Pharmaceutical Water Market Size

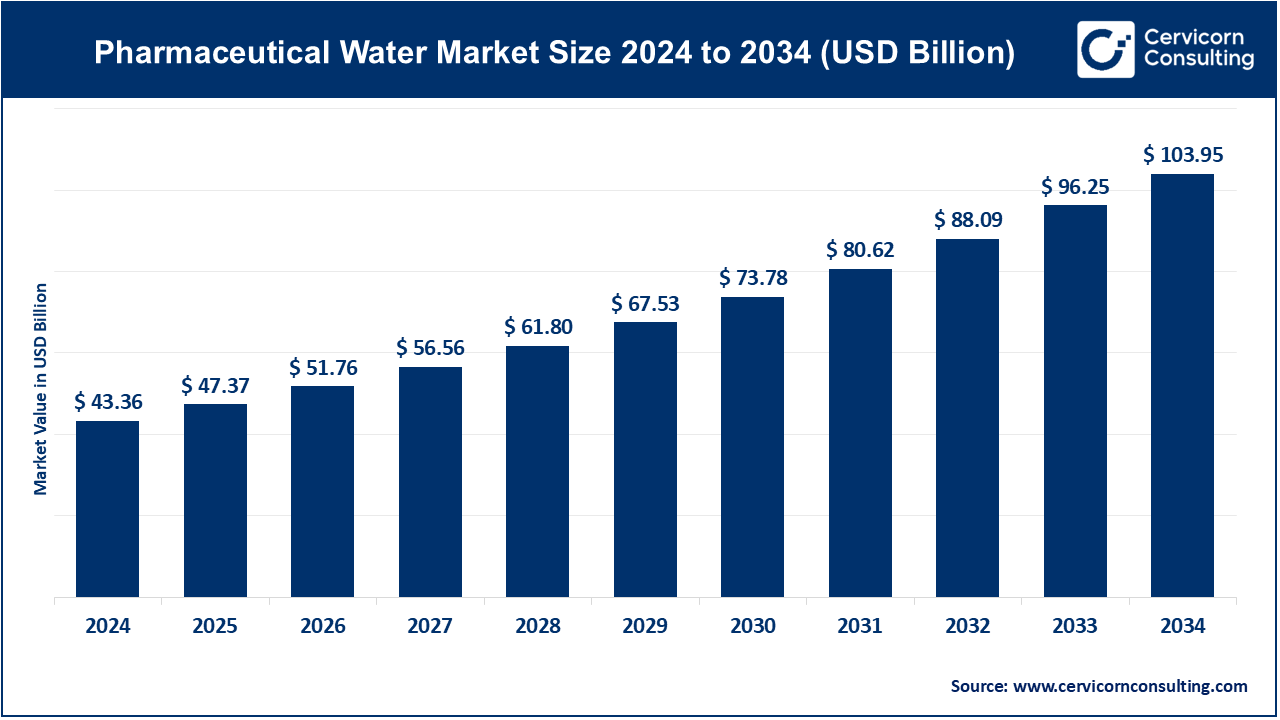

The global pharmaceutical water market was valued at USD 43.36 billion in 2024 and is projected to reach USD 103.95 billion by 2034, growing at a CAGR of 9.26% from 2025 to 2034.

What is the Pharmaceutical Water Market?

The pharmaceutical water market revolves around the production, treatment, and distribution of high-purity water used across the pharmaceutical and biotechnology industries. This specialized water is critical for drug manufacturing, laboratory testing, cleaning of equipment, and formulation of medicines, ensuring the highest standards of quality and safety.

The market includes various grades of water:

-

Purified Water (PW) – for general pharmaceutical processes.

-

Water for Injection (WFI) – for injectable drug production.

-

Sterile Water – for specialized laboratory and clinical applications.

The significance of this market lies in its direct impact on patient safety and regulatory compliance. Stringent quality requirements are enforced by regulatory bodies like the U.S. Pharmacopeia (USP), European Pharmacopoeia (EP), and World Health Organization (WHO). Companies are investing heavily in advanced purification systems, digital monitoring, and sustainable solutions to meet these standards.

