Market Overview

The global plasmid DNA manufacturing market was estimated at around USD 2.34 billion in 2024 and is projected to grow to approximately USD 11.67 billion by 2034, reflecting a robust CAGR of 17.43% from 2025 to 2034. Plasmid DNA plays a crucial role in gene therapies, cell therapies, DNA vaccines, and mRNA-based therapeutics, with demand surging significantly following the COVID-19 pandemic and the rapid development of mRNA vaccines. The market’s expansion is further reinforced by substantial investments from both government and private sectors in biopharmaceutical infrastructure, alongside partnerships between biotech companies and research institutions driving innovation in plasmid DNA technologies.

Key Market Trends

-

Advancements in Synthetic Biology – Innovations in synthetic biology are improving plasmid design, production scalability, and efficiency. Automated, high-throughput platforms are being increasingly utilized to produce plasmids with higher purity and lower contamination risks.

Example: Adoption of high-yield fermentation systems and automated chromatography techniques. -

Expansion of mRNA Vaccine Platforms – The success of mRNA vaccines during the COVID-19 pandemic has significantly boosted demand for plasmid DNA, which serves as a key template for mRNA synthesis.

Example: Global mRNA vaccine output rose by approximately 40% post-pandemic, directly increasing plasmid DNA requirements. -

Growing Adoption of Gene and Cell Therapies – Plasmid DNA is essential for viral vector production and CRISPR-based gene editing, driving demand from advanced therapeutic pipelines.

Example: Over 50% of ongoing gene therapy trials now require plasmid DNA, ensuring steady market growth. -

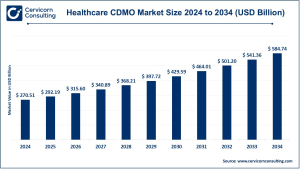

Increasing Outsourcing to CDMOs – Pharmaceutical and biotech companies are increasingly partnering with Contract Development and Manufacturing Organizations (CDMOs) to meet GMP standards and scale production efficiently.

Example: Investments in plasmid DNA-focused biotech startups have risen by around 25% year-over-year. -

Regulatory Emphasis on Quality and Compliance – Stringent guidelines from governments and regulatory agencies are pushing manufacturers to enhance facility standards and implement rigorous quality control processes.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2518

Market Drivers

-

Rising Demand for Gene and Cell Therapies – The growth of targeted and personalized medicines relies heavily on plasmid DNA as a delivery vehicle.

Quantitative Insight: The global cell and gene therapy market is expected to grow at a CAGR of 22.8%, indirectly boosting plasmid DNA demand. -

mRNA Vaccine Development – Pandemic-driven vaccine strategies have permanently expanded plasmid DNA applications in vaccine production.

Quantitative Insight: Annual plasmid DNA output is increasing by approximately 30% per year. -

Government and Private Sector Investments – Supportive policies, funding, and infrastructure development are enabling capacity expansions across the globe.

-

Technological Advancements – Innovations in fermentation, purification, and plasmid stabilization are improving yields while reducing production costs.

Impact of Trends and Drivers

-

Applications: The cell and gene therapy and DNA vaccine segments are witnessing the fastest growth. In 2024, the cell and gene therapy segment accounted for 54.10% of market revenue.

-

Regional Insights: North America leads the market with a 43.21% revenue share, supported by advanced biotech infrastructure and innovation. Europe follows with 27.42%, while Asia-Pacific is poised for rapid expansion due to growing biopharma capabilities.

-

Grades and Development Phases: GMP-grade plasmid DNA dominates with 85.92% of revenue in 2024, particularly in clinical therapeutics (54.40% share).

Challenges and Opportunities

-

Challenges: High production costs, complex regulatory frameworks, and strict quality requirements continue to challenge smaller players.

-

Opportunities: Expansion of gene therapy pipelines, increasing mRNA vaccine production, and outsourcing to specialized CDMOs offer significant growth potential.

Future Outlook

The plasmid DNA manufacturing market is expected to maintain double-digit growth over the next decade. By 2034, the market is projected to reach USD 11.67 billion, fueled by ongoing adoption of gene therapies, mRNA vaccines, and precision medicine. Emerging trends, including synthetic biology-driven plasmid optimization, automation in production, and global CDMO collaborations, are set to further accelerate growth and expand regional market presence.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us