U.S. Long-Term Care Market Overview

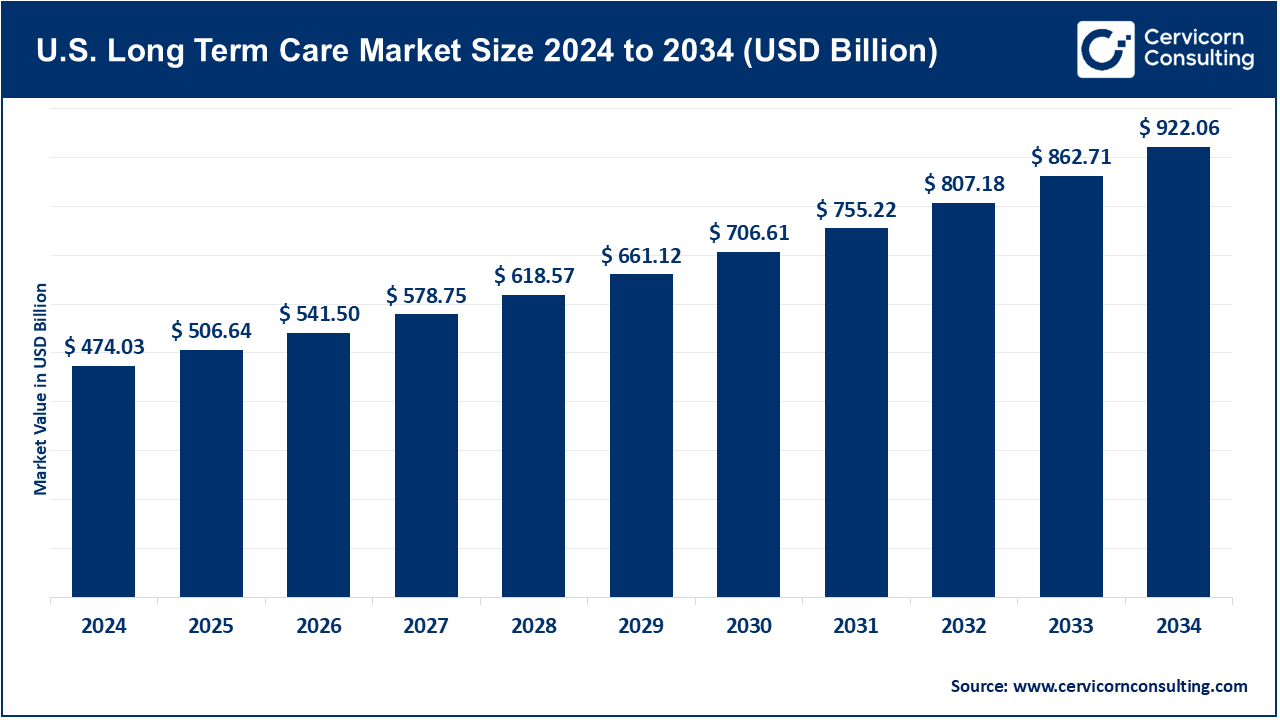

The U.S. long-term care (LTC) market plays a vital role in the healthcare ecosystem, catering to individuals with chronic illnesses, disabilities, or functional limitations that require extended care. In 2024, the market was valued at approximately USD 474.03 billion and is expected to nearly double to USD 922.06 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.86% between 2025 and 2034. LTC services in the U.S. encompass institutional care such as skilled nursing facilities and nursing homes, assisted living and memory care communities, home health services (including skilled nursing, therapy, and home health aides), hospice and palliative care, as well as community-based support programs. The market is highly fragmented, with thousands of independent providers operating alongside national chains and healthcare system-affiliated organizations.

Key Market Trends

Shift Toward Home and Community-Based Services (HCBS): There is an increasing preference for home-based care among patients and payers, driven by cost savings, patient comfort, and improved recovery outcomes. Integration of telehealth, remote monitoring devices, and mobile care coordination tools has accelerated adoption. Companies like LHC Group and Amedisys have invested in digital-first home health models to enhance clinician routing and patient outcomes.

