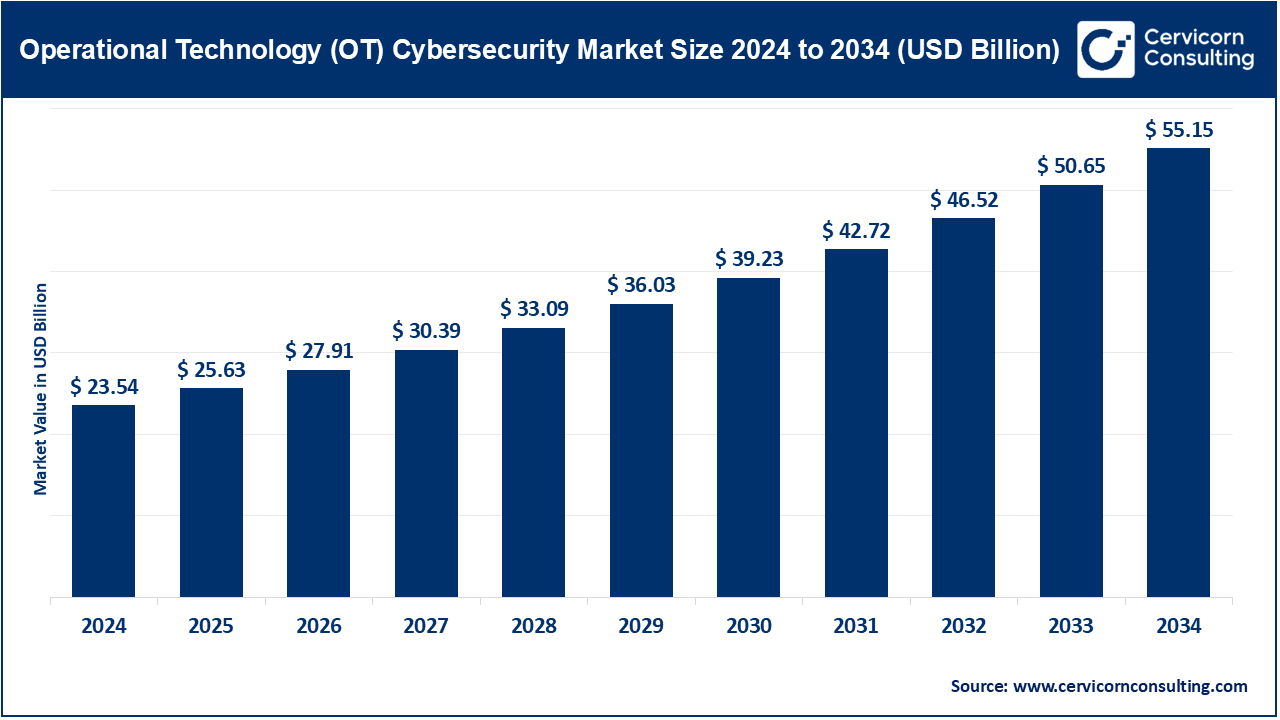

The global operational technology (OT) cybersecurity market stood at USD 23.54 billion in 2024 and is forecasted to reach nearly USD 55.15 billion by 2034, growing at a robust CAGR of 16.4% between 2025 and 2034. This impressive growth trajectory is fueled by rapid IIoT integration, increasing convergence of IT and OT environments, and the rising frequency of cyberattacks targeting critical infrastructure.

📌 Get a Free Sample: https://www.cervicornconsulting.com/sample/2719

Key Market Trends

-

IT–OT Convergence

The merging of IT systems, data analytics, and IIoT into operational workflows boosts efficiency and visibility but also widens the attack surface. To counter these risks, industries are adopting integrated cybersecurity frameworks. For instance, European automotive facilities deployed unified IT/OT platforms in 2024. -

Adoption of Zero-Trust Security in OT

Zero-trust principles — where every connection is verified — are increasingly applied in OT. By 2025, several U.S. energy companies had already rolled out zero-trust security models in SCADA environments. -

AI-Driven Threat Detection & Analytics

Machine learning and AI are being deployed to baseline OT system behavior and flag anomalies in real time. A leading oil producer successfully applied AI in 2024 to detect pipeline irregularities, cutting response times significantly. -

Cloud-based OT Security Solutions

Cloud-driven OT security tools, such as SIEM and centralized threat intelligence, are on the rise. Cloud models accounted for about 40.3% of market revenue in 2024, offering scalability and rapid patching capabilities. Case studies show SIEM migration reduced investigation times by up to 40%. -

Rising Use of Managed Security Services

Due to the scarcity of OT-specific security talent, organizations are outsourcing monitoring and response. Managed security services captured ~39.8% of offering revenue in 2024, reflecting enterprises’ reliance on external expertise for continuous protection.

Market Drivers

-

Escalating cyberattacks on critical systems: High-profile ransomware incidents — such as the 2024 cyberattack at a major Asian port — have intensified investments in OT defense.

-

Tightened regulatory frameworks: Policies like the UK’s Cyber Security and Resilience Bill (2025) require strict OT compliance and audits, forcing organizations to increase budgets for security.

-

IIoT expansion and digital transformation: Growing deployment of sensors and telemetry increases vulnerability, directly contributing to the market’s 16.4% CAGR forecast.

-

Talent shortages and high setup costs: With limited OT security experts available, companies are increasingly investing in managed and professional services, which represented 28.8% of component revenue in 2024.

-

Technology advancements: Adoption of AI/ML, zero-trust security models, and cloud-native SIEMs have made OT security more scalable and cost-effective. Notably, solutions alone contributed 71.2% of the total component market in 2024.

Impact of Trends & Drivers

-

Regional impact: North America led with 37.7% market share in 2024, driven by stricter regulations and early digitization, while Asia-Pacific is projected to see the fastest growth due to industrial expansion and IIoT adoption.

-

By component: With solutions dominating at 71.2%, investments are concentrated on endpoint protection and segmentation. However, the ~39.8% share of managed services highlights the growing outsourcing trend.

-

By security type: Network security accounted for 48.5% share, remaining the most critical defense mechanism for industrial control systems.

-

By application: Energy & utilities were the leading vertical with 38.9% share, reflecting the sector’s critical need for robust security.

-

By deployment: On-premises deployments made up 59% due to sovereignty and performance demands, while cloud adoption (~41%) is rapidly increasing.

Challenges & Opportunities

Key Challenges

-

Legacy OT infrastructure: More than 60% of plants rely on unsupported PLCs that lack patching capabilities.

-

Fragmented toolchains: Siloed tools slow down detection and response processes.

-

Talent scarcity: A shortage of OT cybersecurity experts and high deployment costs hinder adoption.

Opportunities

-

AI & anomaly detection: Advanced predictive analytics are proving effective in reducing downtime and risk.

-

Managed detection & response (MDR): Vendors offering specialized MDR services are poised for rapid growth.

-

Cloud-native SIEM & intelligence sharing: These accelerate response times and streamline compliance.

Future Outlook

Looking ahead to 2034:

-

Demand in energy & utilities will remain strong, with manufacturing and transportation catching up as IIoT expands.

-

Combined solutions, AI-powered detection, and managed services will dominate as organizations prefer bundled, vendor-managed offerings.

-

North America will continue to hold the largest market share, but Asia-Pacific is expected to emerge as the fastest-growing region, requiring localized strategies for compliance and deployment.

📌 Contact for Detailed Market Insights: https://www.cervicornconsulting.com/contact-us