Stainless Steel Market Overview

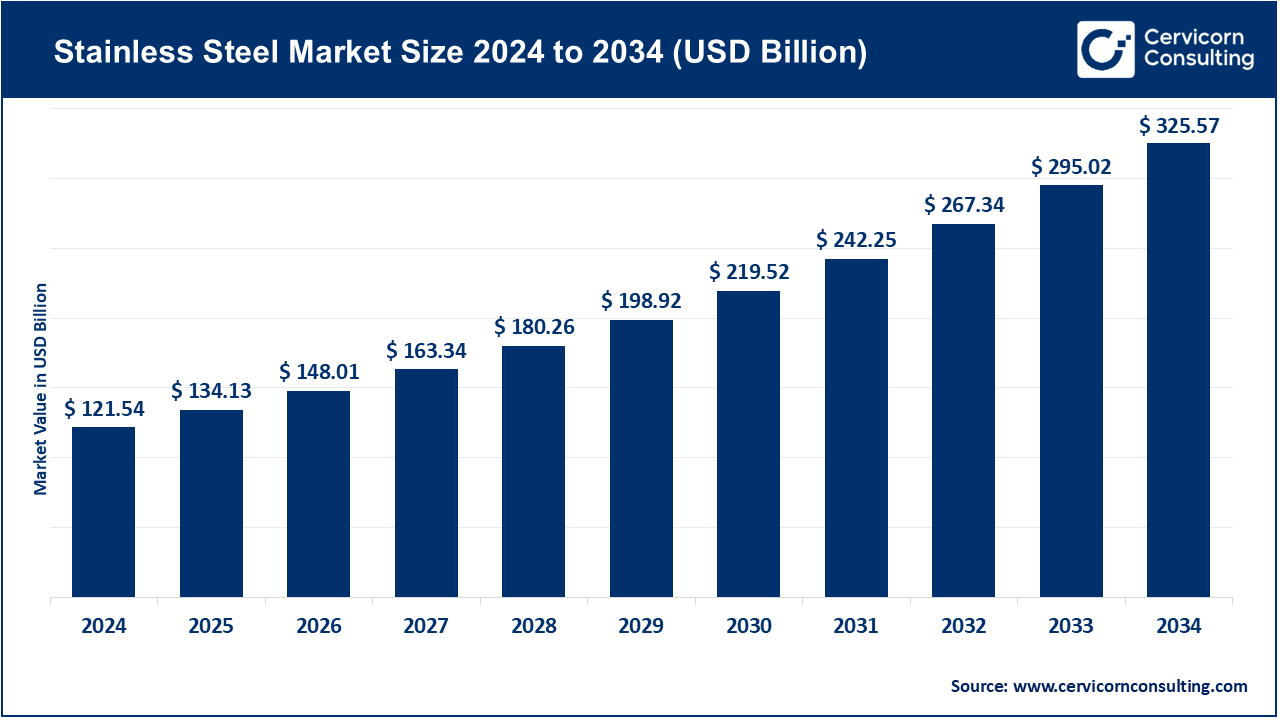

The global stainless steel market was valued at around USD 121.54 billion in 2024 and is projected to reach nearly USD 325.57 billion by 2034, advancing at a CAGR of 10.36% between 2025 and 2034. Stainless steel—an alloy of iron containing at least 10.5% chromium—is highly valued for its resistance to corrosion, durability, and recyclability. Its wide applications cover construction, automotive, aerospace, consumer goods, and medical sectors, driven by urbanization, infrastructure expansion, and stricter environmental norms. Moreover, innovations in alloy design and energy-efficient production technologies are boosting overall market momentum.

👉 Get a Free Sample: Stainless Steel Market Report

Key Market Trends

-

Sustainability in Production: The global shift toward low-carbon and circular economy models highlights stainless steel as a sustainable material. For instance, Outokumpu is set to introduce stainless steel with 95% recycled content in 2024, significantly cutting carbon emissions across industries such as construction and automotive.

-

Reshoring & Supply Chain Localization: To minimize reliance on imports and strengthen domestic supply chains, producers are localizing operations. Cleveland-Cliffs’ stainless processing facility in Ohio illustrates how reshoring can safeguard U.S. jobs and ensure production stability amidst trade uncertainties.

-

Technological Advancements: Continuous R&D is yielding high-performance alloys and energy-efficient manufacturing methods, enhancing both productivity and end-use performance.

-

Digitalization & Smart Manufacturing: Incorporating AI, IoT, and digital systems into stainless steel production is improving efficiency, traceability, and quality assurance.

-

Growing Construction & Automotive Demand: The surge in infrastructure projects, urbanization, and preference for corrosion-resistant materials is driving higher stainless steel usage in these key sectors.

Market Drivers

-

Trade Protection Measures: Tariffs and trade barriers are bolstering local stainless steel production. For example, U.S. tariffs on Finnish imports have enabled Cleveland-Cliffs to expand capacity in Ohio.

-

Infrastructure & Construction Growth: Stainless steel’s durability and corrosion resistance make it a preferred choice for bridges, skyscrapers, and industrial structures.

-

Technological Innovations: Breakthroughs in alloy development and low-energy production techniques are improving efficiency while aligning with sustainability goals.

-

Urbanization & Industrialization: Particularly in the Asia-Pacific region, population growth and rapid industrial expansion are fueling consumption in the construction and automotive industries.

Impact of Trends and Drivers

-

By Region: Asia-Pacific accounted for 44.28% of global revenue in 2024, led by industrial growth in China and India.

-

By Application: Construction held the largest share at 36.12%, driven by heavy investments in infrastructure.

-

By Product Form: Flat products contributed 41.85% of revenue, commonly used in automotive panels, building materials, and kitchen appliances.

-

By Grade: Austenitic stainless steel dominated with 50.47% share, credited to its superior weldability and corrosion resistance.

Challenges & Opportunities

-

Challenges: Price fluctuations in raw materials, tightening environmental regulations, and ongoing supply chain disruptions.

-

Opportunities: Expanding applications in sustainable construction, renewable energy, and advanced stainless steel alloys present major growth potential.

Future Outlook

The stainless steel market is set for strong long-term growth, fueled by demand in construction, automotive, and industrial sectors. With a projected value of USD 325.57 billion by 2034, supported by a CAGR of 10.36%, the industry will benefit from innovation in alloys, sustainability initiatives, and reshoring strategies. Key future drivers include the integration of smart manufacturing technologies and wider adoption of circular economy practices, which will define the next decade of market evolution.