Technological Advancements and Digital Health Integration: LTC providers are adopting AI-driven scheduling, EMR analytics, predictive analytics, and remote monitoring technologies to optimize operations, enhance patient engagement, and improve clinical outcomes. For example, Enhabit uses digital tools to improve home health efficiency while reducing operational costs.

Value-Based Care and Medicare Advantage Expansion: The rise of Medicare Advantage plans and value-based payment models rewards cost-efficient care delivery while prioritizing quality outcomes. Providers that reduce hospital readmissions, coordinate care effectively, and lower per-episode costs gain a competitive edge. Bundled payments and risk-sharing agreements encourage home health and post-acute care providers to innovate in patient management.

Workforce and Staffing Innovations: Staffing shortages, particularly among nurses, home health aides, and therapists, remain a critical challenge. Providers are leveraging technology for workforce optimization, adopting flexible scheduling systems, and implementing training programs to improve retention and quality of care. Workforce pressures have also accelerated consolidation among smaller agencies to create larger, more efficient networks.

Consumer Expectations for Holistic and Personalized Care: Seniors increasingly seek integrated services beyond traditional clinical care, including social engagement, nutritional support, transportation, and lifestyle assistance. LTC providers are expanding offerings in assisted living and home health to enhance patient satisfaction and overall quality of life.

👉 Get a Free Sample: Cervicorn Consulting

Market Drivers

Aging Population: The primary growth driver is the aging Baby Boomer generation. The U.S. population aged 65 and above continues to rise, creating sustained demand for both institutional and home-based care. Increased longevity has also led to a higher prevalence of chronic conditions such as dementia, Alzheimer’s, diabetes, and cardiovascular diseases, which increases the need for ongoing care.

Government Initiatives and Policy Support: Programs like Medicaid HCBS waivers expand funding for home-based services. CMS reforms, including PDGM adjustments, incentivize providers to improve efficiency and quality while leveraging technology-enabled care coordination.

Technological Adoption: Investment in telehealth, remote monitoring, and EMR analytics enhances clinical outcomes and operational efficiency, allowing providers to optimize staff allocation, reduce readmissions, and improve patient satisfaction.

Shift to Value-Based Care Models: Growing adoption of value-based payments encourages providers to deliver high-quality care cost-effectively, particularly in post-acute and home health segments, focusing on preventive care and smooth hospital-to-home transitions.

Impact of Trends and Drivers

-

Home Health and Hospice: Rapid expansion due to HCBS funding, Medicare Advantage incentives, and technology adoption, with companies like LHC Group and Amedisys capturing substantial market share.

-

Institutional Care: Skilled nursing facilities remain essential for high-acuity patients, but competition from home-based services is driving operational adjustments. Genesis HealthCare is leveraging post-acute rehabilitation partnerships with hospitals to maintain relevance.

-

Regional Variations: States with robust Medicaid HCBS programs such as California, Texas, and Florida see faster home health adoption, while regions with a higher density of nursing homes maintain stable institutional demand.

-

Application-Specific Impacts: Memory care and assisted living services are growing in response to dementia prevalence and demand for personalized, socially engaging care.

Challenges & Opportunities

Challenges:

-

Workforce shortages and high turnover

-

Regulatory changes and reimbursement uncertainty

-

Market fragmentation and intense competition

Opportunities:

-

Adoption of digital health and AI-driven operational solutions

-

Expansion of value-based care and Medicare Advantage programs

-

Consolidation and M&A to build larger regional and national networks

Future Outlook

Emerging trends such as home and community-based care expansion, technology integration, and value-based payment adoption are expected to drive the evolution of the U.S. LTC market. Providers embracing digital transformation, workforce solutions, and holistic patient care are likely to gain a competitive edge and capture a larger share of this fragmented market. Home health, hospice, and assisted living segments are projected to lead growth, supported by demographic trends, policy incentives, and evolving consumer expectations.

For more insights and comprehensive data, visit: Cervicorn Consulting – U.S. Long-Term Care Market