Market Overview

In 2024, the global vehicle roadside assistance market was valued at USD 27.1 billion and is forecast to grow steadily, reaching approximately USD 45.21 billion by 2034. This expansion reflects a compound annual growth rate (CAGR) of 5.31% during the forecast period from 2025 to 2034. Market growth is primarily driven by ongoing digital transformation, increased collaboration between insurance companies and service providers, and the seamless integration of roadside assistance offerings with connected and smart vehicle platforms.

The vehicle roadside assistance market serves as a vital pillar within the global automotive and mobility ecosystem, delivering essential emergency services such as towing, battery jump-starts, tire replacement, fuel delivery, and vehicle lockout assistance. The market has shown consistent growth, supported by rising vehicle ownership levels, higher road traffic density, and the growing reliance on on-demand mobility and safety support solutions.

Key Market Trends

1. Digitalization and App-Based Roadside Assistance Solutions

One of the most influential trends shaping the vehicle roadside assistance market is the widespread adoption of digital platforms and mobile applications. Service providers are increasingly utilizing GPS-enabled apps, real-time vehicle tracking, and automated dispatch technologies to reduce response times and improve customer satisfaction. These digital solutions enable users to request assistance instantly, track service status, and benefit from transparent pricing, significantly enhancing overall convenience.

2. Integration with Connected and Telematics-Enabled Vehicles

The increasing penetration of connected vehicles and telematics technologies is reshaping roadside assistance services. Automakers and OEMs are embedding assistance features directly into vehicle infotainment and onboard systems, enabling automatic breakdown alerts, remote diagnostics, and predictive maintenance notifications. This integration minimizes vehicle downtime and enhances operational efficiency, particularly within premium and electric vehicle segments.

Get a Free Sample:

https://www.cervicornconsulting.com/sample/2358

3. Growth of Subscription-Based and Bundled Service Offerings

Roadside assistance services are increasingly delivered through subscription models or bundled with vehicle warranties, insurance coverage, and extended service contracts. This transition from pay-per-use services to recurring subscription models improves customer loyalty while creating stable and predictable revenue streams for service providers and insurance companies.

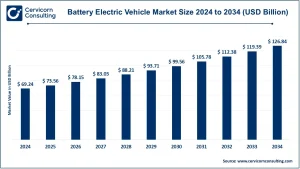

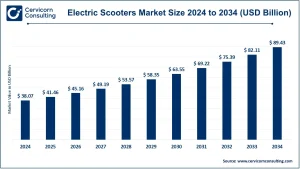

4. Increasing Focus on Electric Vehicle (EV) Roadside Assistance

As electric vehicle adoption continues to accelerate globally, roadside assistance providers are expanding their service portfolios to include EV-specific support such as mobile charging solutions, battery diagnostics, and specialized EV towing services. This trend is particularly evident in regions with strong EV adoption policies and urban electrification programs.

5. Strategic Partnerships and Ecosystem Collaboration

The market is witnessing a rise in strategic collaborations among automakers, insurance companies, mobility platforms, and roadside assistance providers. These partnerships enhance service reach, improve operational efficiency, and strengthen value propositions by offering integrated and comprehensive mobility support solutions.

Market Drivers

Rising Global Vehicle Ownership

The steady increase in global vehicle ownership, particularly across emerging economies, remains a key driver of the vehicle roadside assistance market. As more vehicles operate on roads worldwide, the demand for breakdown and emergency support services continues to grow. Additionally, aging vehicle fleets contribute to higher incident rates, further driving service demand.

Growing Adoption of Vehicle Insurance and OEM Assistance Programs

Insurance providers and automotive OEMs are increasingly incorporating roadside assistance as a standard or value-added feature within their offerings. This integration significantly broadens the customer base and accelerates market growth, especially in developed markets where bundled mobility services are becoming standard practice.

Technological Advancements in Dispatch and Service Operations

Innovations in AI-powered dispatch systems, GPS tracking, predictive analytics, and cloud-based service management platforms are enhancing operational efficiency across the market. These technologies enable optimized routing, faster response times, and scalable service operations, reducing costs while improving service quality.

Rising Consumer Demand for Convenience and Safety

Modern consumers increasingly expect round-the-clock, on-demand roadside support with minimal response times. Heightened awareness of road safety and emergency preparedness has led to greater willingness to subscribe to roadside assistance services, particularly among urban commuters and long-distance travelers.

Supportive Road Safety and Mobility Initiatives

Government initiatives aimed at improving road safety, vehicle compliance, and emergency response infrastructure indirectly support market growth by promoting the adoption of structured and professional roadside assistance services.

Impact of Trends and Drivers

The combined influence of market trends and growth drivers is reshaping the competitive dynamics of the vehicle roadside assistance market. Passenger vehicles continue to account for a significant market share due to high ownership levels, while commercial vehicles benefit from long-term, fleet-based roadside assistance contracts.

From a regional perspective, North America and Europe lead the market due to high insurance penetration, mature automotive ecosystems, and advanced digital infrastructure. Meanwhile, Asia-Pacific is experiencing the fastest growth, driven by expanding vehicle fleets, urbanization, and rising consumer awareness of roadside assistance services.

The growing adoption of connected vehicles and electric vehicles is also creating new service categories, prompting providers to invest in advanced technologies, EV-compatible equipment, technician training, and deeper digital integration.

Challenges and Opportunities

Challenges

-

High operational costs associated with maintaining 24/7 service availability

-

Fragmented service networks in developing regions

-

Limited EV-specific infrastructure in certain markets

Opportunities

-

Expansion of EV-focused roadside assistance solutions

-

Rising demand for subscription-based and fleet management service contracts

-

Significant untapped potential in emerging markets with growing vehicle ownership

Future Outlook

The vehicle roadside assistance market is expected to sustain steady growth over the next decade, supported by ongoing technological innovation, evolving mobility models, and increasing consumer dependence on digital assistance platforms. With a projected CAGR of 5.31% through 2034, the market is anticipated to exceed USD 45 billion, driven by connected vehicle integration, EV adoption, and deeper collaboration with insurance providers and OEM ecosystems.

As mobility continues to shift toward service-oriented and digitally enabled models, roadside assistance will remain an essential component of the global automotive support infrastructure.