Market Trends

Several emerging trends are shaping the pharmaceutical water market:

-

Technological Advancements

The adoption of reverse osmosis (RO), electrodeionization (EDI), and UV sterilization systems has significantly improved water quality. Smart, IoT-enabled purification units allow real-time monitoring and predictive maintenance, reducing downtime and ensuring compliance. -

Sustainability and Green Initiatives

Pharmaceutical companies are increasingly investing in water recycling, energy-efficient systems, and waste reduction technologies. Sustainable water solutions not only reduce environmental impact but also lower operational costs. -

Growth of Biopharmaceuticals and Vaccines

The rising production of biologics, vaccines, and sterile injectables drives demand for high-purity water. Manufacturers are expanding facilities with high-capacity purification systems to meet these needs. -

Modular and Compact Water Systems

To support small-scale and emerging pharmaceutical manufacturers, modular, space-efficient water purification units are becoming popular. These systems offer scalability and reduced installation costs. -

Regulatory Compliance and Automation

Continuous updates in USP, EMA, and WHO guidelines are pushing companies toward automated, validated water systems to maintain consistent quality and documentation.

Market Dynamics

Drivers

-

Increasing Pharmaceutical Production – Growth in biologics and vaccines raises the demand for purified water.

-

Government Initiatives – Policies like India’s Pharma Vision 2020 and China’s Made in China 2025 support advanced pharmaceutical infrastructure, indirectly boosting water system demand.

-

Technological Innovation – Advanced EDI, RO, UV, and membrane filtration systems enhance efficiency and compliance.

-

Sustainability Focus – The push for environmentally friendly operations drives adoption of green water systems.

Restraints

-

High initial costs for installing advanced purification systems.

-

Maintenance and validation complexities.

-

Regional regulatory discrepancies that may delay market adoption.

Opportunities

-

Expansion into emerging pharmaceutical hubs in Asia-Pacific, Latin America, and the Middle East.

-

Adoption of digital monitoring and automation to improve operational efficiency.

-

Development of compact, modular systems for small-scale manufacturers.

Challenges

-

Meeting evolving regulatory standards across multiple regions.

-

Balancing costs of technology adoption with operational efficiency.

-

Ensuring consistent water quality across production scales.

Regional Analysis

North America

-

Drivers: Advanced healthcare infrastructure, stringent FDA regulations.

-

Growth Potential: High due to increasing biologics and vaccine manufacturing.

-

Unique Factors: Strong presence of multinational pharmaceutical companies investing in innovative water systems.

Europe

-

Drivers: High regulatory compliance (EMA), growing biopharmaceutical sector.

-

Growth Potential: Moderate to high, especially in Germany, Switzerland, and the UK.

-

Unique Factors: Focus on sustainability and energy-efficient water technologies.

Asia-Pacific

-

Drivers: Rapidly expanding pharma hubs in India and China.

-

Growth Potential: Highest growth due to government incentives and manufacturing expansion.

-

Unique Factors: Rising demand for vaccines and biosimilars accelerates system adoption.

Latin America

-

Drivers: Growing demand for generic drugs, healthcare investment.

-

Growth Potential: Moderate, led by Brazil and Mexico.

-

Unique Factors: Regulatory focus on water quality for exports.

Middle East & Africa

-

Drivers: Expansion of pharma manufacturing in GCC countries.

-

Growth Potential: Emerging, with investments under initiatives like Saudi Vision 2030.

-

Unique Factors: Emphasis on healthcare modernization and pharmaceutical self-reliance.

Recent Developments

-

Veolia Water Technologies and other leaders are expanding operations to provide turnkey pharmaceutical water systems.

-

SUEZ Water Technologies launched modular EDI-based systems for emerging markets.

-

Thermo Fisher Scientific and Merck KGaA upgraded lab-grade and WFI systems with digital monitoring and energy-efficient designs.

-

Mergers & Acquisitions: Consolidation in the market, such as Pall Corporation becoming part of Danaher, strengthens technological capabilities and geographic reach.

-

Regulatory Updates: Continuous revisions in USP and EMA guidelines ensure higher compliance standards for pharmaceutical water systems.

Conclusion

The pharmaceutical water market is poised for robust growth, driven by technological advancements, rising biopharmaceutical production, and stringent regulatory requirements. Companies investing in innovation, compliance, and regional expansion are well-positioned to lead the market in the coming decade.

For more detailed insights and data, you can visit the original source: Cervicorn Consulting

Read: CAR T-Cell Therapy Market Trends and Emerging Opportunities